Munis touch firmer in spots to start 2026

Processing Content

Munis were steady to a touch firmer in spots to kick off 2026, as U.S. Treasuries cheapened slightly out long and equities ended mixed.

The two-year muni-UST ratio Friday was at 69%, the five-year at 64%, the 10-year at 66% and the 30-year at 87%, according to Municipal Market Data’s 3 p.m. EDT read. ICE Data Services had the two-year at 68%, the five-year at 63%, the 10-year at 66% and the 30-year at 86% at a 4 p.m. read.

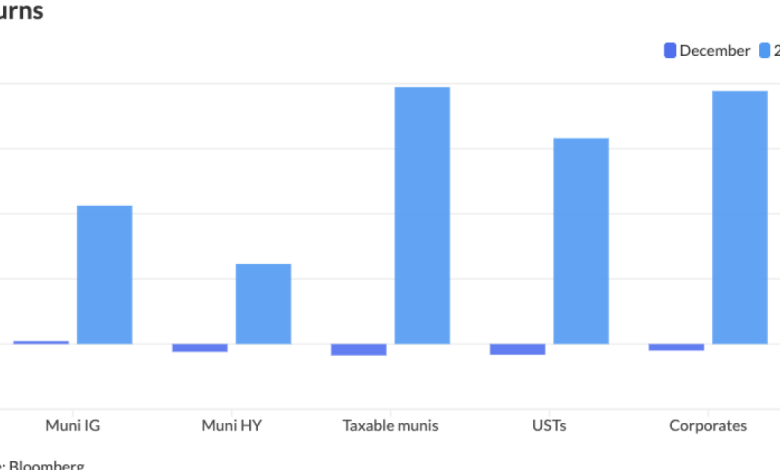

“As market participants reassemble after the holiday break, January is poised to extend the relative success that had backdropped the second half of 2025, despite weaker December performance triggered by softer technical conditions (i.e., heavy supply and lower demand accompanied by smaller inflows earlier in the month), underperformance relative to Treasuries and corporates, and ongoing inflationary worries,” said Jeff Lipton, The Bond Buyer’s market intelligence strategist.

With the muni calendar “heating up” ahead of another projected year of record issuance, he expects “investor demand to comfortably digest the new supply given reinvestment needs and compelling yield and income opportunities.”

While munis may keep underperforming within fixed income, the performance gap can show “noted tightening, and should technicals go into overdrive, there is certainly room for outperformance,” Lipton said.

Credit fundamentals should remain “favorable” for now, but sector-specific challenges are materializing, leading to greater “analytical rigor” this year, he said.

The ratio of upgrades to downgrades will continue to tighten in 2026 and are likely to be a more balanced relationship, he said.

New-issue calendar

The new-issue calendar is an estimated $6.382 billion, with $5.782 billion of negotiated deals on tap and $600 million of competitives.

The Board of Regents of the University of Texas System leads the negotiated calendar with $1 billion of revenue financing system bonds.

The competitive calendar is led by North Attleborough, Massachusetts, with $74.595 million of general obligation municipal purpose loan bonds of 2026.

AAA scales

MMD’s scale was little changed: 2.43% (unch, -3bp roll) in 2027 and 2.39% (unch, no roll) in 2028. The five-year was 2.40% (-2bp, +1bp roll), the 10-year was 2.78% (unch, +2bp roll) and the 30-year was 4.25% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to a basis point: 2.43% (-1) in 2027 and 2.38% (-1) in 2028. The five-year was at 2.36% (-1), the 10-year was at 2.75% (unch) and the 30-year was at 4.17% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.44% (unch) in 2027 and 2.39% (unch) in 2028. The five-year was at 2.40% (-1), the 10-year was at 2.76% (unch) and the 30-year yield was at 4.22% (unch) at 3 p.m.

Bloomberg BVAL was little changed: 2.47% (unch) in 2027 and 2.42% (-1) in 2028. The five-year at 2.36% (-1), the 10-year at 2.71% (unch) and the 30-year at 4.13% (unch) at 4 p.m.

Treasuries were slightly weaker out long.

The two-year UST was yielding 3.477% (flat), the three-year was at 3.546% (+1), the five-year at 3.74% (+1), the 10-year at 4.19% (+2), the 20-year at 4.815% (+2) and the 30-year at 4.868% (+2) near the close.

Fund flows

Investors added $674.9 million to municipal bond mutual funds in the week ended Wednesday, following $851.6 million of inflows the prior week, according to LSEG Lipper data.

High-yield funds saw outflows of $232.4 million compared to outflows of $267.4 million the previous week.

Tax-exempt municipal money market funds saw inflows of $2.073 billion for the week ending Dec. 29, bringing total assets to $149.954 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds was 2.70%.

Taxable money-fund assets saw $63.485 billion added, bringing the total to $7.535 trillion.

The average seven-day simple yield was 3.44%.

The SIFMA Swap Index was at 2.36% on Wednesday compared to the previous week’s 3.32%.

Primary to come

The Board of Regents of the University of Texas System is set to price $1 billion of revenue financing system bonds, Series 2026A. Goldman Sachs.

The

The Black Belt Energy Gas District (/AA-//) is set to price $814.6 million of gas project revenue bonds, 2025 Series F. J.P. Morgan.

The Tennessee Energy Acquisition Corp. (Aa3///) is set to price $767.545 million of gas project revenue bonds, Series 2026A. Goldman Sachs.

The Conroe Independent School District (Aaa/AAA//) is set to price Wednesday $442.915 million of PSF-insured unlimited tax school building bonds, Series 2026. FHN Financial.

The

Illinois Housing Development Authority (Aaa///) is set to price Tuesday $200 million of social revenue bonds, consisting of $155 million of non-AMT bonds, 2026 Series A, and $45 million of taxable bonds, 2026 Series B. Morgan Stanley.

The Florida Housing Finance Corp. (Aaa///) is set to price Tuesday $200 million of homeowner mortgage revenue bonds, consisting of $140 million of non-AMT 2026 Series 1 bonds and $60 million of taxable 2026 Series 2 bonds. Raymond James.

The Omaha Public Power District (A1/A//) is set to price Thursday $168.005 million of separate electric system revenue refunding bonds (Nebraska City 2), 2026 Series A. Wells Fargo.

The Connecticut Health and Educational Facilities Authority (Aaa/AAA//) is set to price Tuesday $168 million of Yale University issue revenue bonds, Series V. J.P. Morgan.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $145 million of homeownership mortgage refunding bonds, consisting of $120 million of non-AMT Series A bonds and $25 million of taxable Series B bonds. Wells Fargo.

Broomfield, Colorado, (Aa2///) is set to price Wednesday $112.41 million of sewer activity enterprise revenue and refunding bonds. Stifel, Nicolaus & Co.

Competitive

North Attleborough, Massachusetts, (/AA+//) is set to sell $74.595 million of general obligation municipal purpose loan bonds of 2026, at 11 a.m., Eastern Wednesday.