Is There Still Upside for Hecla Mining After a 203% Rally in 2025?

- Wondering if Hecla Mining’s dramatic stock performance means it’s now a bargain or getting ahead of itself? You’re not alone as many investors have been eyeing the numbers and asking whether there’s still upside left.

- In just the past month, Hecla Mining’s share price rose by 29.2%, with a 13.2% gain over the past week alone, and a year-to-date return of 203.6%.

- This surge comes as silver prices have rallied strongly this year, with headlines highlighting supply shortages and growing demand from technology and clean energy sectors. These factors have given investors plenty of reasons to take a closer look at miners like Hecla.

- However, our simple valuation score for Hecla Mining is just 0 out of 6, meaning it doesn’t pass any of the typical undervaluation checks. Let’s break down what that actually means in practice by comparing traditional valuation methods and keep an eye out for a smarter way of sizing up value that we’ll reveal at the end.

Hecla Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hecla Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. For Hecla Mining, this process involves examining its ability to generate cash over time and accounting for the fact that a dollar today is worth more than a dollar in the future.

Hecla Mining’s most recent annual Free Cash Flow stands at $124.5 million. Analysts expect substantial growth in the next few years, with Free Cash Flow projections reaching as high as $325 million by 2028. Beyond the first five years, projections are extrapolated, and by 2035, estimated Free Cash Flow stands at $201 million according to Simply Wall St’s model. All cash flows are presented in USD.

Based on these projections and a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $6.18. With Hecla Mining’s recent share price already well above this estimate, the DCF analysis indicates the stock is 158.5% overvalued compared to its current price.

This suggests that, at these levels, the market is pricing in much stronger growth or cash generation than what the model can justify today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hecla Mining may be overvalued by 158.5%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hecla Mining Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies. It is particularly useful because it quickly allows investors to see how much they are paying for each dollar of a company’s earnings, which is a critical factor when assessing mature, income-generating businesses like Hecla Mining.

However, the number that counts as a “normal” or “fair” PE ratio can shift dramatically depending on expectations for future earnings growth and the perceived risks associated with the business. Higher growth companies can usually justify a higher PE, while those with more risks or volatile earnings often trade at a discount.

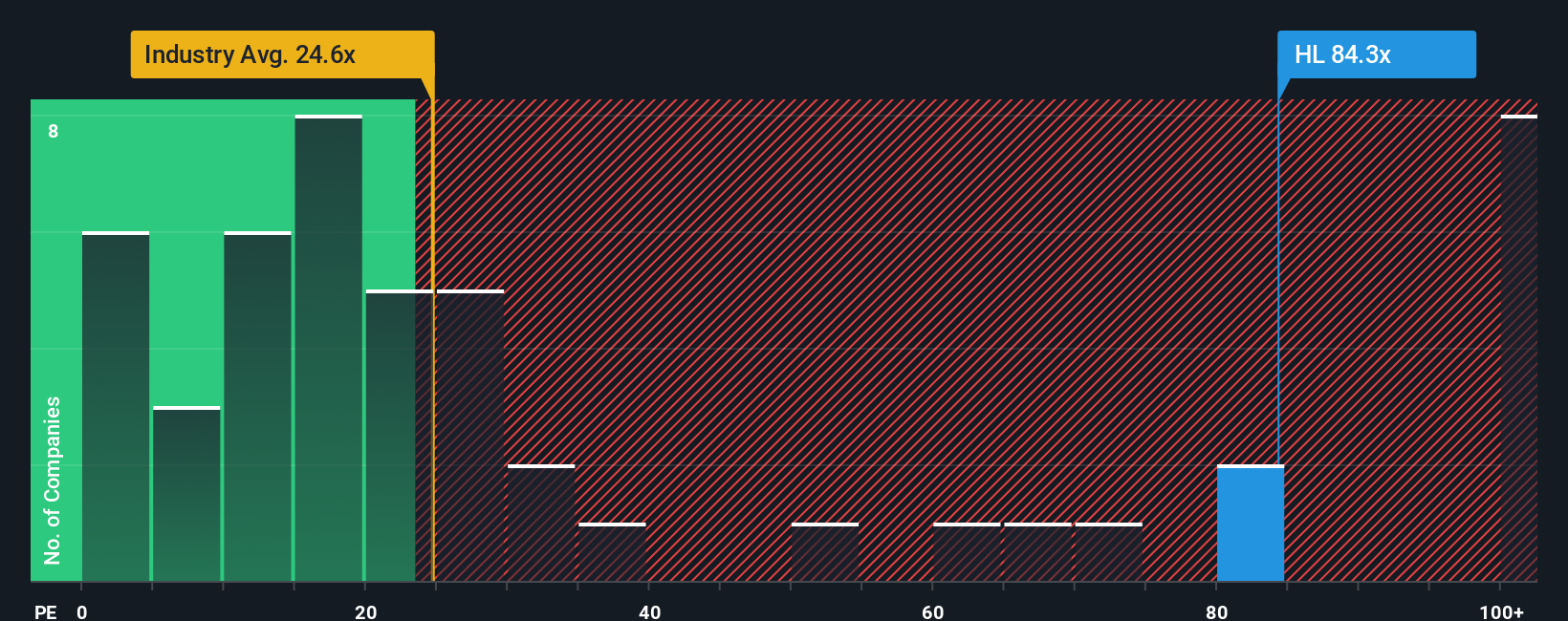

Currently, Hecla Mining trades at a PE ratio of 53.9x. This is significantly higher than both the Metals and Mining industry average of 22.1x and the peer group average of 15.4x. At first glance, this high multiple could suggest the stock is priced for aggressive growth or has some qualitative advantages that the market is valuing.

To bring more nuance to this comparison, Simply Wall St uses a proprietary “Fair Ratio,” which reflects what would be a reasonable PE multiple for Hecla based on its unique profile, including its growth outlook, profit margins, risk factors, industry conditions, and overall market capitalization. In Hecla’s case, the Fair Ratio is calculated at 24.4x, offering a more tailored benchmark than industry or peer averages alone.

The Fair Ratio provides better context because it dynamically adjusts for factors such as cyclical swings in earnings, projected growth, and company-specific risks, all of which can make straight peer or industry comparisons misleading. By leveraging this approach, investors may gain a more realistic picture of what the stock is truly worth in today’s market environment.

Comparing Hecla’s 53.9x PE to the Fair Ratio of 24.4x suggests significant overvaluation at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hecla Mining Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple, intuitive way to connect your perspective on a company with the numbers by combining your beliefs about Hecla Mining’s future revenue, earnings, and margins into a story that justifies a specific fair value.

Unlike static models, a Narrative gives context to your investment decision by linking the company’s story to a financial forecast, and then distilling those views into a single fair value estimate. This approach lets you clearly see how your assumptions stack up, and it is easy to access through Simply Wall St’s Community page, already trusted by millions of investors.

With Narratives, you can compare your fair value to the current share price to guide your investment decisions, and your analysis stays current because Narratives automatically update with new news, earnings, or company reports. For instance, some investors think Hecla Mining is worth as much as $14.40 because they expect surging silver demand and operational efficiency to drive long-term growth, while others put fair value as low as $6.50 due to worries about rising costs and regulatory risks.

Do you think there’s more to the story for Hecla Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com