Dogecoin Whales Fall Silent as New ETFs Debut in the U.S.

Dogecoin large holders have slowed their activity despite the arrival of the first spot DOGE ETFs

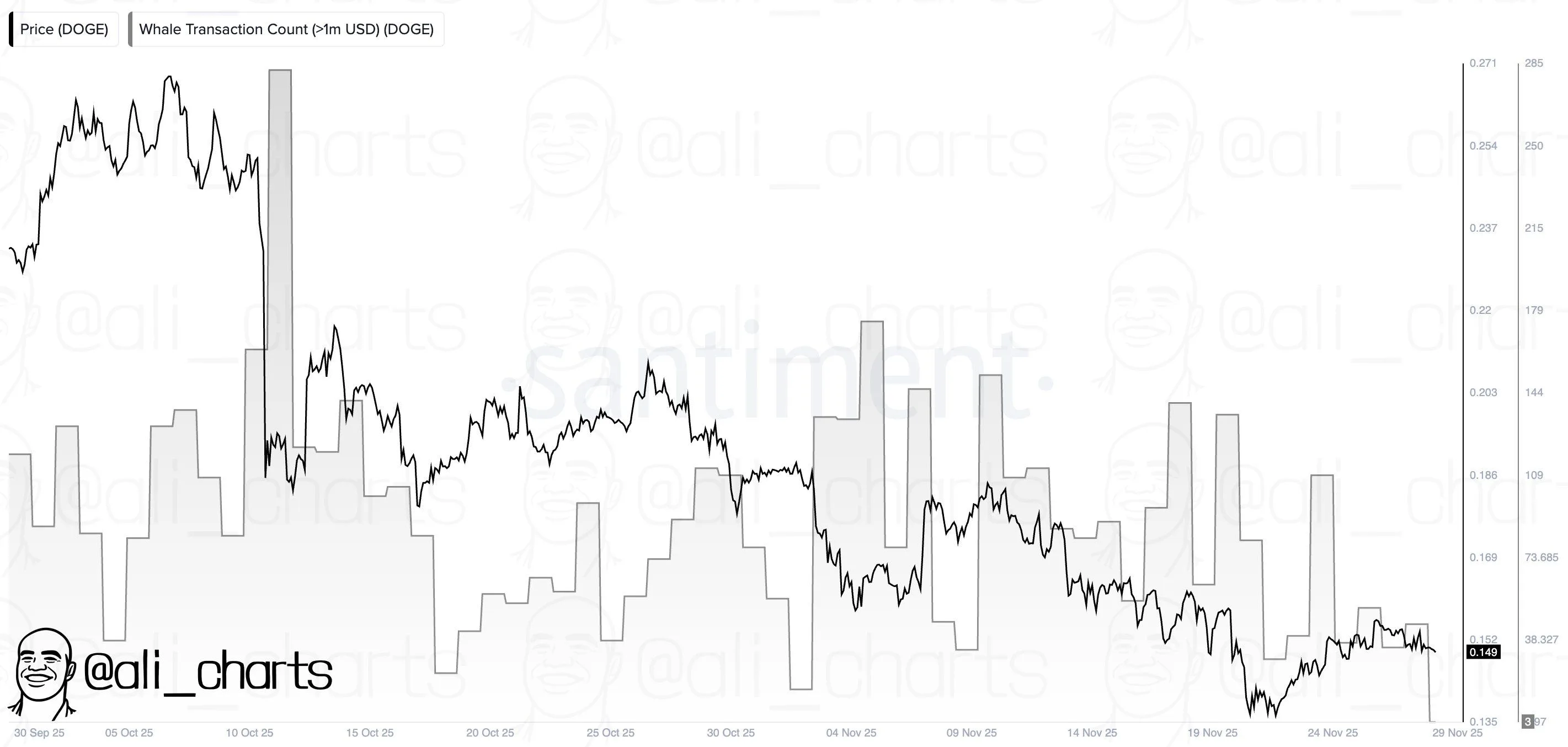

Whale Activity Hits Two-Month Low

Blockchain data shows that Dogecoin

Source: X

The reduced activity coincides with Dogecoin’s narrow price range since mid-October. The asset has held between $0.133 and $0.20 for several weeks. At the time of this publication, Dogecoin is trading at around $0.15, suggesting a 1.08% increase in the last 24 hours.

DOGE price chart, Source: CoinMarketCap

The upper boundary at $0.20 remains a strong resistance zone. Any attempt at a breakout may struggle if market sentiment remains weak. Dogecoin face immediate resistance at $0.156, which marked a clear rejection on Nov. 26 after a short recovery streak.

ETF Launch Generates Limited Impact

The launch of spot Dogecoin ETFs was expected to inject fresh interest into the market. Grayscale introduced its DOGE ETF, listed under the ticker GDOG, on the New York Stock Exchange at the start of the week. Bitwise also rolled out its own Dogecoin product under the 20-day 8(a) window, marking a rare moment of institutional expansion for the meme-inspired asset.

Despite these developments, market reaction remained subdued. GDOG recorded a debut trading volume of $1.4 million, falling below industry expectations

Regulators in the United States are still reviewing a 21Shares filing for a non-leveraged Dogecoin ETF. Approval could add another gateway for institutional investors, but observers caution that the current environment may limit near-term inflows.

The muted response also contrasts with earlier ETF rollouts in the crypto sector. Products tied to Bitcoin and Ethereum saw stronger initial demand, driven by broader market optimism. In contrast, the latest wave of altcoin ETFs is entering a market that appears more cautious, with investors weighing macro risks and shifting liquidity conditions.

Technical Outlook Remains Fragile

Dogecoin’s technical setup reflects ongoing uncertainty. The asset continues to trade within a tight range, showing little sign of decisive momentum. Bears point to declining whale activity as a signal that large holders may not expect immediate upside. Bulls, however, argue that reduced movement may indicate consolidation before a stronger directional shift.

Resistance at $0.156 and $0.20 will be key levels to watch. A move above these thresholds could help restore short-term confidence, though sustained buying pressure remains uncertain. Support near $0.133 has held for several weeks, suggesting that sellers are hesitant to push the price significantly lower without new catalysts.