TSX Penny Stocks To Watch: 3 Picks With Market Caps Under CA$40M

The TSX has kicked off its fourth-quarter earnings season with a strong start, reflecting broad-based growth across multiple sectors. For investors looking beyond the major players, penny stocks—though an outdated term—still hold relevance as they can offer surprising value and potential for growth. In this article, we explore several penny stocks that combine solid fundamentals with the potential to stand out in today’s market landscape.

Top 10 Penny Stocks In Canada

Click here to see the full list of 366 stocks from our TSX Penny Stocks screener.

Let’s dive into some prime choices out of the screener.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Lithium Minerals Corp. is a mineral exploration and development company with operations in Chile and Canada, and it has a market cap of CA$12.05 million.

Operations: Currently, First Lithium Minerals Corp. does not report any revenue segments.

Market Cap: CA$12.05M

First Lithium Minerals Corp., with a market cap of CA$12.05 million, is a pre-revenue company focused on mineral exploration in Chile and Canada. The company has more cash than debt, and its short-term assets exceed liabilities, indicating sound liquidity management. However, it remains unprofitable with a negative return on equity and reported net losses for the recent quarter and nine months ending September 2025. Despite reducing losses over the past five years by 9.1% annually, its share price remains highly volatile. The board of directors is experienced with an average tenure of 3.6 years.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caldwell Partners International Inc., with a market cap of CA$28.93 million, offers candidate research and sourcing services across Canada, the United States, and Europe.

Operations: The company generates revenue through its Caldwell segment, contributing CA$98.94 million, and its IQTalent segment, adding CA$12.29 million.

