Robinhood to Vie for Key Retail Role in Mega SpaceX IPO

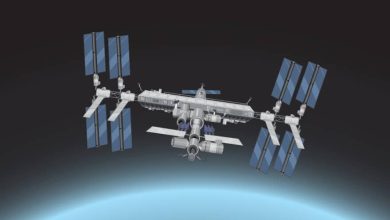

(Bloomberg) — Robinhood Markets Inc., the upstart broker credited with getting young people hooked on trading, is vying for a key role in SpaceX’s blockbuster initial public offering, according to people familiar with the matter.

Robinhood is jockeying with several Wall Street banks to secure a big slug of coveted SpaceX stock to sell directly to its retail investors, said the people, who asked to not be identified because the details aren’t public. The company would likely offer the shares through its IPO Access platform, which lets users buy stock at the IPO price, before they trade on the open market.

Most Read from Bloomberg

Elon Musk’s rocket and satellite company is considering earmarking a significant portion of the shares for retail investors, the people said. The listing could potentially come midyear, though the timing could change, they said. Robinhood’s move is ruffling the feathers of big Wall Street banks angling for an IPO role, which would ordinarily include handling the retail allocation, the people said.

A potential role for Robinhood — with about 27 million funded customers as of Nov. 30 — in the jumbo listing underscores how the retail trading app has become a major force on Wall Street, as its mobile-first, commission-free trading model has taken hold in the past decade. It also illustrates Musk’s affinity for retail traders, having famously tweeted “Stonks” at the height of the meme-stock frenzy.

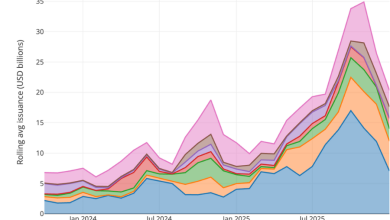

SpaceX is targeting an IPO that would raise significantly more than $30 billion in a transaction that would value the company at about $1.5 trillion, Bloomberg News has reported. The firm may target a June listing, around Musk’s birthday, some of the people said, and could seek to raise as much as $50 billion, one of them said. That would make it the biggest IPO of all time. Bank of America Corp., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley are expected to have senior roles.

A representative for Robinhood declined to comment. A representative for SpaceX, formally known as Space Exploration Technologies Corp., didn’t respond to a request for comment. The Financial Times reported earlier that Musk has suggested timing a possible IPO to coincide with a planetary phenomenon and his birthday in June, and it could raise as much as $50 billion.

Retail traders have traditionally been an afterthought when it comes to comes to how IPOs work: big firms typically sell stock to institutional buyers, which determine the price, before trading commences on the open market when anyone can buy. Tech-oriented firms such as Robinhood itself, Airbnb Inc. and Uber Technologies Inc. began upending that model by setting aside IPO shares for their users.