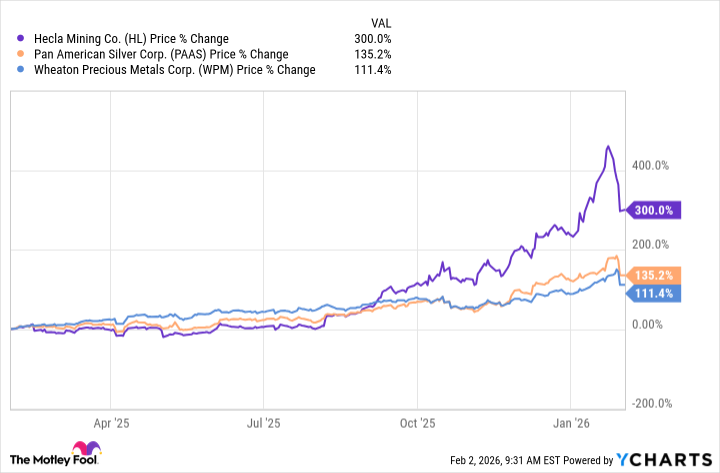

This Mining Stock Was Up 300% in 2025 — Here’s What It Could Mean for Future Dividends

Hecla Mining benefited from rising silver and gold prices in 2025, but how is the extra cash being used?

Investors were very upbeat about Hecla Mining (HL 4.31%) last year, sending the shares higher by 290% in 2025. That’s not surprising given the company’s focus on precious metals, which rallied strongly last year amid increased geopolitical and economic uncertainty. But is this silver-focused miner’s dividend set to change thanks to its vastly improved financial results?

What does Hecla do?

Like most precious metals miners, Hecla doesn’t just produce one metal. Its primary focus is silver, which accounted for around 48% of its revenues in the third quarter of 2025. Gold was No. 2 at 37%, with lead and zinc making up the rest of the top line. Very clearly, the prices of silver and gold will have the biggest effect on Hecla’s financial performance.

Image source: Getty Images.

Given the massive rally in the prices of silver and gold in 2025, it shouldn’t come as any surprise that Hecla performed very well as a business last year. To put some numbers on that, the company’s sales rose 67% year over year in Q3 2025. The company went from being break-even a year ago to earning $0.15 per share in Q3 2025, an improvement that’s so impressive that showing it in percentage terms doesn’t make any sense.

Today’s Change

(-4.31%) $-0.97

Current Price

$21.55

Key Data Points

Market Cap

$15B

Day’s Range

$20.95 – $22.97

52wk Range

$4.46 – $34.17

Volume

30M

Avg Vol

24M

Gross Margin

33.05%

Dividend Yield

0.07%

Very clearly, Hecla did quite well during this period of rising silver and gold prices. But what is the company doing with that cash, and could investors expect a big dividend boost?

Putting money to good use

The quick answer on dividends is that investors probably shouldn’t expect any change to the current policy of paying $0.015 per share per year. Management has been focused on paying down debt and reinvesting in the business. That’s not a bad thing; it’s just a capital allocation decision.

Some precious metals miners have stated dividend policies that change along with the price of the commodities they produce. For example, Pan American Silver‘s (PAAS 1.78%) dividend is tied directly to the price of silver. Streamer Wheaton Precious Metals‘ (WPM +0.26%) dividend is tied to its overall financial performance. That’s just not the case at Hecla, where the dividend is totally at the discretion of the Board of Directors with no indication of what their dividend decision might be beyond the $0.015 per year.

Don’t hold your breath on the dividend

At this point, investors probably shouldn’t expect a big dividend payday from Hecla Mining. That’s doubly true given the resent pullback in silver and gold prices. Notably, precious metals are highly volatile commodities that can turn on a dime. If what you really want are dividends, you should probably look elsewhere. Indeed, even variable dividend policies like those of Pan American Silver and Wheaton come with notable downside risk if precious metals prices continue to decline.