Does Eli Lilly’s Rally Signal a Better Value After Its Weight-Loss Drug Breakthrough?

- Ever wondered if Eli Lilly’s massive popularity actually means it is a good value right now? You are not alone. Figuring out if a stock justifies its price is half the challenge for smart investors.

- The stock climbed 32.2% in the last month alone and is up 38.2% year-to-date, adding to its impressive multi-year run.

- Recent headlines have spotlighted Eli Lilly’s advances in weight-loss and diabetes treatment drugs, which have captured both investor and patient attention. Big partnerships and regulatory milestones have added fuel to the stock’s momentum, shifting how the market views its long-term growth prospects.

- But when it comes to our valuation checklist, Lilly only ticks 1 out of 6 boxes for being undervalued. See the full breakdown here. We will walk through what common valuation methods say and why there is a more insightful way to think about value at the end of this article.

Eli Lilly scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

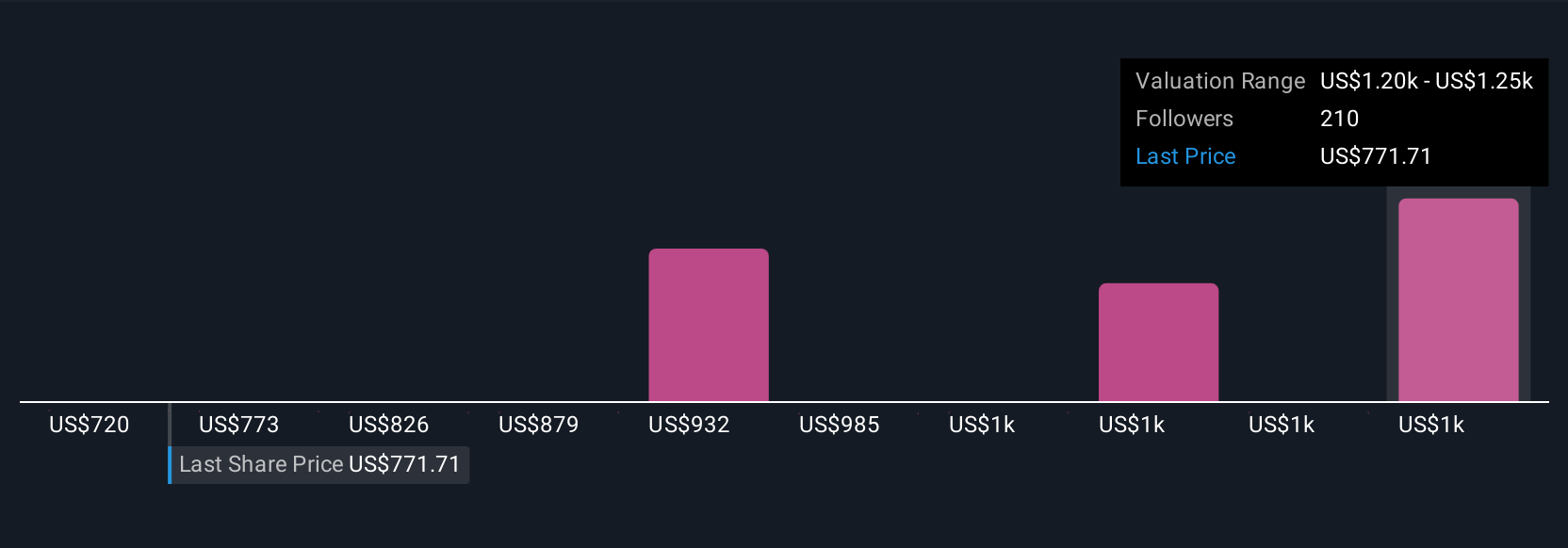

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today’s value. This approach reflects the time value of money and helps investors gauge whether a stock’s price reflects its long-term earning potential.

For Eli Lilly, analysts estimate the company’s current Free Cash Flow at approximately $6.15 billion. Over the next five years, this figure is expected to climb substantially, with projections by Simply Wall St suggesting Free Cash Flow could reach nearly $37.35 billion in 2029. Estimates beyond 2029 are extrapolated rather than anchored directly to analyst predictions, providing a view on potential longer-term growth.

After applying the DCF model and discounting these projected cash flows, the intrinsic value of Eli Lilly stock is calculated to be about $1,270.28 per share. This suggests that, compared to its current market price, the stock is trading at a 15.3% discount. This aligns with the model’s findings that it is undervalued against projected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eli Lilly is undervalued by 15.3%. Track this in your watchlist or portfolio, or discover 920 more undervalued stocks based on cash flows.

