Aequs IPO Day 1 LIVE: Issue fully booked; GMP, subscription status, price band, other key details. Should you apply?

Aequs IPO Day 1 LIVE: The initial public offering (IPO) of Aequs Ltd has been receiving string demand from investors and has been fully subscribed within hours of opening. Aequs IPO opened on Wednesday, December 3, and will close on Friday, December 5.

The IPO allotment date is likely December 8, and the IPO listing date is December 10. Aequs shares will be listed on both the stock exchanges, BSE and NSE.

The company plans to raise ₹921.81 crore from the book-building issue which comprises a mix of fresh issue of 5.40 crore equity shares worth ₹670 crore, and an offer-for-sale (OFS) component of 2.03 crore shares amounting to ₹251.81 crore. Aequs IPO price band is set at ₹118 to ₹124 per share. The IPO lot size is 120 shares.

JM Financial Ltd. is the book running lead manager and Kfin Technologies Ltd. is the Aequs IPO registrar.

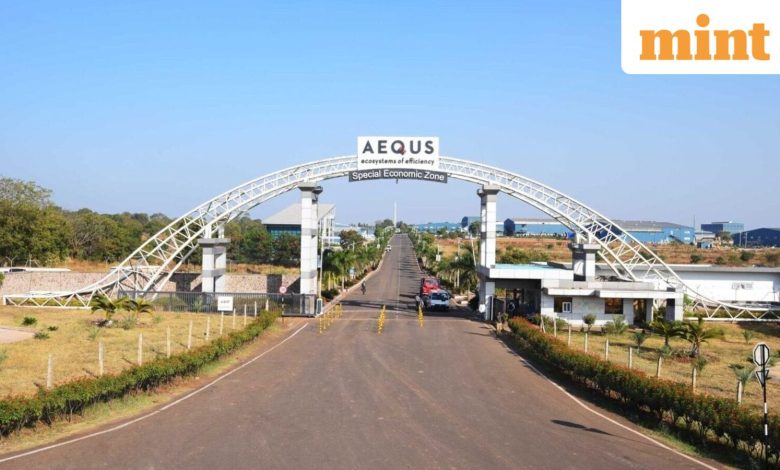

Aequs Ltd is the only precision component manufacturer in India operating within a single Special Economic Zone to offer fully vertically integrated manufacturing capabilities in the aerospace segment.

Aequs IPO GMP Today

Aequs shares are commanding a strong grey market premium (GMP) today. Aequs IPO GMP today has risen to ₹46.5 per share, market experts said. This indicates that in the grey market, Aequs shares are trading higher by ₹46.5 apiece than their issue price.

Aequs IPO GMP today signals that the stock is trading at ₹170.5 apiece in the grey market, a premium of 37.5% to the issue price of ₹124 per share.

Stay tuned to our Aequs IPO Live blog for the latest updates.