Anglo Asian Mining And 2 Other UK Penny Stocks To Consider

The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market pressures, penny stocks remain an intriguing segment for investors seeking growth opportunities in smaller or newer companies. While the term ‘penny stock’ may seem outdated, it still captures a niche area of investment where strong financial health can lead to significant returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Brickability Group (AIM:BRCK) | £0.538 | £173.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.30 | £491.86M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.035 | £15.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.625 | $363.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.85 | £77.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.624 | £196.69M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.47 | £70.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.195 | £192.31M | ✅ 6 ⚠️ 1 View Analysis > |

| ME Group International (LSE:MEGP) | £1.382 | £539.32M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 285 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, along with its subsidiaries, operates gold, silver, and copper producing properties in the Republic of Azerbaijan and has a market cap of £341.88 million.

Operations: The company’s revenue is derived from its mining operations, totaling $67.14 million.

Market Cap: £341.88M

Anglo Asian Mining has demonstrated significant growth in sales and production, with total sales proceeds reaching $125.7 million for 2025, a substantial increase from the previous year. The company has been actively enhancing its operational capabilities, notably through the installation of new filter presses at its Gedabek flotation plant, which is expected to boost copper production. Despite being unprofitable with increasing losses over five years and high share price volatility, Anglo Asian’s seasoned management team and satisfactory net debt to equity ratio provide some stability. Additionally, potential acquisition interest from ACG Metals could influence future developments.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £566.83 million.

Operations: The company generates £261.97 million in revenue from its operations in manufacturing and distributing flooring products.

Market Cap: £566.83M

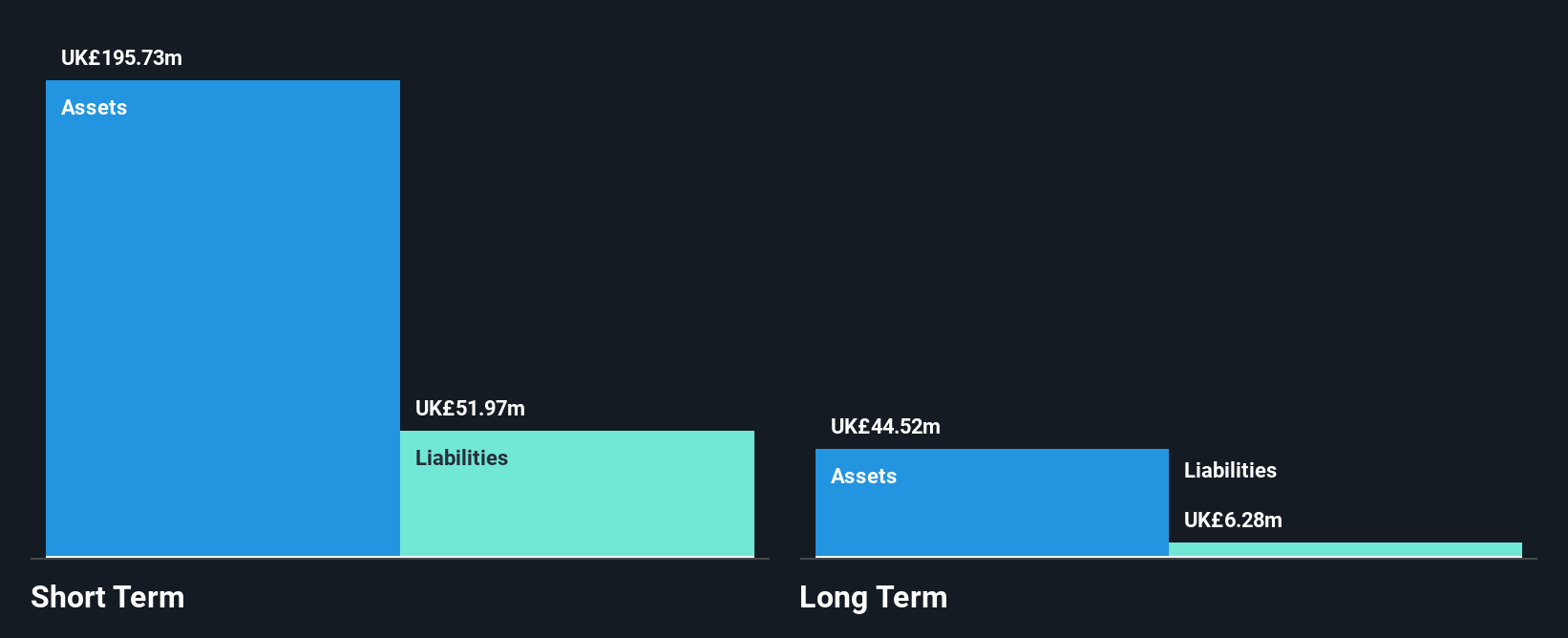

James Halstead plc, with a market cap of £566.83 million and revenue of £261.97 million, demonstrates financial stability through its strong balance sheet, where short-term assets significantly exceed both short- and long-term liabilities. The company has maintained a high return on equity at 22.3%, although recent earnings growth has been negative compared to the industry average. Despite this, James Halstead’s operating cash flow robustly covers its debt obligations, indicating prudent financial management. However, the dividend yield of 6.47% is not well supported by earnings or free cash flows, suggesting potential sustainability concerns in this area.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £622.62 million.

