Best AI Personal Finance Assistants You Should Try in 2026

If you feel you’ve got neither the head nor the time for finances, then maybe 2026 is the year to outsource things – to an AI assistant, that is. Yes, in this article, we’ll be taking a look at some excellent AI personal finance assistants that’ll help you begin the year on the right foot.

The Best Personal AI Finance Assistants for You

The best AI for finance advice and personal assistance makes managing your money and planning easier. Insights and forecasting are important, of course, but context awareness and adaptive learning are just as essential as data encryption.

With that in mind, let’s see what’s on offer:

Cleo

If you want a financial advisor that’s as easy to use as a chatbot like ChatGPT, then Cleo is for you. Its conversational tone really makes it feel like a friend and financial advisor with a wicked sense of humor. It’s not cut out for the bigger picture, such as where to invest and financial forecasts, but if you want to know if you can afford a holiday next month, it’s more than up to the challenge.

It works across bank accounts, offers challenges for saving, and is a great way to plan a budget for younger users looking to get financially savvy. The tool operates on a freemium model, with more advanced options behind a paywall.

YNAB

You Need a Budget. That’s not us telling you; that’s the name of the app. YNAB is the perfect tool for those serious about budgeting. More than month-to-month expenses, this AI tool deals with your spending patterns, learning habits, and provides forecasting and smart financial advice based on them. The tool syncs across multiple devices and offers advice based on proven budgeting methodologies.

All this higher functionality and power does come with a higher price tag, but if you’re serious about budgeting, no matter your goals, this tool’s indispensable.

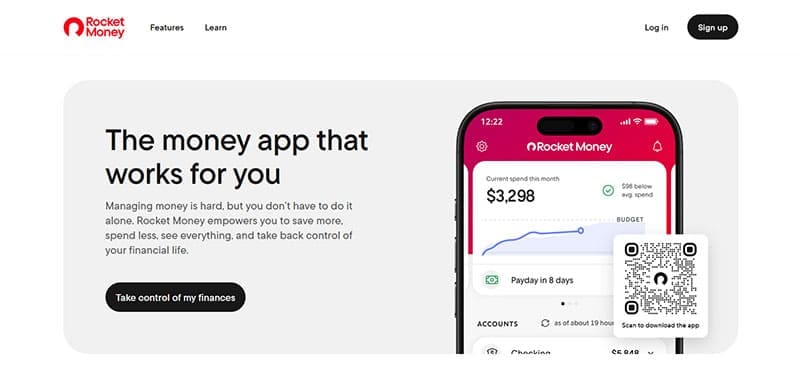

Rocket Money

Personal finances aren’t always about budgeting and planning for the future, but also about how you can improve things today. Rocket Money is one such tool that allows you to find relief in the bills and subscriptions you’re currently paying. It helps with canceling unused subscriptions and will also negotiate for better prices on certain invoices. If you’re too oversubscribed to know where to begin cutting costs, this is for you.

The tool runs on a freemium model, with the most advanced features requiring a fee. Rocket Money also doesn’t focus on investment and forecasts, choosing to pour its power into the present.

PocketGuard

Have you ever wanted to know how much of the money you have is safe to spend without the anxiety and the constant calculation? PocketGuard is your guide in this department. Not only does it factor in and try to eliminate your current expenses (subscriptions included), but it also factors in your income and saving goals to devise budgets that save you from yourself and overspending.

While it may not excel in long-term forecasting or tool customization, the freemium Pocket Guard is user-friendly.