Aston Bay Holdings And 2 Other TSX Penny Stocks To Watch

As we enter 2026, investors are encouraged to keep a close eye on the health of the Canadian economy, especially given recent surprises in employment trends. Penny stocks, often representing smaller or newer companies, remain an intriguing area for investment despite their somewhat outdated label. These stocks can offer a blend of affordability and growth potential when backed by strong financials, making them worth considering for those looking to diversify their portfolios beyond the major market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$55.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$256.98M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.24 | CA$127M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.68M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$52.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$884.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$22.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.33 | CA$172.43M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.05 | CA$32.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$178.57M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 377 stocks from our TSX Penny Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aston Bay Holdings Ltd. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$15.18 million.

Operations: Aston Bay Holdings Ltd. currently does not report any specific revenue segments.

Market Cap: CA$15.18M

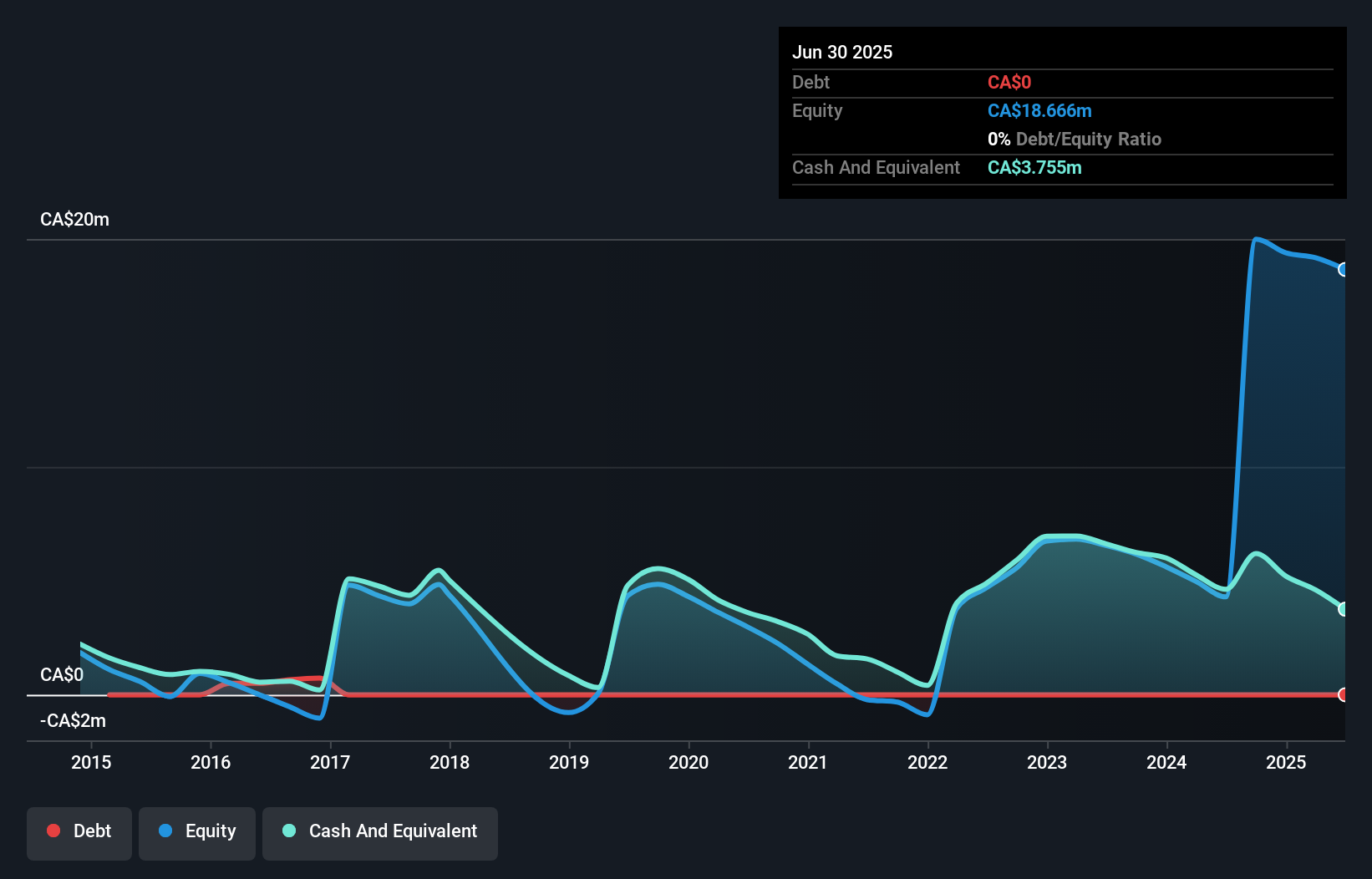

Aston Bay Holdings Ltd., with a market cap of CA$15.18 million, is a pre-revenue company focused on mineral exploration. Recent drilling results at its Storm Project in Nunavut revealed high-grade copper intersections, suggesting potential resource expansion. Despite being unprofitable, the company benefits from having no debt and sufficient cash runway for over three years. Its short-term assets significantly exceed liabilities, providing financial stability despite earnings declines over the past five years. However, the stock experiences high volatility compared to most Canadian stocks and remains sensitive to market fluctuations due to its speculative nature as a penny stock investment.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CVW Sustainable Royalties Inc. focuses on developing technology to recover bitumen, solvents, minerals, and water from oil sands froth treatment tailings, with a market cap of CA$115.37 million.