Operations: The company generates revenue of £1.21 billion from the online retailing of domestic appliances and ancillary services.

Market Cap: £622.62M

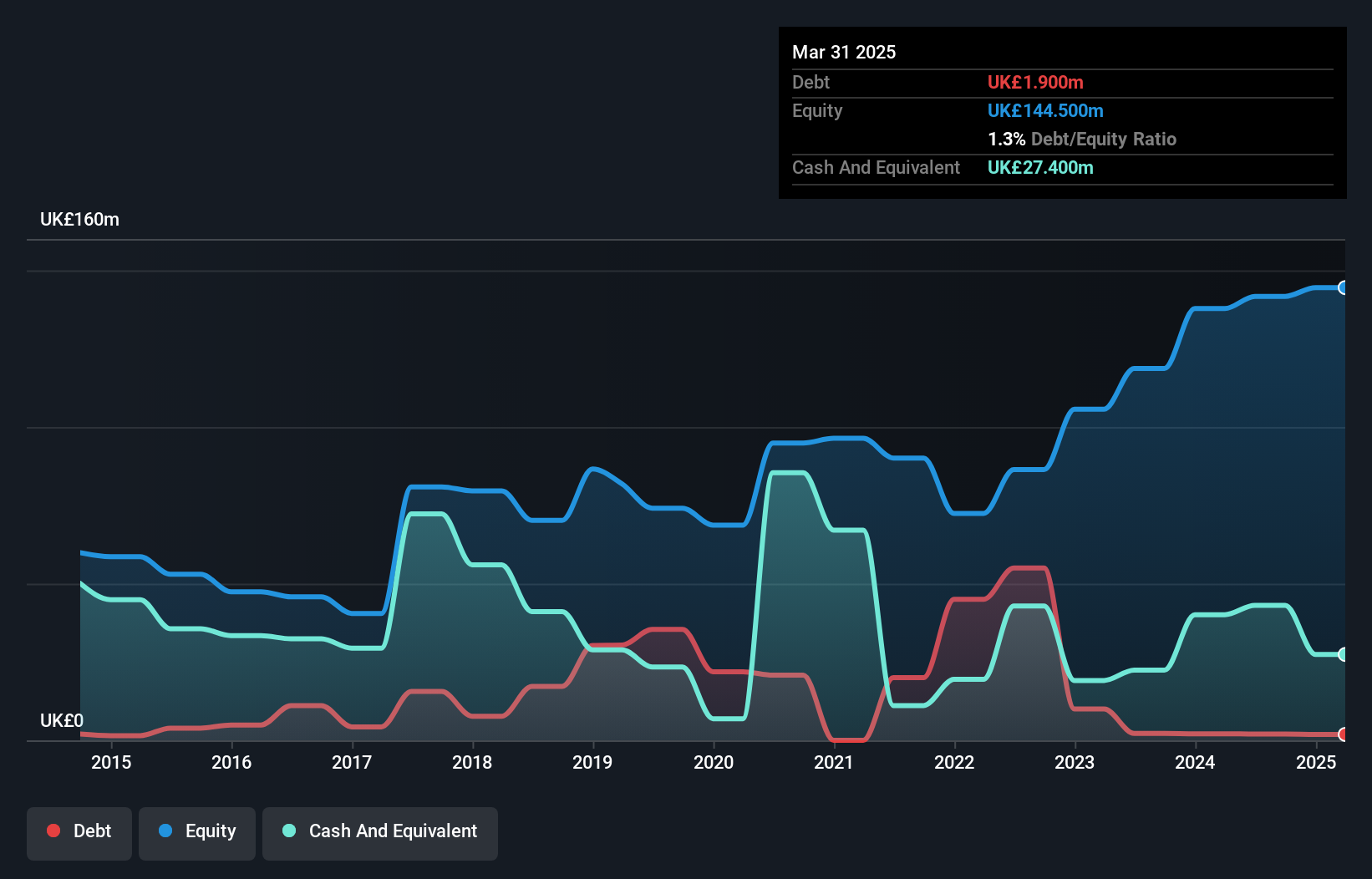

AO World plc, with a market cap of £622.62 million and revenue of £1.21 billion, shows mixed signals as a penny stock consideration. The company has improved its debt profile significantly, with cash exceeding total debt and strong operating cash flow coverage. However, profit margins have declined to 0.9% from 2.5% last year, and recent earnings growth has been negative at -57.6%. Despite this setback, the management team is experienced with an average tenure of 15.5 years, which may provide stability in navigating financial challenges ahead amidst significant insider selling over the past quarter.

Seize The Opportunity

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com