3 Global Stocks Estimated To Be Up To 29.5% Below Intrinsic Value

In the current global market landscape, investors are witnessing a mixed performance across major indices, with value-oriented stocks showing resilience amid volatility driven by concerns over AI investments and geopolitical tensions. As economic indicators signal cooling labor markets and fluctuating manufacturing activity, identifying stocks that are trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

Let’s review some notable picks from our screened stocks.

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates airport facilities and services in Mexico, with a market cap of MX$191.15 billion.

Operations: The company’s revenue segments include MX$20.37 billion from Cancun, MX$3.79 billion from Colombia, MX$5.39 billion from San Juan, Puerto Rico, US, MX$1.75 billion from Merida, and MX$3.33 billion from other airports in Mexico including Villahermosa which contributes MX$661.60 million.

Estimated Discount To Fair Value: 26.6%

Grupo Aeroportuario del Sureste is trading at MX$637.15, significantly below its estimated future cash flow value of MX$868.18, indicating potential undervaluation based on cash flows. The company’s earnings are forecast to grow at 13.2% annually, outpacing the Mexican market’s growth rate of 10.9%. However, its dividend yield of 12.56% is not well covered by earnings or free cash flows, suggesting caution for income-focused investors despite strong revenue growth projections and robust passenger traffic figures reported in recent months.

Overview: Grupo Aeroportuario del Pacífico, S.A.B. de C.V. and its subsidiaries develop, operate, and manage airports in Mexico and Jamaica, with a market cap of MX$250.69 billion.

Operations: The company generates revenue from its operations in developing, operating, and managing airports across Mexico and Jamaica.

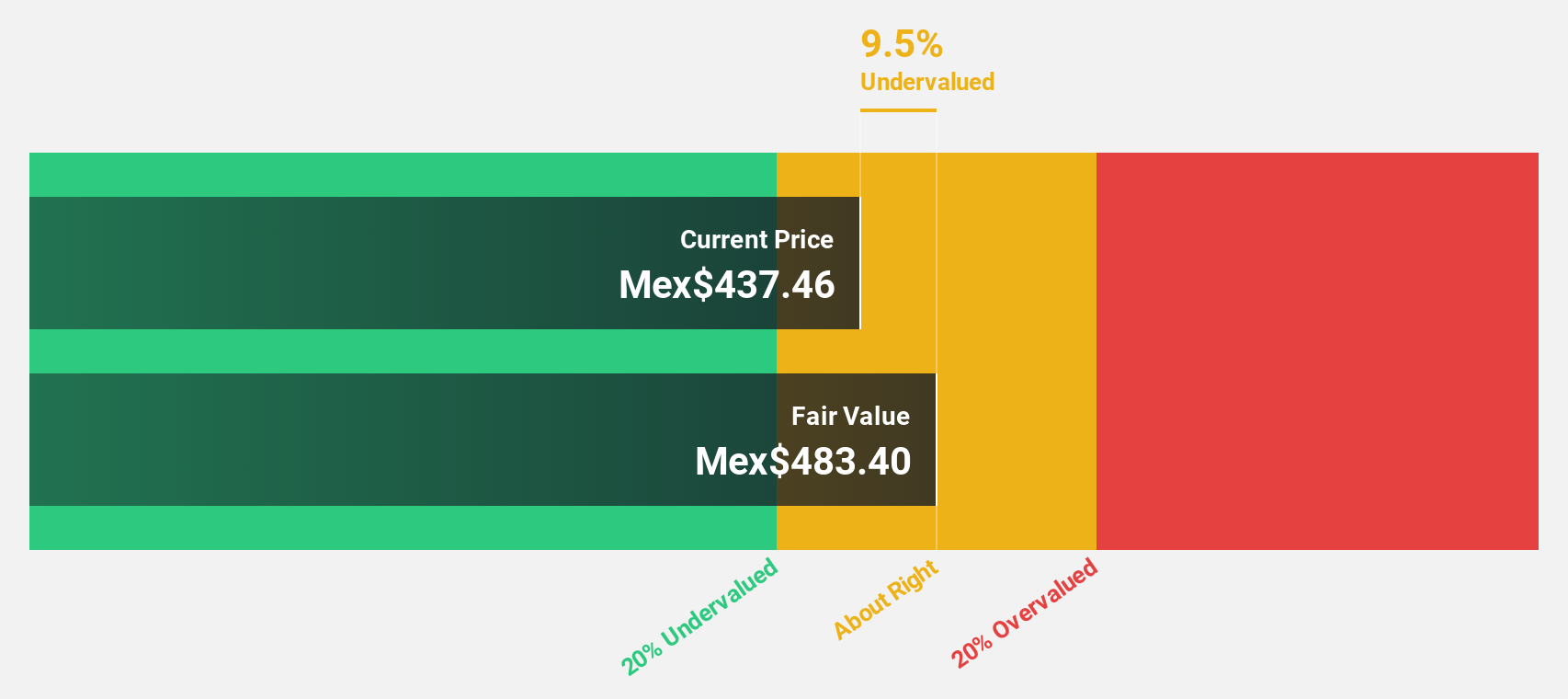

Estimated Discount To Fair Value: 13.7%

Grupo Aeroportuario del Pacífico is trading at MX$496.14, slightly below its estimated future cash flow value of MX$574.6, suggesting potential undervaluation based on cash flows. The company forecasts earnings growth of 16.6% annually, surpassing the Mexican market’s 10.9%. However, its 3.39% dividend yield lacks robust coverage by free cash flows and it carries a high debt level. Passenger traffic showed mixed results recently due to regional disruptions like Hurricane Melissa affecting Jamaican airports.

