Bond Market

-

City to raise $7.5M in bond sale | News

CUMBERLAND — City officials are seeking to raise $7.5 million on the bond market for a variety of upgrades, including…

Read More » -

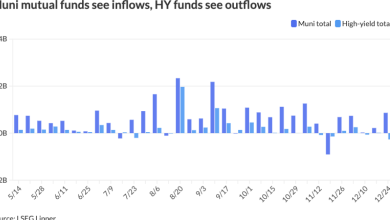

Munis steady, poised to ‘deliver’ next year

Processing Content Munis were steady Friday as U.S. Treasuries were narrowly mixed and equities ended down slightly. The two-year muni-UST…

Read More » -

Navigating Neutral: Fed Policy Is Key for Fixed Income Markets in 2026

2025 was a good year for most fixed income markets but we’re approaching 2026 with caution. All-in yields are still…

Read More » -

‘Reduction in Ultra-Long Bond Issuance’ to Pacify the Bond Market, Tripling Support Funds for Chips and AI

Japan’s budget proposal significantly increases investment in cutting-edge technologies, with the Ministry of Economy, Trade and Industry’s expenditure on chips…

Read More » -

Japan govt approves record 122 trillion yen budget

The Japanese government on Friday approved a record budget for the upcoming fiscal year, to pay for everything from bigger…

Read More » -

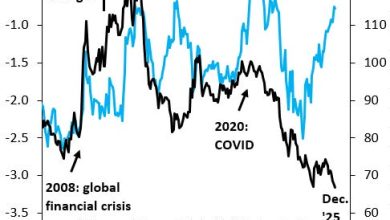

The Great Normalization: What the Reshaping Yield Curve Foretells for 2026

As of late December 2025, the United States bond market has reached a historic milestone, marking the definitive end of…

Read More » -

30-year mortgage rate edges lower | The Arkansas Democrat-Gazette

Let us read it for you. Listen now. Your browser does not support the audio element. WASHINGTON — The average…

Read More » -

Why is the Japanese Yen falling?

Back when I worked at Goldman, I remember one particular Fed meeting when the central bank had hiked but –…

Read More » -

Indian cos bond less with dollar in ’25 as price advantage recedes

Dollar bond issuance from India fell around 35% in 2025 from last year, as companies increasingly turned to the domestic…

Read More » -

Retirement accounts roared back in 2025 after punishing losses during Biden years: study

After four bruising years in which inflation and declining bond markets slammed Americans’ nest eggs, retirement accounts made a big…

Read More »