Profound Dollar Weakness – Robin J Brooks

Every once in a while, I think it’s good to just document what’s going on in markets. This is such a week. It began with a huge bond market sell-off in Japan that spread around the world. It ended with a sharp fall in the Dollar, in line with my call for a resumption of Dollar weakness after the hiatus in the second half of last year.

This post runs through five charts to document what I think have been the key market moves this week:

-

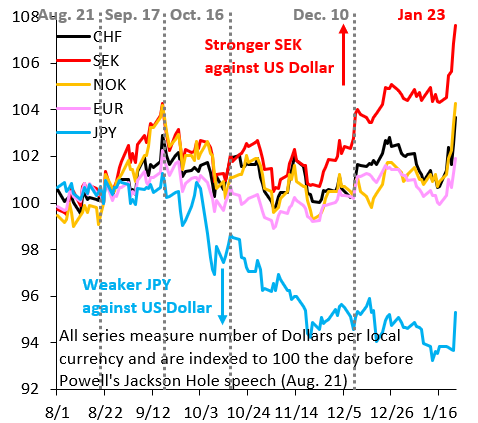

Serious Dollar depreciation has resumed: my key prediction for 2026 – which I outlined in a post on January 1 – is that Dollar weakness resumes this year after the hiatus of H2 2025. My leading indicator for this has been the Dollar versus emerging markets (EM), which has been falling since the Fed’s cut on December 10, as the blue line in the chart below shows. My sense has been that this Dollar weakness would spread to the G10 and this played out this week. The EM Dollar has already fallen meaningfully below its previous range and the G10 Dollar is close to doing that. Breakouts like this are very significant because cross-over investors start piling on. This is a very bearish signal for the Dollar.

-

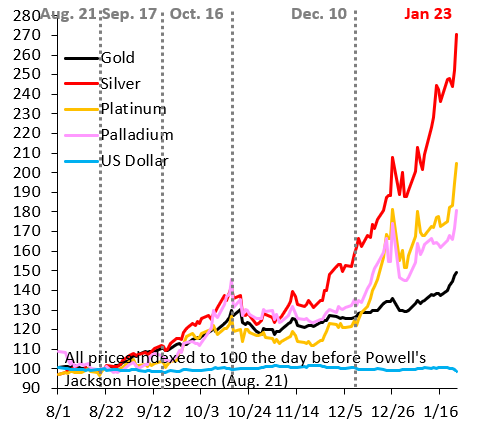

Precious metals are on fire: the combination of heightened geopolitical risk and Japan’s bond market blow-up propelled precious metals sharply higher. Silver is now up a stunning 170 percent since Jackson Hole on August 22, as the red line in the chart below shows. Platinum is up 105 percent (orange line), while gold is up 50 percent (black line). Besides Dollar weakness, my key prediction for 2026 was that the debasement trade would be on fire. There can be no doubt that it is.

-

Safe haven currencies rallied hard: a common misconception is that the debasement trade is only about precious metals. It isn’t. The driving force behind this trade is that governments will try to inflate away unsustainable debt burdens. This makes any low debt country a reasonable safe haven. As the red line in the chart below shows, Sweden has emerged as the top safe haven, followed by Norway (orange line) and Switzerland (black line).

-

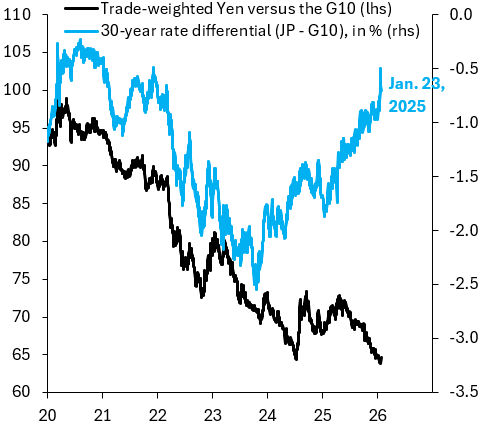

Japan’s fiscal risk premium has never been greater: as the chart below shows, the gap between Japan’s 30-year rate differential (blue) and the trade-weighted Yen versus the G10 (black) has never been greater. A rising rate differential should attract capital inflows to Japan and strengthen the Yen. The fact that this isn’t happening in any meaningful way means that interest rates, especially at the long end of Japan’s yield curve, have not been allowed to rise enough to compensate investors for Prime Minister Takaichi’s disdain for fiscal austerity. Japan needs to break out of its denial on debt. It’ll take further Yen depreciation to get there.

-

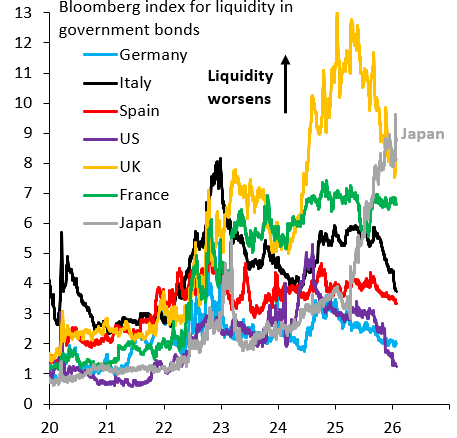

Japan’s bond market didn’t blow up because of poor liquidity: one of my pet peeves in markets is meaningless talk about “liquidity” or “positioning.” This stuff just boils down to people saying: “the market fell because supply was greater than demand.” The blow-up in Japan’s bond market is a case in point. Bloomberg published a piece saying the blow-up happened because of poor liquidity. This is nonsense. Liquidity deteriorated because JGB buyers absented themselves after Takaichi’s dismissive comments on fiscal austerity. In short, it was Takaichi that caused the crash. The deterioration in liquidity was just an endogenous response. The gray line in the chart below shows this. Liquidity only deteriorated in recent days after Takaichi’s comments, i.e. this was an endogenous response and not some kind of market dysfunction or breakdown.

The bottom line is that the Dollar is under fire as is the Yen and global debt markets. The dominant markets theme in 2026 is flight to safety from debt monetization. Precious metals and safe haven currencies will rally a lot further.