Korea’s WGBI inclusion shows investor confidence in local capital market: PIMCO

Pacific Investment Management Company (PIMCO) Managing Director and Group Chief Investment Officer Dan Ivascyn speaks during a press conference at the Conrad Seoul, Yeouido, Wednesday. Courtesy of PIMCO

Pacific Investment Management Company (PIMCO) said Wednesday that Korea’s inclusion in the World Government Bond Index (WGBI) in April reflects investor confidence in the Korean capital market.

“When it comes to Korea Treasury Bonds, we find the Korean local market somewhat attractive, similarly to some other markets across the region, across our emerging market portfolios and global portfolios. We have some exposure, so we find it attractive as a sector,” said PIMCO Managing Director and Group Chief Investment Officer (CIO) Dan Ivascyn during a presser at the Conrad Hotel in Seoul.

Further advancing the optimism are stable policy rates and relatively stable inflation rates, he added.

“We think it’s a reasonably attractive market. Of course, we are very committed to Korea. The recent equity market performance has been very, very strong. We also expect some stability in the Korean currency won as well, relative to the weakness that we’ve seen more recently,” he said.

The CIO added that investors should implement a more defensive strategy since volatility will heighten in the coming years.

“PIMCO thinks the next several years are going to be more volatile,” he added. “We’re already seeing some signs of credit weakness. We are seeing on a regular basis some credit problems across the higher risk of lending areas. We think investors should be more defensive, and we are being more defensive.”

PIMCO has well-known expertise in active fixed income management and also invests across various asset classes, including equities and alternatives in public and private markets, for institutional and individual clients. It has $200 billion in assets under management.

Meanwhile, he said, what is unique relative to history is the incredibly strong performance of the fixed income market every year since the late 2000s.

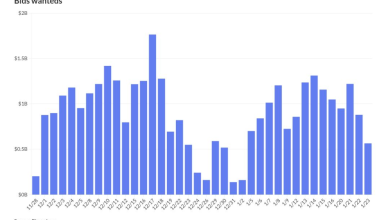

“Private direct lending, lower-quality type lending, have generated a return of about 7 percent more than high-quality bonds over the years following the local financial crisis,” Ivascyn said.

In his view, when high-quality global bonds are included, opportunities expand for increasing yield, at least in U.S. dollar terms.

“Even if you only invest in the government bond market, you can generate returns today somewhere in the 5 percent area. If you expand into other markets, high-quality corporates, other high-quality instruments, you can end up with a yield somewhere at the 6 or 7 percent range. Again, This is very attractive versus equities and increasingly attractive versus cash,” he said.