Bitwise CIO Identifies Gold Surge and Clarity Act’s Fate as Key Crypto Market Drivers

Gold’s rise and Clarity Act’s fate shape crypto market, says Bitwise CIO.

The current state and future of the crypto industry are being shaped by the rapid rise in gold prices and the uncertainty surrounding the Clarity Act. This perspective was shared by Bitwise’s Chief Investment Officer, Matt Hougan.

Gold’s Ascent and Institutional Trust Crisis

In 2025, the precious metal appreciated by 65%. Since the beginning of 2026, its price has increased by another 16%, exceeding $5000 per ounce.

According to the expert, this trend “demonstrates a profound shift.” He described it as a reaction to years of monetary expansion, rising national debt, and a global crisis of trust in centralised institutions.

Hougan identified the key driver of the rally as the massive gold purchases by central banks following the freezing of Russia’s reserves in 2022. This prompted countries to reconsider storing assets in jurisdictions that could confiscate them.

“The trend is gaining momentum. Last week, German economists urged their government to withdraw gold stored at the Federal Reserve Bank of New York and ‘repatriate’ it to Germany. They no longer trust the US to safeguard their reserves,” he noted.

Herein lies the fundamental value of cryptocurrencies, which are resistant to censorship and do not require intermediaries, according to the Bitwise CIO.

Uncertainty Surrounding the Clarity Act

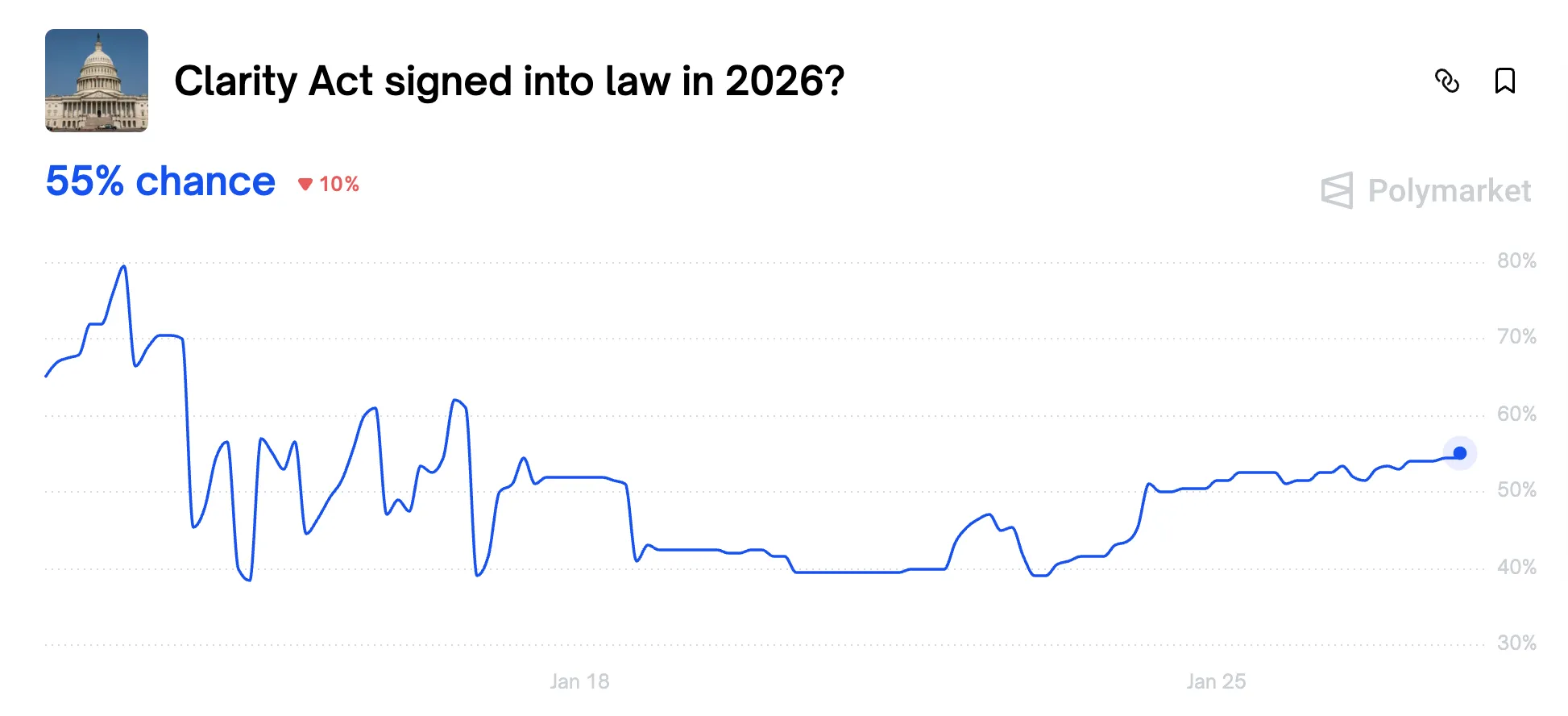

The second critical factor is the fate of the Clarity Act, which aims to allocate regulatory authority over the crypto market between the SEC and the CFTC.

Currently, prediction markets have reduced the probability of the document’s passage from 80% to 50%.

The decline followed criticism from Coinbase CEO Brian Armstrong, who opposed the current version of the bill due to its ban on yield payments on stablecoins.

Hougan outlined two scenarios:

- Passage. A sharp rally effect, as investors begin to factor in the guaranteed growth of stablecoins and tokenisation into current prices.

- Failure. The industry will have about three years to make cryptocurrencies an integral part of everyday life and traditional finance. Success will force regulators to adapt. Failure will leave the sector vulnerable to abrupt policy shifts.

“I remain optimistic about the passage of Clarity. So far, this administration has fulfilled its campaign promises to the crypto industry, and the Clarity Act is one of them. But if it is not passed, I believe we need to prepare for a slower ascent,” the expert concluded.

Earlier, Bitwise announced the end of the bear market.

Found a mistake? Select it and press CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!