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩15.20 trillion.

Operations: The company’s revenue segments include Music at ₩3.12 trillion, Platform at ₩383.01 million, and Tech-based Future Growth at ₩52.85 million.

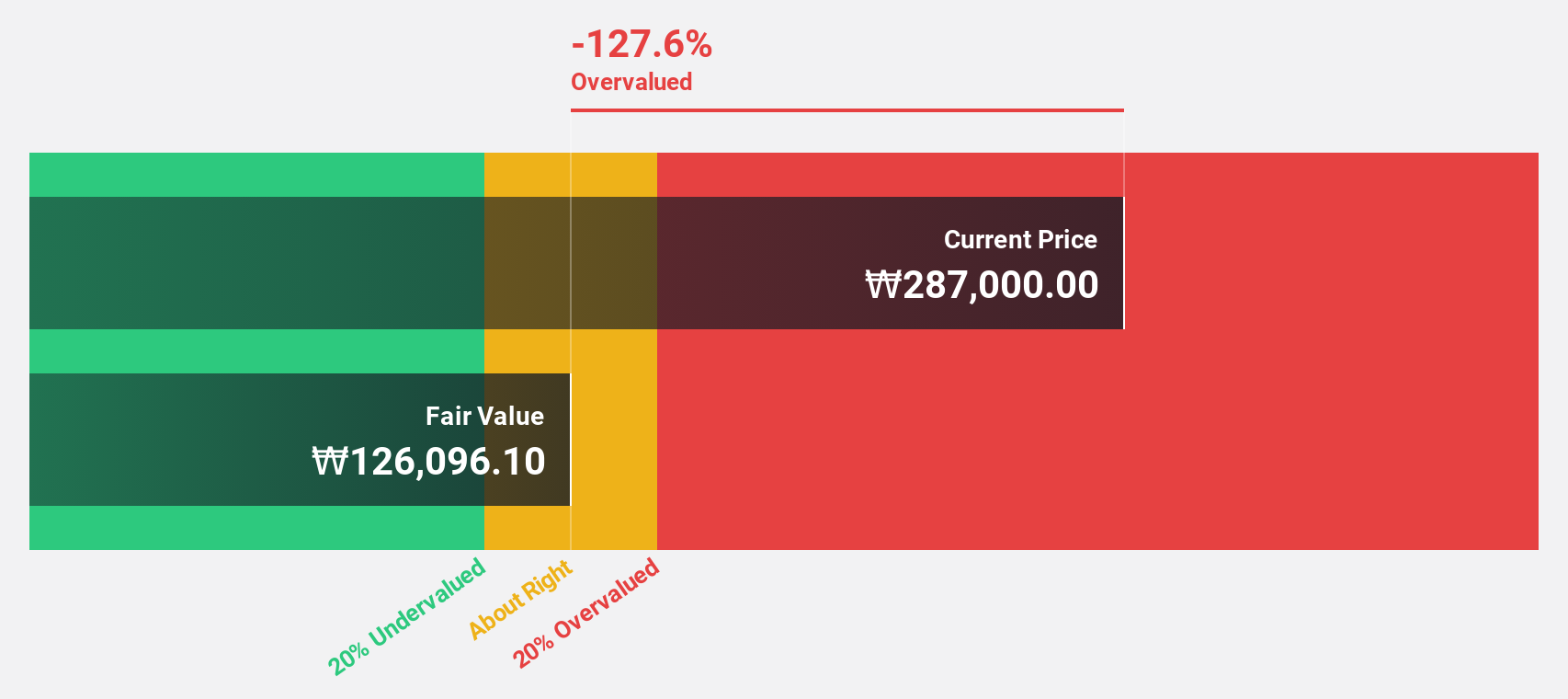

Estimated Discount To Fair Value: 29.5%

HYBE Co., Ltd. is trading at ₩377,000, below its estimated future cash flow value of ₩534,905.21, indicating a potential undervaluation based on cash flows. Although recent earnings showed a net loss of KRW 50.27 billion in Q3 2025 compared to the previous year’s profit, revenue has grown significantly year-on-year. The company is expected to become profitable within three years with earnings growth surpassing market averages despite low forecasted return on equity (10.8%).

Summing It All Up

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com