Tokyo’s bond crash rattles global markets

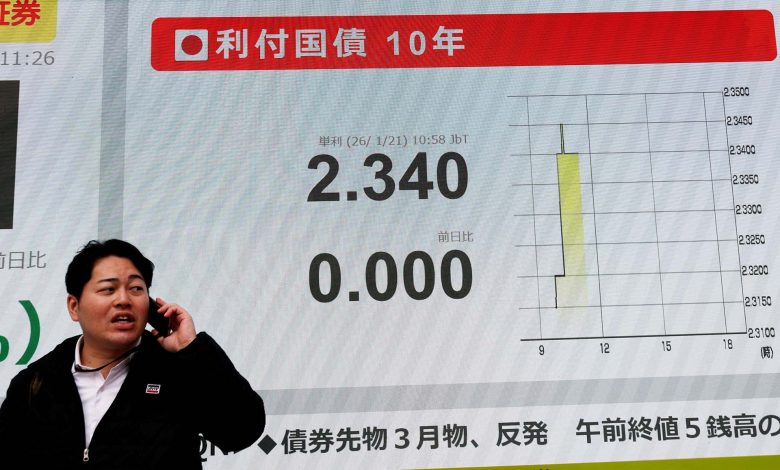

Tokyo’s bond market crash may be the end of easy money in Japan. The Japanese government bond (JGB) market, long a pillar of global stability, has entered a new era of unprecedented volatility, Bloomberg reports.

What happened? Last week, yields jumped 25 basis points in a single session — a rate that previously took months — signaling the end of Japan’s decades-long era of ultra-low rates.

Why the market snapped

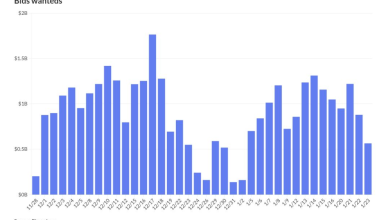

The selloff was triggered by a relatively small amount of trading. Just USD 280 mn in turnover in ultra-long-dated JGBs sparked a USD 41 bn wipeout across the yield curve. Ultra-long maturities were hit the hardest, with about USD 170 mn traded in 30-year bonds and USD 110 mn in 40-year notes, yet yields jumped more than 25 basis points.

This volatility exposed a hollowed-out market: Years of Bank of Japan (BOJ) intervention have thinned liquidity. With the BOJ and domestic life insurers stepping back, prices are increasingly set by marginal trades rather than deep market demand. “This is not a paradox: it is exactly what you expect in a market where depth is thin, dealer balance sheets are constrained, and prices are set by the marginal trade rather than by volume-weighted averages,” said Shoki Omori, chief desk strategist at Mizuho Securities.

The pressure stems from a perfect storm of rising inflation and Prime Minister Sanae Takaichi’s expansionary fiscal plans, which have shown “disregard toward the yield movements” ahead of the Feb. 8 snap election, according to Shinji Kunibe of Sumitomo Mitsui DS Asset Management. Investors fear higher spending will worsen Japan’s already heavy debt burden of about 230% of GDP, creating a “Truss moment” with the currency down and long-end yields getting “a little out of control,” said Ugo Lancioni of Neuberger Berman.

The global ripple effect

The shock rippled through global markets, already pressuring US Treasuries. Goldman Sachs estimates that every 10 basis points of a Japan-specific bond shock lifts US yields by two to three points.

Why it matters: Rising yields threaten the USD 450 bn JPY-funded carry trade — a “bastion” of the global economy — where investors borrow in low-rate JPY to invest in higher-yielding assets, said Amova Asset Management’s Naomi Fink. If the JPY slides further, Japan may sell its US Treasury reserves to defend the currency — exporting its “Japan problem” to Western markets. Albert Edwards of Société Générale told the Financial Times that Western politicians should “quiver with fear” as Japan turns off the liquidity tap that has suppressed global bond yields for years.

Japan reax

The Bank of Japan’s response has so far been a game of “whack-a-mole.” While the BOJ signaled it may buy bonds to stabilize markets — helping debt rebound — it triggered another sharp selloff in the JPY. Rates were held steady on Friday, though inflation forecasts were raised, suggesting the pressure won’t ease soon. “It’s a new era,” said Masayuki Koguchi of Mitsubishi UFJ Asset Management. “This is just the beginning — there’s a chance that bigger shocks will happen.”

Looking ahead

The long-term concern is the “repatriation” of Japanese capital. Higher domestic yields are prompting Japanese institutions to reconsider their USD 5 tn in overseas investments, risking a move back to JGBs that could drain global liquidity. Sumitomo Mitsui Financial Group has already signaled a shift: “I always loved foreign bond investment, but not anymore. Now it’s JGBs,” said Arihiro Nagata, the group’s global markets head.

Ignoring market signals could worsen dysfunction, investors warn. With overseas investors now accounting for 65% of monthly cashbond trading (up from 12% in 2009), the JGB market is in a “fragile transition phase,” and fast-moving foreign capital is amplifying volatility, James Athey of Marlborough Investment Management and Stefan Rittner of Allianz Global Investors said.

(** Tap or click the headline above to read this story with all of the links to our background as well as external sources.)

MARKETS THIS MORNING-

Optimism appears to be the theme for markets this morning, as the anticipation for a wave of Big Tech earnings out later this week offsets the uncertainty triggered by President Trump announcing higher tariffs on South Korean goods and the imminent announcement of Powell’s replacement. Asia-Pacific markets are mostly in the green, with the Kospi leading gains, reversing earlier losses, which came as an immediate reaction to Trump’s announcement.

|

EGX30 |

47,507 |

+1.4% (YTD: +13.6%) |

|

|

USD (CBE) |

Buy 47.00 |

Sell 47.14 |

|

|

USD (CIB) |

Buy 47.02 |

Sell 47.12 |

|

|

Interest rates (CBE) |

20.00% deposit |

21.00% lending |

|

|

Tadawul |

11,271 |

0.0% (YTD: +7.4%) |

|

|

ADX |

10,264 |

-0.2% (YTD: +2.7%) |

|

|

DFM |

6,446 |

-0.6% (YTD: +6.6%) |

|

|

S&P 500 |

6,950 |

+0.5% (YTD: +1.5%) |

|

|

FTSE 100 |

10,149 |

+0.1% (YTD: +2.2%) |

|

|

Euro Stoxx 50 |

5,958 |

+0.2% (YTD: +2.9%) |

|

|

Brent crude |

USD 65.64 |

-0.4% |

|

|

Natural gas (Nymex) |

USD 6.80 |

+28.9% |

|

|

Gold |

USD 5,122 |

+2.1% |

|

|

BTC |

USD 88,198 |

+1.9% (YTD: +0.6%) |

|

|

S&P Egypt Sovereign Bond Index |

1,006 |

+0.1% (YTD: +1.3%) |

|

|

S&P MENA bond & sukuk |

151.61 |

+0.2% (YTD: -0.2%) |

|

|

VIX (Fear gauge) |

16.15 |

+0.4% (YTD: +7.6%) |

THE CLOSING BELL-

The EGX30 rose 1.4% at yesterday’s close on turnover of EGP 7.2 bn (29.5% above the 90-day average). Local investors were the sole net sellers. The index is up 13.6% YTD.

In the green: Fawry (+7.1%), Raya Holding (+6.3%), and GB Corp (+5.3%).

In the red: Beltone Holding (-2.2%), Sidpec (-2.2%), and Palm Hills Developments (-1.6%).