Market Turbulence 2026: Investors Shift from AI to Cyclicals & New Strategies – News and Statistics

Feb 7, 2026

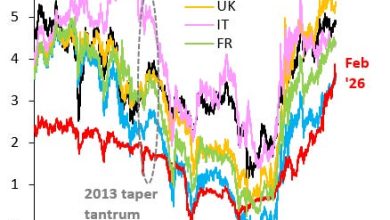

The secular tailwind that fueled markets for the past year has hit heavy turbulence in early 2026. According to the original source, this has led many investors to reflexively move their money into “old school” stocks, or cyclicals, and other “anti-AI” themes like emerging markets stocks.

The analysis suggests that simply swapping one big theme for another may be an inferior response. The reason given is a period of profound “secular uncertainty,” where traditional economic logic is influenced by unresolved questions.

These questions include whether a flood of Chinese exports to Europe will trigger a second global trade war, if the U.S. low-income consumer is hitting a breaking point, and how much more debt the bond market can handle to fund AI infrastructure and government deficits.

Two multiyear phenomena are amplifying this uncertainty. The first is “geo-economics,” where domestic politics, geopolitics, and national security sideline traditional economic considerations. The second is the manner AI and robotics are likely to change many areas.

In this environment, the article states it is harder to pick a winning “mega-trend” from a high level. Success now requires a more granular approach, looking at specific opportunities rather than entire sectors or countries.

The source outlines two alternative strategies. The first is to look for markets that are incomplete or “broken,” such as private credit in emerging markets, where local banks aren’t lending but viable companies with strong collateral need capital.

The second is to capitalize on volatility, as seen recently with tech, bitcoin, and silver. During such fire sales, investors often sell good assets to raise cash, creating a “market for lemons” where everything looks bad. The article suggests that with agility, investors can pick up high-quality assets, including top-tier AI names, at a massive discount while short-term speculators flee.