Breakfast News: ASML Pops 5%, Boosts Nasdaq Futures

Tech stock reports kick off, SpaceX IPO report, earnings gather pace, and more…

Breakfast News: ASML Pops 5%, Boosts Nasdaq Futures

January 28, 2026

| Tuesday’s Markets |

|---|

| S&P 500 6,979 (+0.41%) |

| Nasdaq 23,817 (+0.91%) |

| Dow 49,003 (-0.83%) |

| Bitcoin $89,108 (+1.47%) |

Source: Image created by Jester AI.

1. ASML Q4 Earnings Beat Expectations

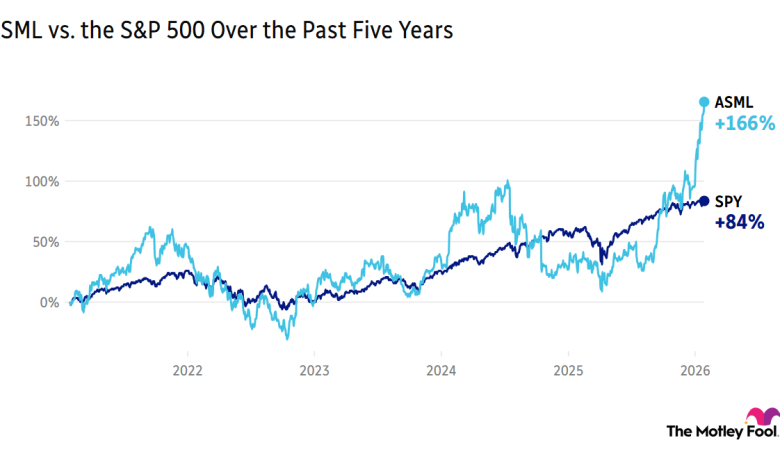

ASML Holding (ASML +2.95%) gained over 5% this morning, after recording bookings of $15.8 billion in the fourth quarter – well ahead of the $7.57 billion analysts had been expecting. The company intends to lift its full-year dividend 17% from last year, with a new buyback program of up to $10.4 billion. ASML is beating the S&P 500 by 88% since May 2022’s Stock Advisor recommendation.

- “More robust expectations of the sustainability of AI-related demand”: CEO Christophe Fouquet spoke of customer optimism, “reflected in a marked step-up in their medium-term capacity plans.” Separately, the company announced 1,700 job layoffs – 3.8% of its workforce.

- “ASML … ‘does not expect 2026 total net sales to be below 2025′”: Fool contributing analyst Dan Caplinger had been unimpressed by ASML’s guidance at Q3 time – but the company now expects an increase of between 4% and 19%. The results helped boost Nasdaq futures around 0.9% this morning.

2. Report: SpaceX Plans June IPO

SpaceX could be set for a mid-June IPO – lining up with a conjunction of Jupiter and Venus on June 8 to 9, and Elon Musk’s birthday on June 28 – reports the Financial Times. The FT previously said Bank of America (BAC +0.34%), Goldman Sachs (GS 0.23%), JPMorgan Chase (JPM 0.28%), and Morgan Stanley (MS +0.43%) are lining up to take part.

- $1.5 trillion valuation: The deal reportedly aims to raise up to $50 billion, exceeding Saudi Aramco‘s $29 billion in 2019 – and making it the biggest IPO ever.

- “The massive value jump is when you can be on your phone or sleeping for the entire ride”: In other Musk-related news, Tesla (TSLA 0.99%) will post Q4 results after today’s close, as the CEO enthuses over its Full Self-Drive service.

3. This Morning’s Key Results From SA Recs

- Starbucks (SBUX 0.61%) is due to post Q1 results before today’s opening bell, as analysts expect another revenue rise this quarter. Recommended by Team Hidden Gems, Starbucks is following a previous positive quarter.

- Corning (GLW +15.72%), a Team Rule Breakers selection, reported rises in Q4 core sales and earnings of 14% and 26% respectively, and “expects YoY growth to accelerate” in Q1. Down more than 4% in pre-market trading after releasing the results, it follows an earnings per share jump of 24% in the last quarter.

- Progressive (PGR +0.11%) will post Q4 earnings this morning. The comprehensive insurance provider saw premium growth in Q3, but suffered a profit fall after a one-off Florida regulatory charge.

4. Next Up: Mag 7 Start to Report, Fed Decision

Tesla is joined by fellow Magnificent Seven stocks Microsoft (MSFT +2.19%) and Meta (META +0.09%) today, scheduled to post their latest results after market close. AI progress will be at the fore, as Alphabet (GOOG +0.40%) – reporting next week – is widely seen as setting the pace.

- “2025 was supposed to be the year of the AI “Agent””: Watch for more news of Microsoft’s next-generation AI chip, Maia 200, designed to give the company added in-house flexibility. Fool analyst Seth Jayson, however, remains skeptical of rapid AI progress.

- “My expectation is they’re signaling a pause”: Investors are looking beyond today’s Federal Reserve rate decision – with no change expected – as former Kansas City Federal Reserve CEO Esther George earlier suggested a “hold for a while.”

5. Your Take

If you could only add to one of your existing holdings, which company would you double down on?

Debate with friends and family, or become a member to hear what your fellow Fools are saying!

This image and article was created using Large Language Models (LLMs) based on The Motley Fool’s insights and investing approach. It has been reviewed by our AI quality control systems. Since LLMs cannot (currently) own stocks, it has no positions in any of the stocks mentioned. JPMorgan Chase is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. The Motley Fool has positions in and recommends ASML, Alphabet, Corning, Goldman Sachs Group, JPMorgan Chase, Meta Platforms, Microsoft, Progressive, Starbucks, and Tesla. The Motley Fool has a disclosure policy.