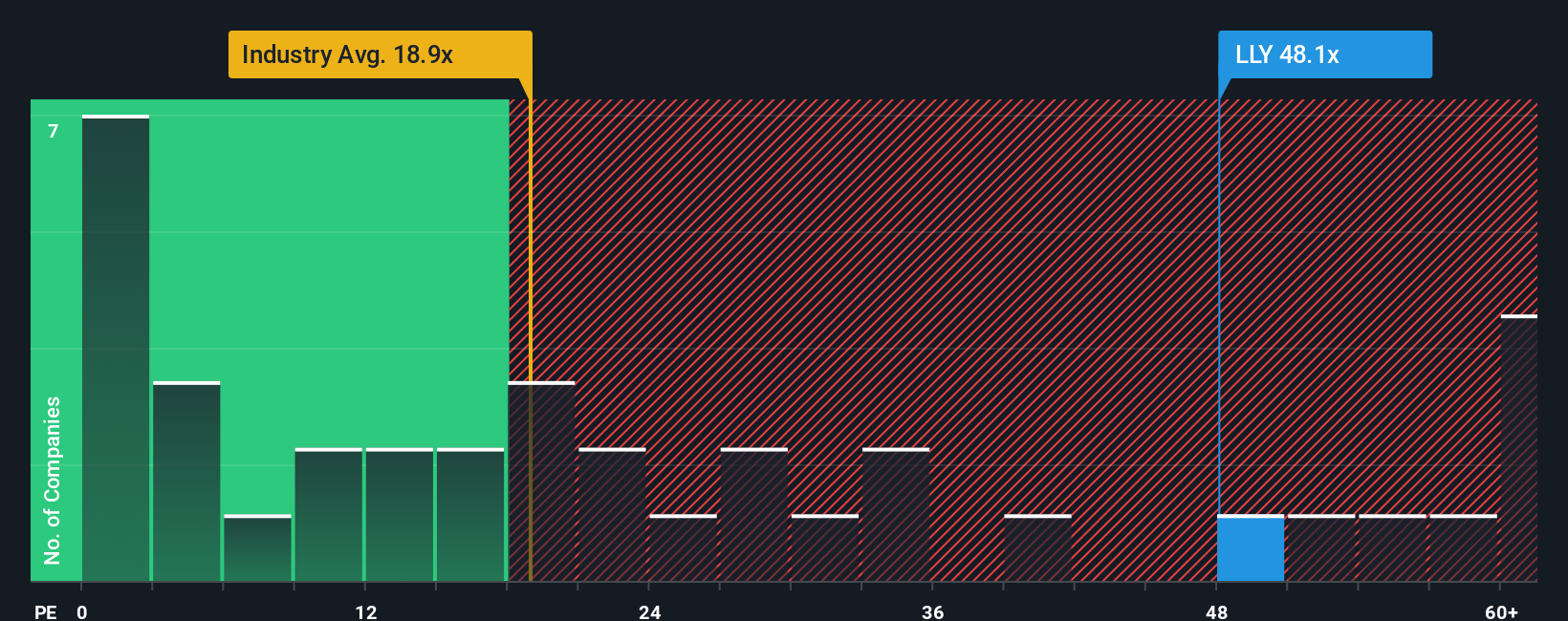

Approach 2: Eli Lilly Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular benchmark for valuing profitable companies because it shows how much investors are willing to pay for each dollar of earnings. This metric allows investors to quickly compare valuation levels between stocks, especially among companies that consistently generate profits like Eli Lilly.

However, the “right” PE ratio is always relative. High-growth companies sometimes warrant loftier PE multiples, as investors expect earnings to climb in the future. Conversely, higher risk or slower growth generally justifies a lower multiple. The key is to find whether the current price fairly reflects these expectations and risks.

Currently, Eli Lilly trades at a PE ratio of 52.3x. This is significantly above both the pharmaceutical industry average of 20.6x and the peer average of 16.3x. While this premium suggests momentum and high expectations, it is important to look deeper than simple comparisons to sector averages.

Simply Wall St calculates a proprietary “Fair Ratio” for each company, tailoring the multiple to factors like future earnings growth, risk, profit margin, market cap, and the company’s industry. For Eli Lilly, the Fair Ratio is 44.5x, which adjusts for the company’s strengths and specific outlook. This approach offers a more precise gauge of valuation than comparing only to generic industry or peer numbers.

With Eli Lilly’s current PE ratio at 52.3x and the Fair Ratio at 44.5x, the stock appears to be trading above a fair value based on its unique profile and prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique story about a company that links its business outlook and strategy to a financial forecast and a single fair value. This approach allows you to capture what you believe will drive future growth, not just what the numbers say today.

Narratives take you beyond raw metrics by letting you integrate your own perspective on Eli Lilly’s revenue growth, margins, risk factors, and relevant news, and then instantly see how these ideas translate into a fair value and investable thesis. This approach connects your view of the company. For example, you may believe years of exclusivity for tirzepatide will sustain high growth and justify a fair value above $1,180, or that increasing regulatory pressure suggests a fair value closer to $650. These views are directly linked to financial outcomes.

Best of all, Narratives are easy to access and use on Simply Wall St’s Community page, where millions of investors share perspectives. They automatically update as new information, such as earnings reports or regulatory news, emerges. This helps you reconsider your stance and decide if it is time to buy, hold, or sell. By comparing your fair value to the current price, Narratives empower you to make smarter, context-driven decisions rather than relying only on static ratios.

For Eli Lilly, we aim to simplify your research with previews of two leading Eli Lilly narratives:

- 🐂 Eli Lilly Bull Case

Fair value: $1,189.18

Current price is 9.6% below fair value

Projected revenue growth: 20%

- Lilly’s growth is driven by rapid expansion of the GLP-1 franchise (Mounjaro and Zepbound) with strong patent protection and rising insurance coverage in the U.S.

- The market for GLP-1 drugs is currently 4% penetrated, suggesting significant room for growth, although supply limits may continue through 2025 before easing with facility expansion.

- Main risks include high drug prices, potential delays in production buildout, competitive entrants expected in 2027 and 2028, and possible side effect-related legal challenges.

- 🐻 Eli Lilly Bear Case

Fair value: $1,003.15

Current price is 7.2% above fair value

Projected revenue growth: 16.8%

- Strong earnings and revenue growth in key diabetes and obesity drugs, as well as innovation in specialty therapies, contribute to the long-term outlook, but valuation depends on effective execution.

- Significant risks stem from reliance on a few blockbuster drugs, regulatory and pricing pressures in the U.S. and Europe, and increasing generic or biosimilar competition.

- Consensus analyst price targets have shifted upward, but forecasts depend on continued margin improvement and successful product launches in the context of ongoing policy debates and changing reimbursement rules.

Do you think there’s more to the story for Eli Lilly? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com