High Growth US Tech Stocks To Watch In January 2026

As the United States markets kick off 2026 with record highs in major indices like the Dow and S&P 500, investors are keeping a keen eye on tech stocks, particularly those poised for high growth. In this favorable economic climate, characterized by a declining unemployment rate and robust index performance, identifying tech companies with strong innovation potential and solid financial health can be crucial for navigating the evolving landscape of high-growth opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 25.98% | 29.94% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.14% | 32.11% | ★★★★★☆ |

| Atlassian | 14.84% | 55.13% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 12.04% | 116.48% | ★★★★★☆ |

| Circle Internet Group | 25.37% | 83.69% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grid Dynamics Holdings, Inc. offers technology consulting, platform and product engineering, and analytics services across North America, Europe, and other international markets with a market cap of approximately $809.89 million.

Operations: The company generates revenue primarily from its computer services segment, amounting to $405.96 million.

Grid Dynamics Holdings has demonstrated a robust performance with an impressive 474% earnings growth over the past year, significantly outpacing the IT industry’s 22% average. This growth is underpinned by strategic collaborations like the recent multi-year agreement with AWS, enhancing its capabilities in generative AI and data engineering. The company’s commitment to innovation is evident in its R&D investments, aligning with revenue growth of 11.2% per year, forecasted to surpass the US market’s 10.5%. Moreover, Grid Dynamics’ tailored solutions across various stages of AI deployment underscore its adaptability and potential for sustained growth in a rapidly evolving tech landscape.

Simply Wall St Growth Rating: ★★★★★★

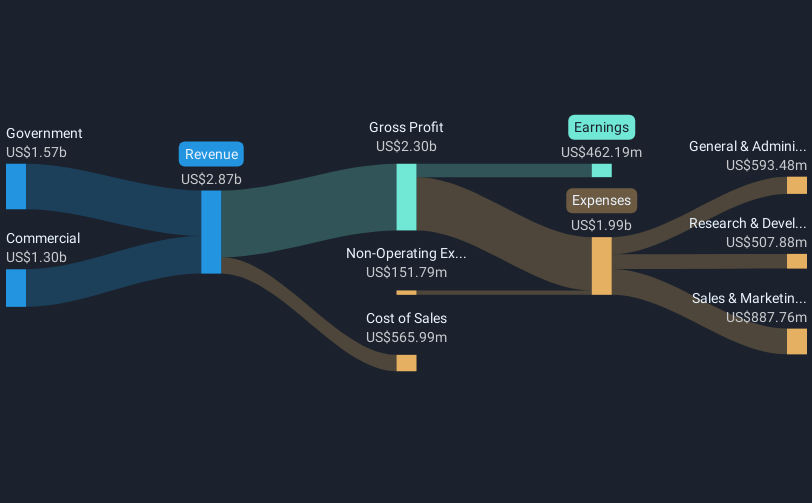

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations across the United States, the United Kingdom, and internationally, with a market cap of $423.04 billion.

Operations: The company generates revenue primarily from two segments: Government, contributing $2.13 billion, and Commercial, with $1.77 billion.

Palantir Technologies has recently showcased its robust integration and deployment capabilities in high-profile sectors, including national security and industrial AI applications. The company’s strategic alliances, such as the newly formed Accenture Palantir Business Group, emphasize its commitment to accelerating enterprise AI transformations across various industries. This approach not only enhances client operations but also solidifies Palantir’s role in driving forward sector-specific innovations. With an annual revenue growth of 26% and earnings growth projected at 29.9%, Palantir’s investment in R&D aligns well with these expanding market opportunities, ensuring sustained advancements in AI and data analytics solutions.

