High Growth Tech Stocks In Asia For January 2026

As global markets navigate the start of 2026 with a backdrop of mixed economic signals and geopolitical events, Asian tech stocks have captured investor attention, buoyed by optimism in domestic tech sectors and strategic policy developments. In this dynamic environment, identifying high growth potential involves focusing on companies that demonstrate resilience through innovation and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 37.20% | 52.08% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 38.79% | 38.39% | ★★★★★★ |

| Shengyi TechnologyLtd | 22.69% | 33.40% | ★★★★★★ |

| Gold Circuit Electronics | 32.04% | 37.48% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

Overview: NEXON Games Co., Ltd. is a South Korean company engaged in game development both domestically and internationally, with a market cap of ₩779.18 billion.

Operations: The company generates revenue primarily from its Game Development Division, which accounts for ₩183.52 billion, while the Rental Sector contributes ₩4.86 billion.

Amid a challenging financial landscape, NEXON Games has reported a significant downturn in its recent earnings, with sales dropping to KRW 50.15 billion from KRW 111.5 billion year-over-year and shifting from a net income of KRW 39.71 billion to a net loss of KRW 11.13 billion in the third quarter of 2025. Despite these setbacks, the company’s projected revenue growth remains robust at 29.8% annually, outpacing the Korean market’s average of 12.3%. Furthermore, NEXON is anticipated to pivot towards profitability within three years, boasting an expected earnings surge of approximately 111.4% per annum. This optimistic outlook is underscored by their commitment to innovation and development in an industry where technological advancement is paramount.

Simply Wall St Growth Rating: ★★★★★☆

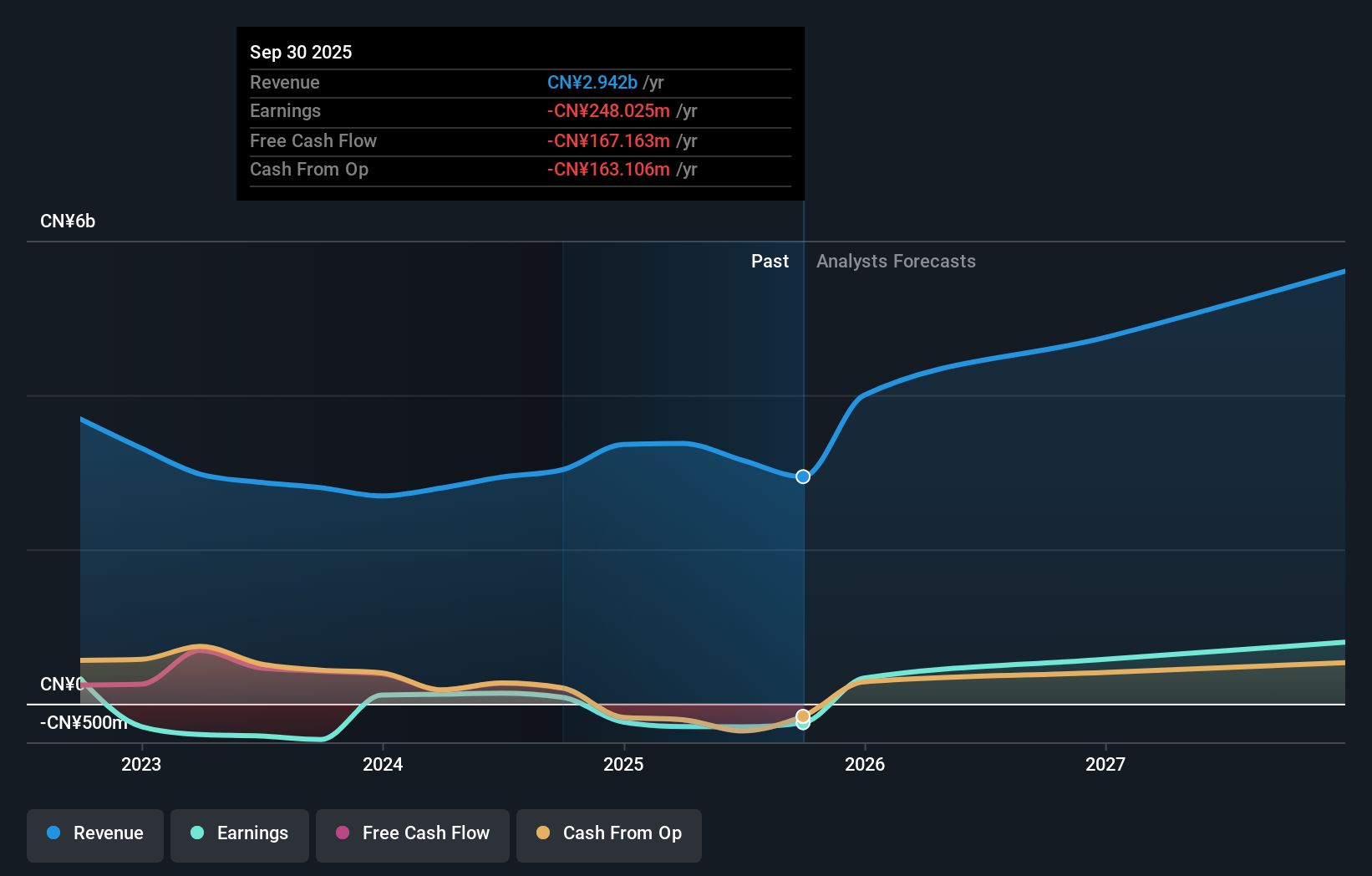

Overview: NanJi E-Commerce Co., LTD engages in brand licensing and mobile Internet marketing services in China with a market capitalization of CN¥7.80 billion.

Operations: The company generates revenue primarily through brand licensing and mobile Internet marketing services. Its market capitalization is CN¥7.80 billion.

NanJi E-Commerce, amidst a competitive e-commerce landscape in Asia, has demonstrated resilience with a reported revenue of CNY 1.99 billion for the nine months ending September 2025, despite a slight dip from CNY 2.41 billion the previous year. The company’s earnings also reflect a modest decrease to CNY 42.79 million from CNY 54.23 million, indicating challenges yet maintaining a steady operational stance. With an annualized revenue growth rate at an impressive 24.3%, NanJi is outpacing the Chinese market average of 14.6%. This growth trajectory is supported by strategic investments in R&D which are crucial for staying ahead in tech innovation and customer engagement strategies in high-growth markets like China’s bustling e-commerce sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CELSYS, Inc. operates in Japan providing content creation solutions and has a market cap of ¥48.21 billion.

Operations: CELSYS, Inc. focuses on content creation solutions in Japan. The company generates revenue through its digital art software and related services.

CELYS, navigating through a dynamic tech landscape, has recently adjusted its full-year earnings outlook upwards, reflecting robust sales from both one-time purchases and subscription models of its flagship software CLIP STUDIO PAINT. This revision anticipates net sales to hit ¥9.26 billion, with an operating profit of ¥2.9 billion. Further enhancing shareholder value, the firm completed a share buyback program in December 2025, repurchasing shares worth ¥999.99 million. These strategic moves underscore CELSYS’s agility in adapting to market demands and optimizing capital allocation to bolster its financial health amidst competitive pressures.

Seize The Opportunity

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NEXON Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com