Patriotic Investors Beware Fat Fees on Trump’s Truth Social ETFs

-

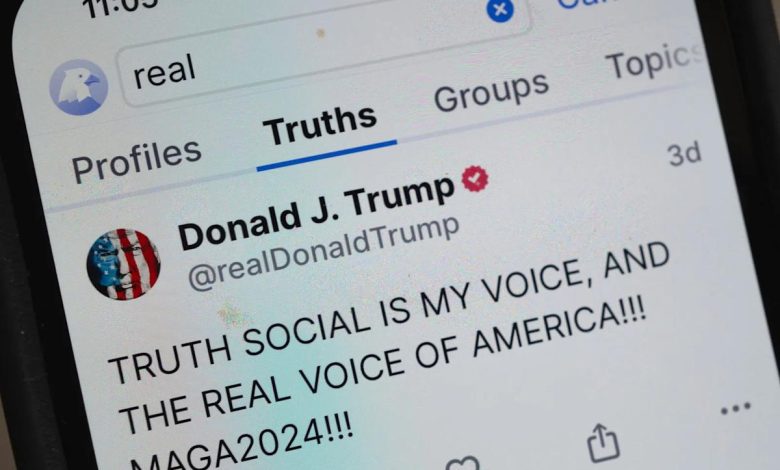

President Donald Trump’s Truth Social launched a suite of ETFs for “patriotic investors”

-

All five Truth Social ETFs have an annual expense ratio of 0.65% or 65 basis points

-

Truth Social American Red State REITs ETF (NYSE American: TSRS) targets operators in states where a Republican won at least two out of last three elections

-

Major ETFs with similar REIT strategies such as Schwab charge as little as 7 basis points for a diversified mix of U.S. REIT investments

This week, Trump Media & Technology Group Corp. (Nasdaq: DJT) offered a late Christmas gift to retail investors that isn’t a newfangled cryptocurrency like the $TRUMP and $MELANIA coins that might scare off older conservative Americans. Instead, it’s a suite of well-established vehicles known as an exchange-traded funds (ETFs) that bundle together shares of companies for “patriotic investors who want to invest in American ingenuity.” Before pouring in any hard-earned cash, such patriots should dig a little deeper into the fees the Truth Social ETFs charge.

The premise of the ETFs is straightforward: Invest in “securities with a Made in America focus spanning diverse industries” and hope to reap financial returns. There’s been a raft of individual companies such as PSQ Holdings, Inc. (PSQH) to go public in the last few years (which also have heavy ties to the Trump family) offering a similar mantra around “America first” principles but the new ETFs aim to bundle stocks rather than create any new operating business.

The ETFs include Truth Social American Security & Defense ETF (NYSE American: TSSD), Truth Social American Next Frontiers ETF (NYSE American: TSFN), Truth Social American Icons ETF (NSYE American: TSIC), Truth Social American Energy Security ETF (NYSE American: TSES) and Truth Social American Red State REITs ETF (NYSE American: TSRS).

But investors, particularly those who are retired and seeking income in the form of yield, may be surprised how much the ETFs charge. Take Truth Social American Red States ETF, which charges 65 basis points like its sister ETFs (all of them track indexes rather than pay an active fund manager). Schwab U.S. REIT ETF (NYSE: SCHH), by comparison, charges just 7 basis points. Vanguard Real Estate ETF (NYSE: VNQ) which has a heavy focus in red, sunbelt states, charges 13 basis points.

While the difference may seem small, it would add up over time. Assuming both assets held steady in value over a decade (while paying out distributions from real estate income), the Red States ETF would collect 6.5% in expense fees while the Schwab U.S. REIT ETF would charge just 0.70%.