Alpha Exploration And 2 Other TSX Penny Stocks To Consider

The Canadian market has demonstrated remarkable stability, with the TSX hitting record highs despite a barrage of geopolitical and policy-related headlines. In such a resilient market, investors often look beyond the noise to focus on fundamentals, which can be particularly rewarding when considering penny stocks. Although the term “penny stocks” might seem outdated, these smaller or newer companies can offer unique opportunities for growth and value when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.05 | CA$52.58M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$4.10 | CA$288.24M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.12 | CA$117.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.45 | CA$3.76M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$52.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.47 | CA$964.68M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.21 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.67 | CA$183.59M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$0.98 | CA$29.73M | ✅ 2 ⚠️ 3 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.02 | CA$191.47M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 377 stocks from our TSX Penny Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpha Exploration Ltd., with a market cap of CA$46.66 million, focuses on acquiring, exploring, and developing mineral resource properties in Eritrea through its subsidiary.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$46.66M

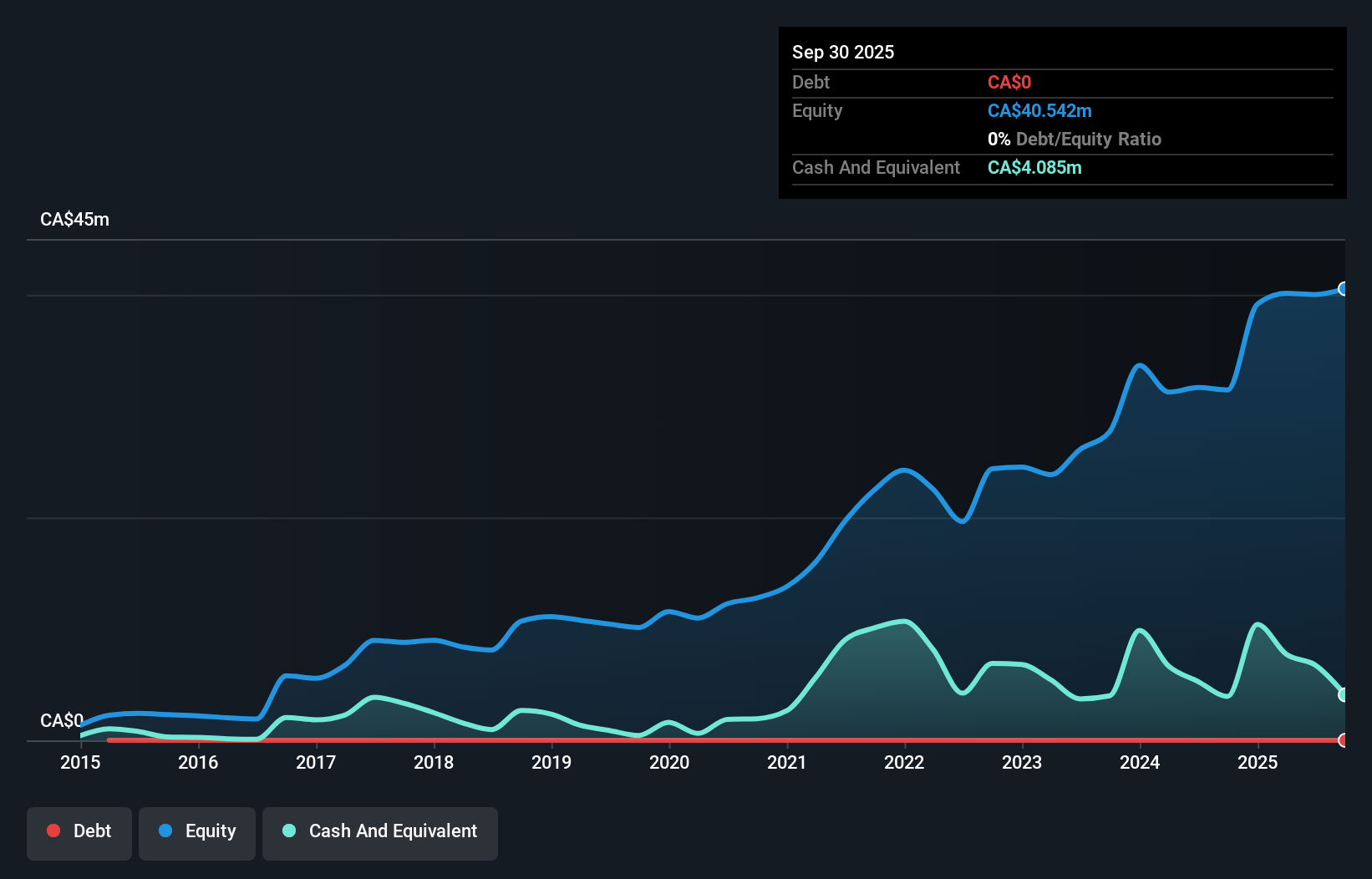

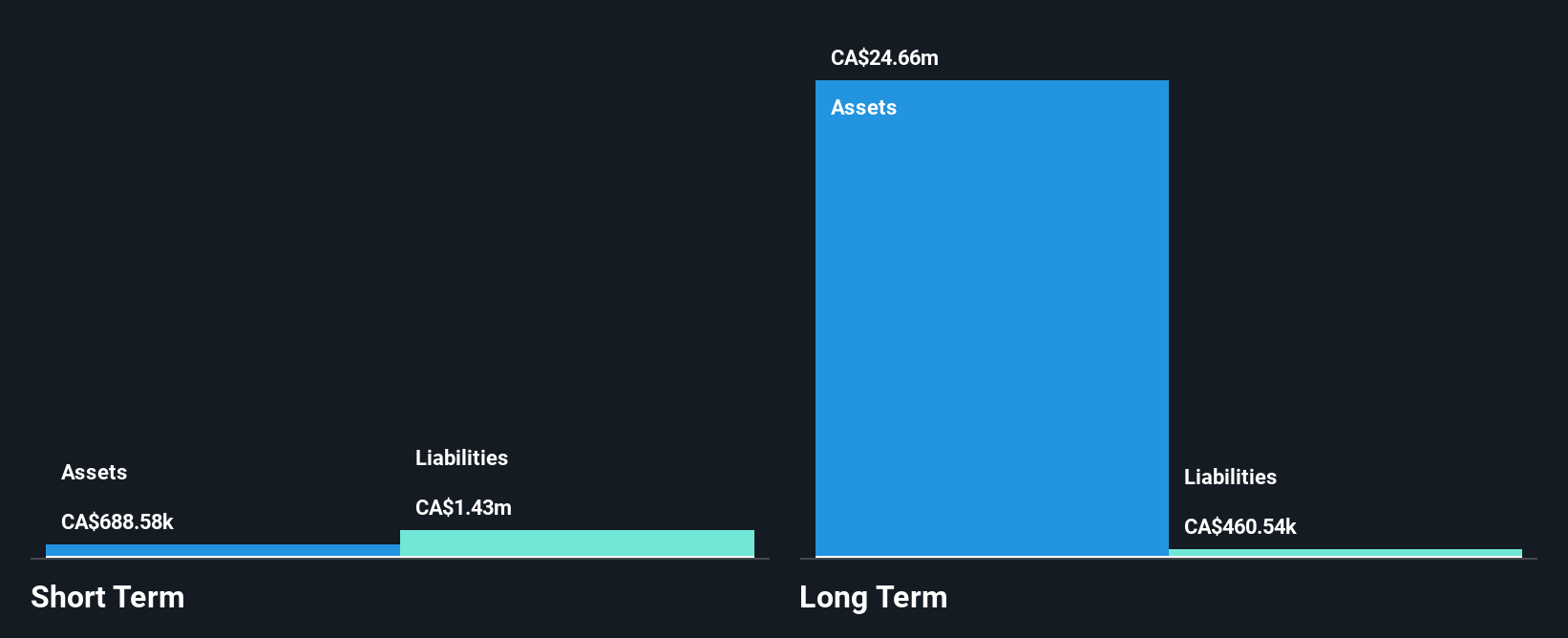

Alpha Exploration Ltd., with a CA$46.66 million market cap, is pre-revenue and focuses on mineral resource exploration in Eritrea. Recent drilling at the Aburna Gold Project revealed promising gold mineralization, enhancing its exploration prospects. The company has no debt and its short-term assets exceed liabilities, indicating sound financial health for its size. Leadership changes include John Wilton’s appointment to the Board of Directors, bringing valuable expertise in gold and copper exploration management. Despite recent profitability challenges, Alpha’s strategic focus on expanding resource potential could position it well within the speculative landscape of penny stocks.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skyharbour Resources Ltd. is involved in acquiring, exploring, and evaluating uranium and thorium mineral properties in Canada, with a market cap of CA$94.87 million.

