Bank of Japan’s QT Cuts $502 billion from Balance Sheet. JGB Yields Surge as BOJ Steps away from Bond Market

Japanese Government Bond 10-year yield rose to 20-year high of 2.13%, 30-year yield hit 3.50%.

By Wolf Richter for WOLF STREET.

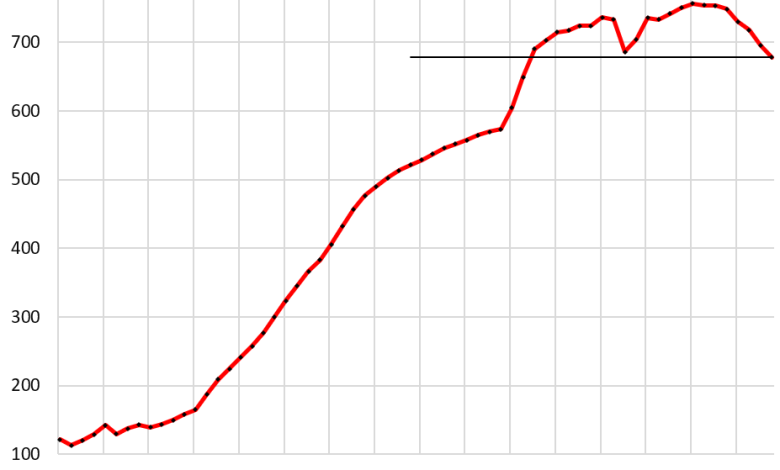

In the quarter through December, total assets on the Bank of Japan balance sheet fell by ¥18.0 trillion (-$115 billion) from the prior quarter, and by ¥70.2 trillion year-over-year, according to the BOJ’s balance sheet data today.

Total assets, now down to ¥677.8 trillion ($4.33 trillion), are at the lowest level since Q2 2020, and down by ¥78.6 trillion (-$502 billion), or by 10.4%, from the peak in the quarter through March 2024.

Back during the QE era, the BOJ conducted QE in several forms:

- Buying Japanese government securities (now 80% of total assets).

- Lending to banks and other entities (loans are now 11% of total assets).

- Buying stock-market traded equity ETFs and Japanese REITS (now 5.6% of total assets)

- Buying commercial paper and corporate bonds (now down to just 0.4% of total assets).

- Bank stocks purchased in 2000 and 2009/2010 (now zero, sold the last ones in the quarter through September 2025).

Japanese government securities declined by ¥12.4 trillion in the quarter through December (-$79 billion), the biggest quarterly drop since QT started in early 2024.

At ¥544 trillion ($3.47 trillion), they’re at the lowest level since the quarter through June 2022.

All of them are now Japanese Government Bonds (JGBs); the last Treasury bills matured off the balance sheet in the quarter and were not replaced.

Since the peak in the December 2023 quarter, holdings of Japanese government securities have dropped by ¥47.9 trillion (-8.1%).

The BOJ’s holdings of Japanese government securities move in three-month cycles due to the timing of when long-term bonds mature and when they’re replaced with newly issued bonds of the same type. So I use the BOJ’s quarterly data in my balance sheet updates here, which iron out the three-month cycles.

Loans declined by ¥4.3 trillion in the quarter, and by ¥29 trillion year-over-year, to ¥79.5 trillion ($507 billion).

Since the peak in Q1 2022, the outstanding loan balance has fallen by ¥72.0 trillion, or by 48%.

These loans now account for 11% of the BOJ’s total assets. The BOJ provided loans to banks and other entities under several programs, including the pandemic-era loans that caused the total amount of loans outstanding to more than triple in two years:

BOJ’s equity ETFs, Japanese REITs, and bank stocks.

The BOJ stopped buying ETFs and J-REITs in Q4 2023 when its holdings at acquisition cost reached ¥37.8 trillion ($241 billion).

Unlike bonds and loans that come off the balance sheet when they mature, equity ETFs, Japanese REITs, and bank stocks don’t mature; the BOJ has to sell them outright to shed them.

The BOJ sold off its last bank stocks in the September quarter. It had purchased them in the early 2000s and again in 2009-2010. In 2016, the BOJ started selling them at a slow pace over a 10-year time span. This process can be a guideline for how the BOJ will sell its ETFs and Japanese REITs: very slowly.

The BOJ is preparing to sell its ETFs and J-REITs, it said at its September meeting. The sales haven’t started yet. The initial pace will be glacial: ETFs at a pace of ¥330 billion a year ($2.2 billion) and J-REITs at a pace of ¥5 billion per year ($33 million).

But that pace is faster than it seems: The BOJ has carried ETFs and J-REITs at acquisition cost and has not marked them up to market, though market prices have soared since it started buying them in 2012. Since January 2012, the Nikkei 225 has soared by 500%! But that pace of ETF sales is at acquisition cost, while market prices of some of the ETF shares the BOJ will be selling may have tripled or quadrupled since it started buying them in 2012, and the market value of those sales would be far higher than the stated value at acquisition cost.

Equity ETFs and J-REITs were always only a small part of the BOJ’s QE operations, but the hype around those purchases in the US QE-promoting financial media was huge. Combined, they currently account for only 5.6% of the BOJ’s total assets.

Commercial paper and corporate bonds fell by ¥1.0 trillion in the quarter to just ¥2.75 trillion ($18 billion), the lowest since 2011.

Since the peak at the end of 2021, they have plunged by 76% as they matured.

They were always just a tiny part of the BOJ’s QE operations, at their peak accounting for only 2.2% of the BOJ’s total assets. They’re now down to just 0.4%.

JGB yields are slowly being freed from the BOJ, which stepped away from QE and yield-curve control, started shedding its holdings and hiking its policy rates. At its December meeting, it hiked again by 25 basis points to a still ridiculously low 0.75%, and is talking about further rate hikes – but at a glacial pace. In a sign of how long the Japanese monetary experiment has lasted, that ridiculously low policy rate of 0.75% is the highest since 1995!

The 10-year yield of JGBs rose to 2.13% today, the highest since February 1999, continuing the rise that had commenced in late 2019.

But the 10-year yield is still very low, and substantially below the rate of inflation, which has been running at around 3%.

To take some upward pressure off long-term yields, the BOJ said it would slow the pace of QT somewhat in the next fiscal year, which starts on April 1.

And the 30-year JGB yield rose to 3.50% today.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()