3 TSX Penny Stocks With Market Caps Up To CA$200M

As the Canadian market navigates a landscape marked by geopolitical tensions and U.S. policy shifts, fundamentals such as low energy prices and moderating inflation continue to underpin stability, with the TSX reaching record highs. In this context, penny stocks—though an outdated term—remain relevant for investors seeking opportunities in smaller or newer companies that might offer both value and growth potential. By focusing on financial strength and clear growth paths, these stocks can present compelling options for those looking to explore beyond the usual market leaders.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$52.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.78 | CA$277.57M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.17 | CA$118.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.45 | CA$3.63M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.45 | CA$918.11M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.98M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.62 | CA$182.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.01 | CA$30.33M | ✅ 2 ⚠️ 3 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.03 | CA$186.13M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 375 stocks from our TSX Penny Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Enterprise Group, Inc. operates as an equipment rental and construction services company in Canada with a market cap of CA$107.73 million.

Operations: The company generates revenue of CA$33.84 million from its operations in Canada.

Market Cap: CA$107.73M

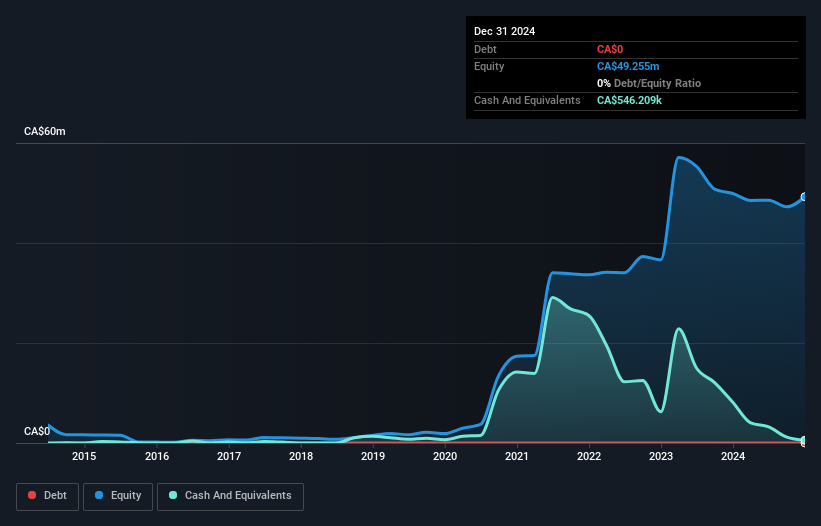

Enterprise Group’s recent financial results show a mixed performance, with third-quarter sales increasing to CA$9.21 million from CA$6.8 million year-over-year, but nine-month sales slightly declined compared to the previous year. The company has maintained profitability over the past five years, yet its net profit margin has decreased from 16.8% to 10.5%. Enterprise’s management and board are highly experienced, which may contribute positively to strategic decisions. The company’s debt levels have improved and are well-covered by operating cash flow; however, interest coverage remains a concern at only 2.5 times EBIT. Short-term assets exceed short-term liabilities but fall short of covering long-term obligations.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Desert Mountain Energy Corp. is involved in the exploration and development of oil, gas, helium, natural gas, hydrogen, and mineral properties in the Southwestern United States with a market cap of CA$23.20 million.

Operations: The company’s revenue is primarily derived from its mineral exploration activities, totaling CA$0.26 million.