Operations: Skyharbour Resources Ltd. does not report distinct revenue segments as it focuses on the acquisition, exploration, and evaluation of uranium and thorium mineral properties in Canada.

Market Cap: CA$94.87M

Skyharbour Resources Ltd., with a market cap of CA$94.87 million, is pre-revenue and focused on uranium exploration in Canada’s Athabasca Basin. Recent drilling at the Moore Uranium Project identified new targets like the Nomad Zone, highlighting strong potential for future discoveries. The company has expanded its land holdings by acquiring additional claims, enhancing its prospect generator business model aimed at strategic partnerships. Skyharbour is debt-free, with sufficient short-term assets to cover liabilities, though it remains highly volatile compared to other Canadian stocks. Its seasoned management and board provide stability as they advance multiple exploration initiatives in 2026.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZincX Resources Corp. is involved in the acquisition, exploration, development, and evaluation of mineral resource properties in Canada with a market cap of CA$17.85 million.

Operations: Currently, there are no reported revenue segments for ZincX Resources Corp.

Market Cap: CA$17.85M

ZincX Resources Corp., with a market cap of CA$17.85 million, is pre-revenue and focused on mineral exploration in Canada. Despite being unprofitable, the company has reduced its losses over the past five years by 9.9% annually and maintains more cash than total debt, ensuring a sufficient cash runway for over a year based on current free cash flow trends. However, short-term liabilities exceed short-term assets, raising liquidity concerns. Recent auditor reports have expressed doubts about its ability to continue as a going concern, adding risk to potential investors despite no significant shareholder dilution recently.

Make It Happen

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com