Tech Stocks Nvidia, Alphabet Drag Global Equities Markets

66

/ 100

SEO Score

Tech Stocks Nvidia, Alphabet Drag Global Equities Markets

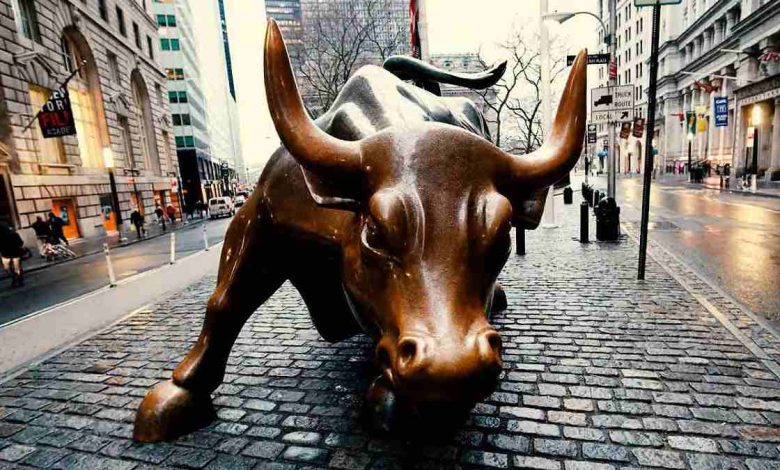

With selloffs in U.S. tech stocks, global equity markets recorded a mixed performance this week, reflecting diverging regional dynamics as investors navigated softer inflation prints, end-year portfolio adjustments and monetary policy adjustments.

Investors’ sentiments were twisted across the markets with global exchange rate dynamics, while huge AI bubble concerns amidst rising spending topped Wall Street discussions.

In the US, major indices retreated week on week as technology-led weakness dragged sentiment lower. The NASDAQ saw a -0.70% weekly drop, while the S&P 500 also slipped by -0.57%, as investors digested the recent softer inflation data and speculated on the timing of Fed rate cuts.

Analysts at Anchoria Securities Limited spotted profit-taking in high-growth names such as Nvidia, Alphabet, Microsoft, etc., and caution ahead of year-end rebalancing also contributed to the pullback.

In contrast, European markets posted gains, buoyed by optimism around easing inflation and potential monetary policy support.

The FTSE 100 expanded by +1.46% w/w, Germany’s DE40 added +0.26% w/w, while France’s FR40 rose by +0.14%. Overall, the broader Euro Stoxx 50 rose by +0.60%, signalling broad-based resilience across the region.

Notably, sentiment was reinforced by the European Central Bank’s (ECB’s) decision to hold interest rates steady, maintaining its main refinancing rate at 2.15% and signalling that while inflation is easing, policymakers remain cautious about premature easing.

This stance provided reassurance to markets that rate cuts could come later in 2026, supporting risk appetite without triggering volatility. Asian sentiment was more subdued, with China’s FTSE index down by -0.60% w/w amid lingering concerns over property sector stress and slower economic recovery momentum.

Structural growth challenges and limited policy stimulus continue to weigh on Chinese equities, reinforcing a cautious outlook for the region heading into 2026.

The NGX All-Share index finished the week on a positive note, extending its upward trend with a 1.76% WoW gain to close at 152,057.38 points.

Buying interest in blue-chip tickers like BUAFOODS (+6.02%), BUACEM (+4.94%), NESTLE (+10.00%), FIRSTHOLDCO (+42.70%), and GUINNESS (33.01%) masks off the decline seen in GTCO (-2.00%), PRESCO (-1.38%), and NB (-3.52%), as market breadth expanded to 1.56x, reflecting a broader positive sentiment across the bourse.

Sector-based, five of the six sectors under our purview closed positive, as seen in Banking (+2.75%), Consumer Goods (+4.51%), Insurance (+3.07%), Industrial Goods (+0.72%), and Pension (+1.89%), while Oil and Gas (-0.17%) closed in the red.

The market capitalisation moved in tandem by +1.76% week on week to ₦96.94 trn, and the NGXASI ytd closed at 47.73% #Tech Stocks Nvidia, Alphabet Drag Global Equities Markets Naira Falls as FX Intervention Fails to Ease Market Pressure