Simply Wall St Growth Rating: ★★★★★☆

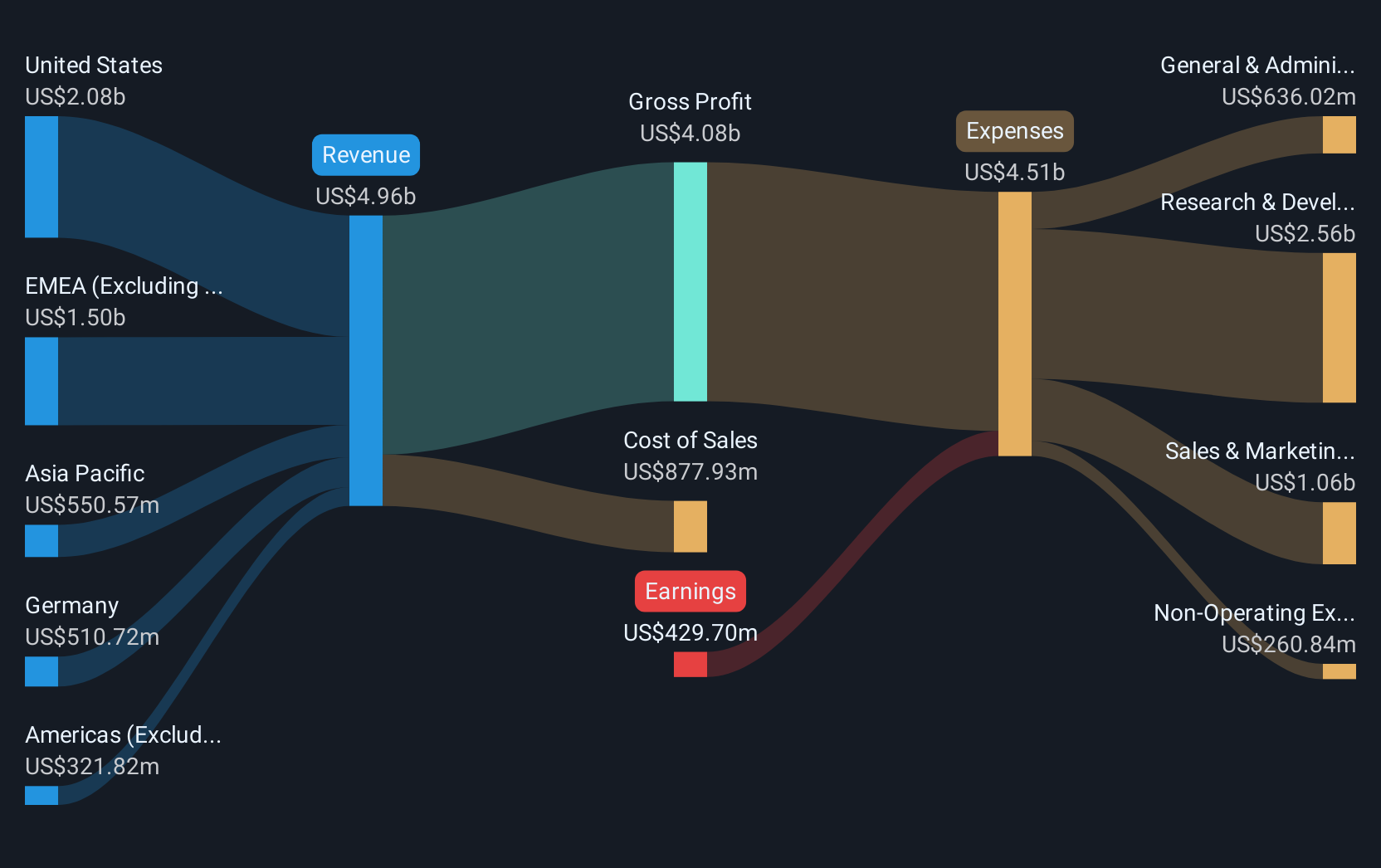

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across global organizations, with a market cap of $38.52 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $5.46 billion.

Atlassian’s strategic positioning in the cloud sector, notably through its enhanced presence on AWS Marketplace, underscores its adaptability and forward-thinking approach. This move not only broadens accessibility to Atlassian’s products globally but also integrates advanced AI tools that streamline enterprise operations. Despite recent executive changes, Atlassian continues to innovate; it repurchased shares worth approximately $578.73 million last year, reflecting confidence in its financial strategy. With expected annual revenue growth of 14.8% and a transition to profitability within three years, Atlassian is aligning its R&D investments—marked by a significant focus on cloud and AI technologies—to capitalize on evolving market demands effectively.

Next Steps

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com