Munis steady; states face headwinds in 2026

Processing Content

Munis were steady Tuesday as short-term U.S. Treasuries were slightly weaker and equities ended up.

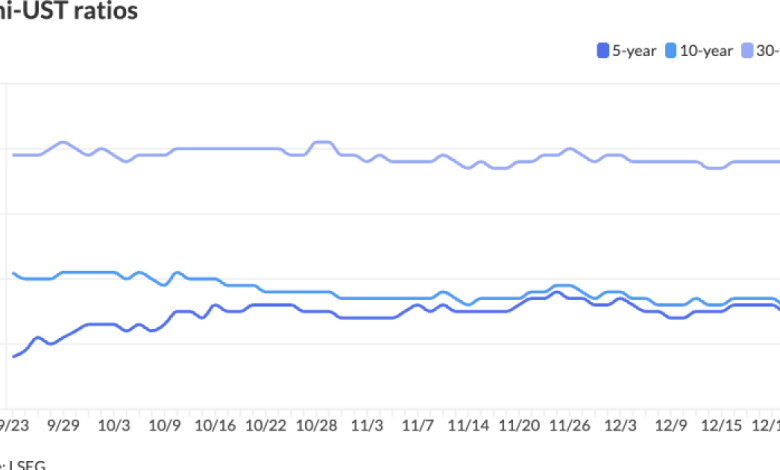

The two-year muni-UST ratio Tuesday was at 68%, the five-year at 65%, the 10-year at 66% and the 30-year at 88%, according to Municipal Market Data’s 3 p.m. EDT read. ICE Data Services had the two-year at 69%, the five-year at 64%, the 10-year at 66% and the 30-year at 87% at a 4 p.m. read.

This year was a “confusing, volatile year, and the states face growing threats in 2026 and thereafter,” said Matt Fabian, president of Municipal Market Analytics.

“The current (and future) pullback in federal discretionary spending in many policy areas may well be permanent, whether or not partisan control over the federal government changes,” he said.

This compels states to decide how, or whether, they should replace the feds in certain areas — such as education, health care, and disaster recovery — or whether the “added burden” should be passed off to governments and utilities, private companies, and/or individual citizens, Fabian said.

Concurrently, “the effects of climate change continue to accelerate even as the ultimate responsibility for climate change adaptation (i.e., preserving the status quo despite increasing physical and political changes) has fallen decidedly to the states over the last decade,” he said.

State and local spending and revenues have to contend with this “major stress,” while “demanding a reorientation in governance towards enterprise risk management and very long-term planning,” Fabian said.

“These two points, along with persistent inflation, at least $2 trillion of deferred maintenance needs, and a backlog of infrastructure build-out in areas where population growth has outstripped state and local spending, all suggest that this year’s record issuance — the first period of sustained growth in outstanding municipal debt since the financial crisis — is likely to continue and/or be surpassed in 2026,” Fabian said.

There have not been three straight years of new-issue volume growth in the past decade, said Ted Ruddock, managing director of fixed income private wealth at Raymond James, and Drew O’Neil, director of fixed income strategy at the firm.

With most issuance forecasts expecting 2026 to see

However, “surges tend to be followed — at some point — by a pause and even a pullback,” Ruddock and O’Neil said.

“We’re hopeful that won’t be the case in 2026 as the demand for municipals, and their tax-equivalent yields (that rival long-term pre-tax equity average returns) has been insatiable this year,” they said. “We don’t see that changing in 2026.”

Volume may get off to a slow start early next year, as it takes issuers several weeks to “ramp up” issuance at the start of every new year in what is known as the “January effect,” Ruddock and O’Neil said.

Over the last decade, January issuance has averaged under 80% of the average monthly volume, they said.

“If you have money to invest and are thinking about waiting to see what 2026 has to offer, expect a challenging environment to start the new year,” the Raymond James strategists said. “There will likely be a ‘food fight’ for bonds in early January and that’s a recipe for higher prices, lower yields.”

AAA scales

MMD’s scale was unchanged: 2.46% in 2026 and 2.41% in 2027. The five-year was 2.43%, the 10-year was 2.76% and the 30-year was 4.24% at 3 p.m.

The ICE AAA yield curve was unchanged: 2.46% in 2026 and 2.43% in 2027. The five-year was at 2.40%, the 10-year was at 2.77% and the 30-year was at 4.19% at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.45% in 2025 and 2.42% in 2026. The five-year was at 2.43%, the 10-year was at 2.76% and the 30-year yield was at 4.22% at 3 p.m.

Bloomberg BVAL was unchanged: 2.48% in 2025 and 2.43% in 2026. The five-year at 2.37%, the 10-year at 2.71% and the 30-year at 4.13% at 4 p.m.

Short-term treasuries were slightly weaker.

The two-year UST was yielding 3.529% (+2), the three-year was at 3.579% (+3), the five-year at 3.737% (+2), the 10-year at 4.167% (flat), the 20-year at 4.785% (-1) and the 30-year at 4.827% (-1) near the close.