Market Cap: CA$28.93M

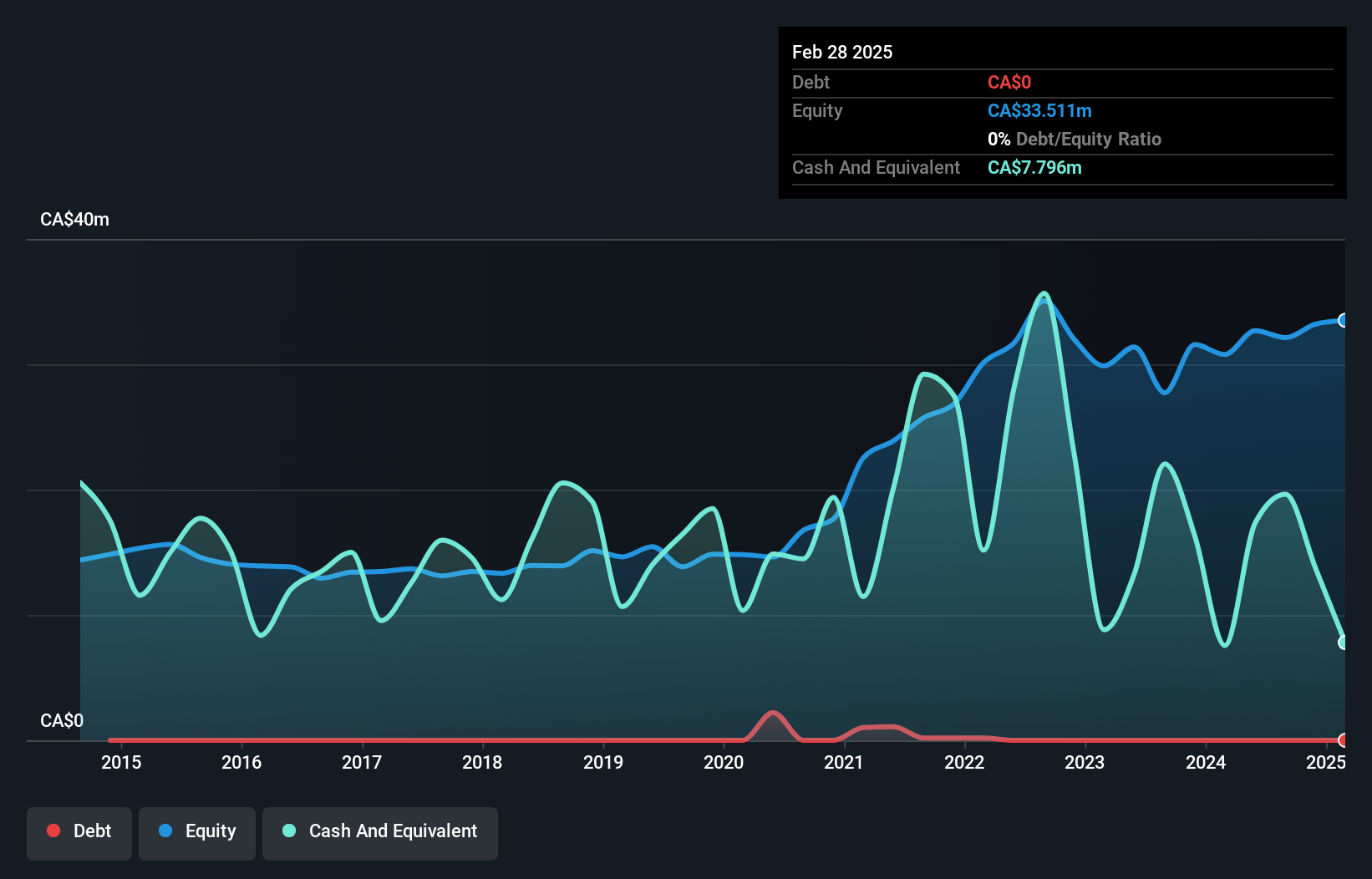

Caldwell Partners International Inc., with a market cap of CA$28.93 million, has shown substantial revenue growth, reporting CA$29.28 million for the first quarter ended November 30, 2025. The firm is debt-free and maintains stable weekly volatility at 9%. It recently enhanced its leadership team by adding Dr. Christoph Themel as a Partner in Life Sciences and Healthcare Practice, potentially strengthening its executive search capabilities in regulated environments. Despite an unstable dividend track record, Caldwell’s earnings have surged by over 200% year-on-year, reflecting high-quality earnings and improved profit margins from last year’s figures.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Firm Capital Apartment Real Estate Investment Trust focuses on acquiring and managing multi-residential properties in the U.S., with a market cap of CA$37.19 million.

Operations: The trust generates its revenue from multi-residential properties in the United States, amounting to $6.95 million.

Market Cap: CA$37.19M

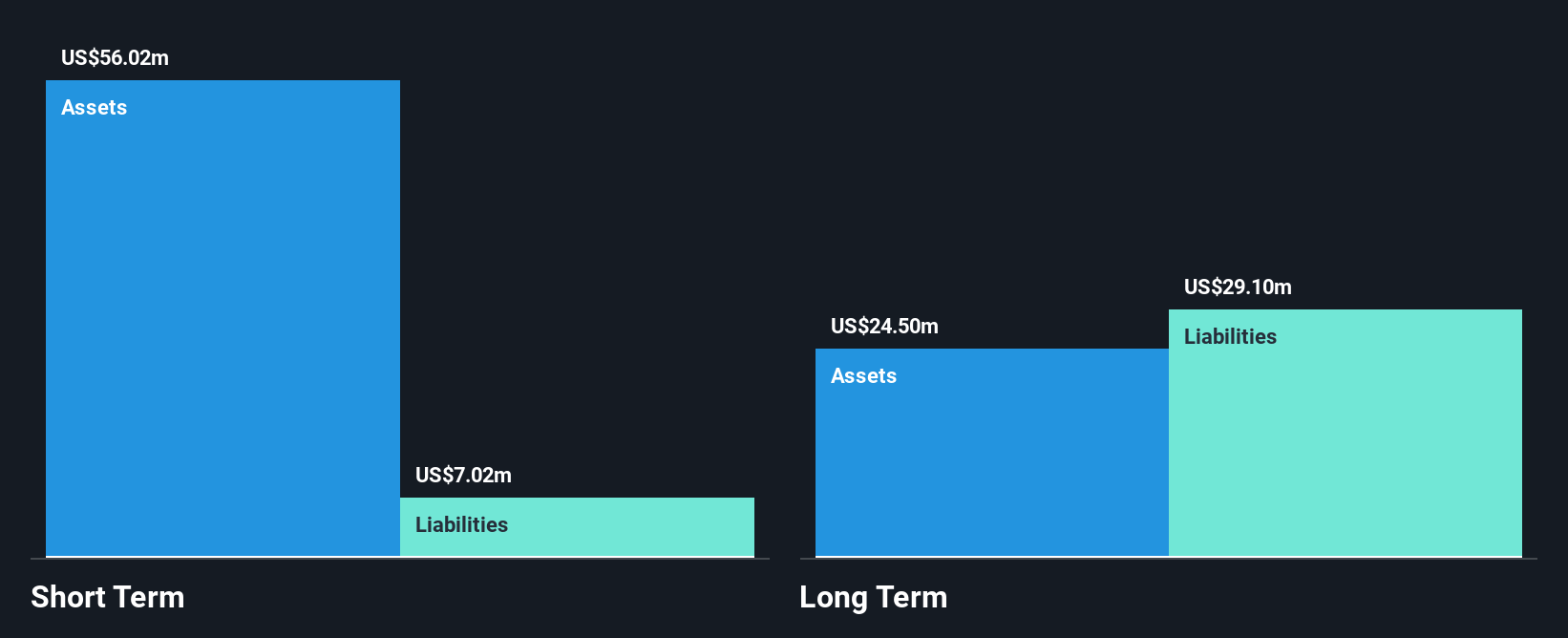

Firm Capital Apartment Real Estate Investment Trust, with a market cap of CA$37.19 million, is focused on U.S. multi-residential properties and reported third-quarter sales of US$1.55 million, slightly down from the previous year. Despite having short-term assets exceeding both short- and long-term liabilities, the trust remains unprofitable with a net loss of US$5.45 million for the quarter. Its debt to equity ratio has increased over five years to 66%, indicating high leverage, while its share price has been highly volatile recently. The company trades below estimated fair value but faces challenges in achieving profitability amidst declining earnings trends.

Key Takeaways

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com