Operations: There are no reported revenue segments for CVW Sustainable Royalties Inc.

Market Cap: CA$115.37M

CVW Sustainable Royalties Inc., with a market cap of CA$115.37 million, is pre-revenue and focuses on technology for oil sands tailings recovery. The company is debt-free, with short-term assets of CA$3.2 million exceeding both short and long-term liabilities, indicating a solid financial position despite its unprofitability. Recent earnings reports show increased losses compared to the previous year, highlighting ongoing financial challenges. Management and board members are experienced, but the cash runway is less than one year based on current free cash flow trends, potentially impacting future operations without additional funding or revenue generation.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trailbreaker Resources Ltd. is a mineral exploration company engaged in acquiring, evaluating, exploring, and developing mineral assets in Canada, with a market cap of CA$15.68 million.

Operations: Trailbreaker Resources Ltd. does not report any revenue segments.

Market Cap: CA$15.68M

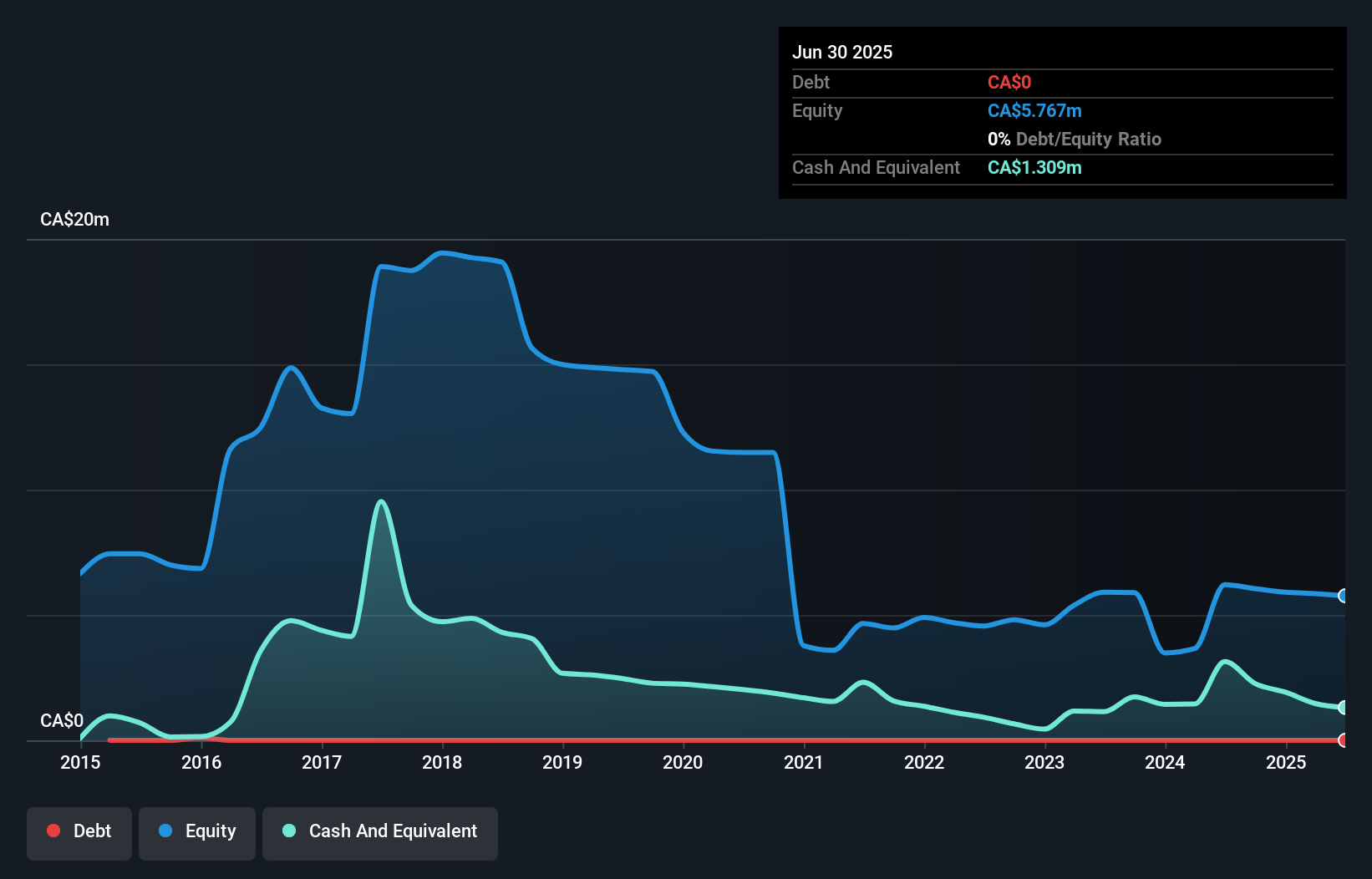

Trailbreaker Resources Ltd., with a market cap of CA$15.68 million, is a pre-revenue mineral exploration company focused on projects in Canada. The company is debt-free and has short-term assets of CA$1.3 million exceeding its liabilities, suggesting a stable financial base despite its lack of revenue. Recent exploration at the Atsutla Gold project in British Columbia expanded high-grade gold and copper-silver showings, indicating potential resource growth. However, Trailbreaker’s cash runway is less than one year if current cash flow trends persist, which may necessitate additional funding to sustain operations and further exploration activities.

Key Takeaways

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com