Market Cap: CA$23.2M

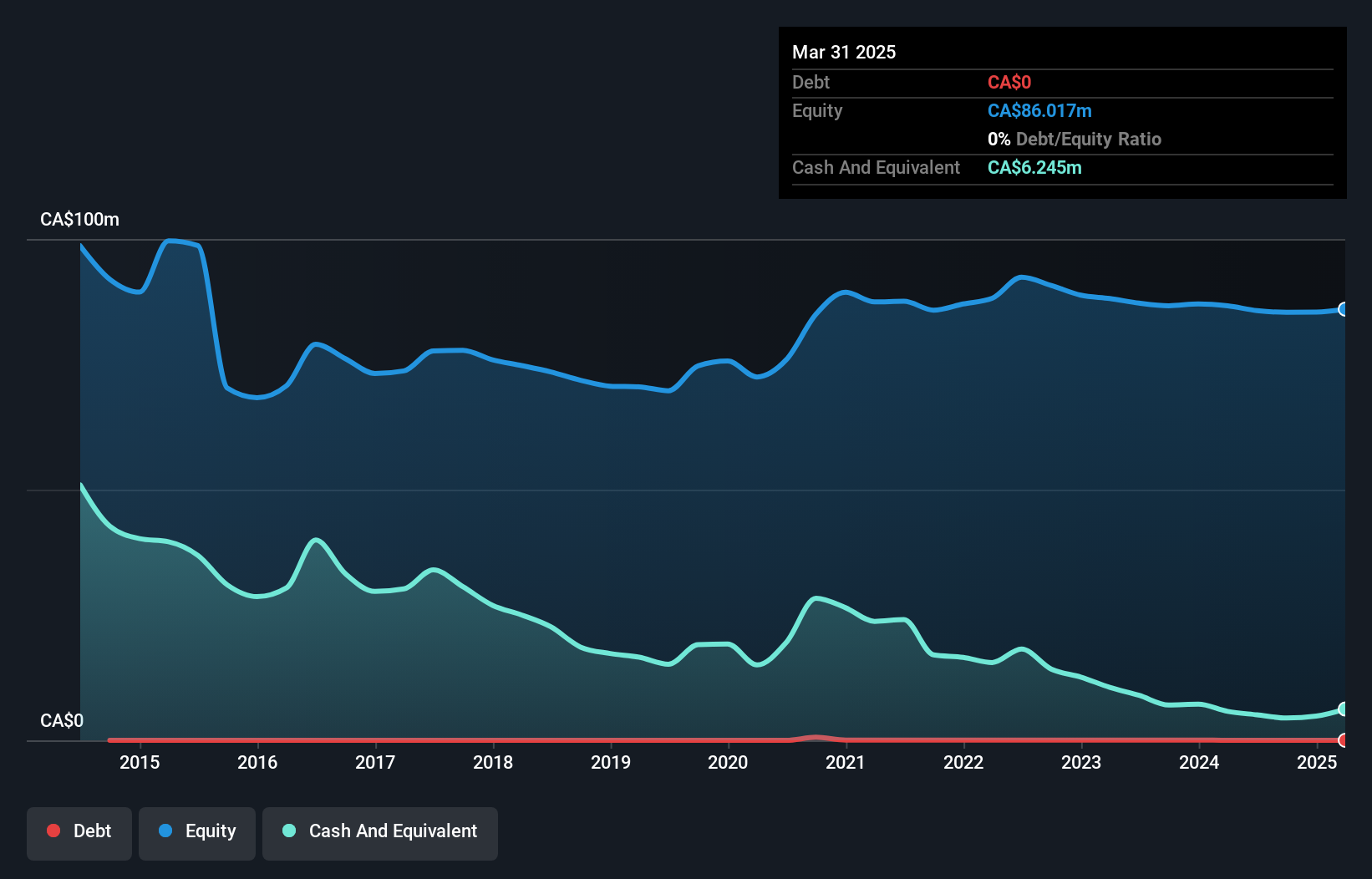

Desert Mountain Energy Corp. is a pre-revenue company with a market cap of CA$23.20 million, primarily involved in mineral exploration. The firm recently announced a private placement to raise CA$275,000, which may help extend its one-month cash runway. Despite being debt-free and having experienced management and board teams, the company’s short-term assets exceed liabilities but do not cover long-term liabilities of CA$3 million. A strategic move includes forming a joint venture for an SNC battery manufacturing facility in New Mexico, aiming to leverage produced water from oil wells for cooling and processing needs while extracting valuable rare earth elements.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strategic Metals Ltd. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in Canada with a market cap of CA$35.51 million.

Operations: There are no reported revenue segments for this exploration stage company.

Market Cap: CA$35.51M

Strategic Metals Ltd., with a market cap of CA$35.51 million, is an exploration stage company that remains pre-revenue. The firm has become profitable this year, reporting a net income of CA$3.19 million for the third quarter ending September 30, 2025, aided by a significant one-off gain of CA$4.8 million. Despite low return on equity at 2.6%, Strategic Metals benefits from being debt-free and having seasoned management and board teams with average tenures exceeding industry norms. Recently, the company announced a share repurchase program to capitalize on potential price weaknesses using unallocated cash resources for up to 8,500,000 shares by December 2026.

Next Steps

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com