Euro rebounds in January IPOs

In January to date, US$16.2 billion has been issued – and the euro has started the year strong.

Earlier this month Euronext announced the listing of defence company Czechoslovak Group (CSG) on Euronext Amsterdam, boasting that it was “the world’s largest defence IPO ever recorded, both in terms of amount raised and market capitalisation.”

The US$4.6 billion IPO is also the largest of 2026 to date, taking a significant lead above runner-up Forgent Power’s US$1.6 billion issuance and settling Euronext as the third most active exchange group.

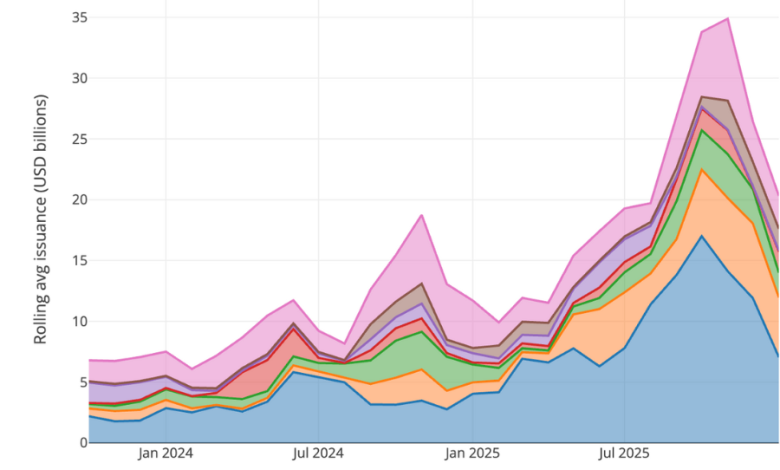

USD Volume · by Exchange Group · since 2025-12 · to 2026-01

This is a stark contrast to December. Europe finished 2025 with a whimper, with little activity after Verisure’s mega US$4.26 billion IPO on Nasdaq’s Stockholm Stock Exchange in September. Not only the largest EUR issuance of the year, it was also the third largest globally – beaten only by Medline’s US$7.2 billion Nasdaq Global Select Market IPO a month later in October, and Contemporary Amperex Technology’s US$5.3 billion offering on the Hong Kong Stock Exchange in May.

Globally, however, IPO volumes increased by 18% year-on-year in December based on a three-month rolling average, reaching US$15.46 billion.

The US dollar remained the issuance denomination of choice, followed by the Hong Kong dollar and the Indian rupee. However, its share of total IPO volume fell from 43% in October to 37% in December. Its growth relative to global peers began to taper off in September.

The currency’s most active month was August, when more than US$16 billion was issued.

The largest issuance of the month was US$1.2 billion by Indian active mutual fund manager ICICI Prudential Asset Management, followed by a US$859 million issuance from US construction equipment rental company EquipmentShare.com.

Following the CSG launch, Euronext has opened its six month pre-IPO training programme for the year. A dedicated aerospace and defence section is being added to the initiative.

The exchange group said this year’s cohort will include more than 160 companies from 22 countries, with combined annual revenues of €29bn and 140,000 employees. The support programme aims at helping management teams through the practical work that typically derails listings late in the process. The workshops and tutoring cover a range of ‘get up to speed’ subjects, from tightening reporting and governance, shaping an “equity story”, stress-testing disclosure and legal readiness, and preparing for post-IPO investor communication.

Other European exchange groups, from SIX to Deutsche Börse, also offer pre-IPO programmes.