$193M Crypto War Chest Forces White House to the Table

The cryptocurrency industry has amassed $193 million in political firepower with midterm elections just ten months away, and the White House is now scrambling to rescue a stalled digital asset bill.

With that kind of money on the table, the Trump administration has effectively been summoned to the negotiating table.

Sponsored

War Chest Loaded Before The Battle Even Begins

Crypto political action committee Fairshake announced Tuesday that it held $193 million at the end of 2025—nearly matching the $195 million it spent during the entire 2024 election cycle. The money is already in the bank, and the campaign hasn’t even started.

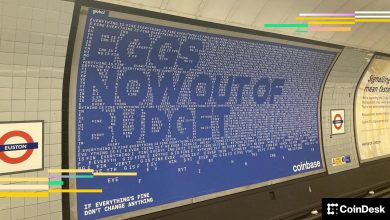

Ripple contributed $25 million, and venture capital firm a16z added $24 million in the second half of last year, while Coinbase gave $25 million in the first half. A Fairshake spokesperson said the PAC remains committed to backing pro-crypto candidates and opposing lawmakers hostile to the industry.

Bill Stalls, White House Steps In

The problem: while this financial arsenal looms over Washington, the industry’s top legislative priority is stuck. The CLARITY Act, a comprehensive bill on digital asset market structure, was pulled from a Senate Banking Committee vote earlier this month after crypto firms and traditional banks clashed over stablecoin yield provisions.

Now the White House is intervening directly. President Trump’s crypto policy council will convene executives from both camps on Monday to hammer out a compromise. The Blockchain Association, Digital Chamber, and Crypto Council for Innovation have confirmed their participation.

Sponsored

Banks Sound The Alarm: $1.5 Trillion At Risk

The banking industry’s opposition isn’t theatrical—it’s existential.

Standard Chartered’s global head of digital assets research, Geoff Kendrick, issued a stark warning this week, estimating that US bank deposits could shrink by roughly one-third of the total stablecoin market cap. If that market grows to $2 trillion, developed-market banks could lose roughly $500 billion in deposits by the end of 2028. Emerging-market banks face an even steeper cliff—up to $1 trillion over the same period.

The math is straightforward but brutal. With dollar-pegged stablecoins currently representing about $301 billion in market value, tens of billions have already migrated out of traditional banking. And unlike a crisis-driven bank run, this is structural—a slow, steady drain.

Bank of America CEO Brian Moynihan sounded an even more dramatic alarm days earlier, suggesting that as much as $6 trillion—roughly 30-35% of total US commercial bank deposits—could eventually shift into stablecoins.

Sponsored

Why The Money Isn’t Coming Back

A key detail makes the threat worse: stablecoin reserves aren’t recycling back into the banking system.

Kendrick estimates Tether holds just 0.02% of its reserves in bank deposits, while Circle holds about 14.5%. The rest sits in Treasury bills and other instruments outside the traditional banking system. Money that leaves banks for stablecoins largely stays out of circulation.

Regional banks face the sharpest exposure. Standard Chartered singled out Huntington Bancshares, M&T Bank, Truist Financial, and CFG Bank as particularly vulnerable, given their heavy reliance on net interest margins from deposit funding.

The Yield War

At the heart of the dispute is a simple question: should stablecoin issuers or crypto exchanges be allowed to pay interest on dollar-pegged tokens?

Sponsored

Last year’s stablecoin law prohibited issuers from paying interest directly, but banks argue it left a loophole that allows third parties, such as exchanges, to offer yield, creating new competition for deposits.

Crypto firms counter that stablecoins already generate returns through reserves and market activity. Blocking rewards, they say, unfairly protects incumbents and stifles innovation. Coinbase has vocally opposed restrictions, arguing they would limit both innovation and institutional adoption.

Political Math

The White House’s direct involvement reveals how urgently the Trump administration wants this bill across the finish line. Trump courted cryptocurrency aggressively during his campaign and now faces pressure to deliver.

Fairshake’s 2024 spending paid off handsomely. Its backed candidates won by overwhelming margins, Congress passed stablecoin legislation, and industry-friendly regulators were appointed to the SEC and other key agencies. The $193 million isn’t just a number—it’s leverage.

Industry executives have credited the White House for bringing all parties to the table. But viewed another way, it’s the administration that got pulled.