Assessing Lundin Mining (TSX:LUN) Valuation After Its Strong 3 Month Share Price Run

What Lundin Mining’s Recent Performance Tells You

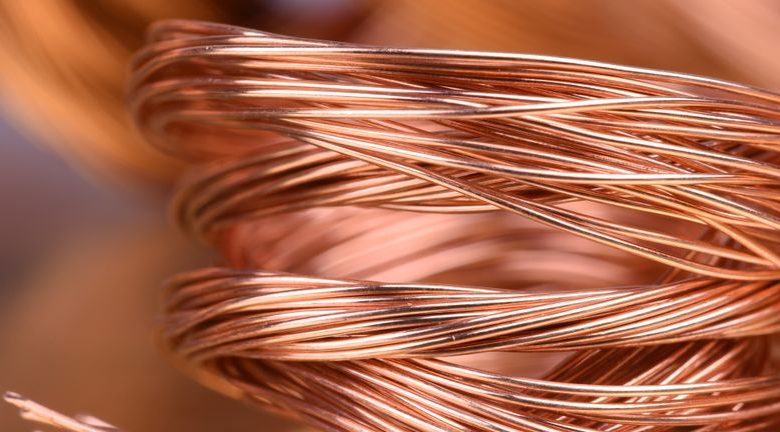

Lundin Mining (TSX:LUN) has caught investors’ attention after a strong past 3 months, with the share price rising about 34%, alongside annual revenue of $3,767.004m and net income of $212.044m.

See our latest analysis for Lundin Mining.

At the latest share price of CA$33.45, Lundin Mining’s recent 1 month share price return of 7.52% and 3 month return of 34.28% sit alongside a very large 1 year total shareholder return of 176.73%, suggesting momentum has been building for some time.

If Lundin’s recent run in copper and base metals has you thinking about where else capital might flow, it could be worth checking out 7 top copper producer stocks as a way to find other miners on investors’ radar.

With Lundin Mining trading at CA$33.45 and sitting only slightly below the average analyst price target, investors may ask whether there is still mispricing or whether the market is already accounting for future growth.

Most Popular Narrative: 3% Overvalued

With Lundin Mining last closing at CA$33.45 against a narrative fair value of CA$32.34, the current share price sits slightly above that framework, which is built around future cash flows, margins and metals exposure.

The updated analyst price target for Lundin Mining has shifted higher to reflect a fair value move from $28.28 to $32.34, as analysts factor in refreshed commodity price forecasts, a slightly lower discount rate of 7.21% and higher expected future P/E multiples, even as they incorporate more cautious assumptions on revenue growth and profit margins.

Curious what justifies paying up for these earnings a few years out? The narrative leans on a tight mix of volume expectations, cautious top line assumptions and a richer earnings multiple that is more often associated with faster growing sectors. Want to see exactly which moving parts drive that CA$32.34 figure and how sensitive it is to those inputs? The full narrative lays out the numbers in black and white.

Result: Fair Value of CA$32.34 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, you still need to keep an eye on concentrated South American exposure and the capital heavy project pipeline, as regulatory or execution setbacks could quickly reshape this story.

Find out about the key risks to this Lundin Mining narrative.

Build Your Own Lundin Mining Narrative

If you see the story differently or simply want to follow your own numbers, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Lundin Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Lundin Mining has sharpened your focus, do not stop here, the wider market holds plenty of other ideas that could better fit your goals and risk comfort.

- Target potential value by scanning companies that look attractively priced with solid fundamentals using our 8 high quality undervalued stocks built from the Simply Wall St screener.

- Strengthen your income stream by hunting for high yield opportunities in our hand picked 7 dividend fortresses curated through the screener’s filters.

- Limit portfolio surprises by zeroing in on resilient names through the 6 resilient stocks with low risk scores sourced from our risk scoring screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com