Wave of govt borrowing set to drench bond market

The govt will step up market borrowings to a record Rs 17.2 lakh crore (gross) in 2026-27, the finance minister said in her Budget speech. The figure is higher than market expectations and the announcement comes at a time when bond yields have hardened amid heavy borrowing by the Centre and states. On Friday, the benchmark 10-year yield on gilts closed at 6.7%, up from 6.5% three months ago.Of the gross borrowing in FY27, net market borrowing has been pegged at Rs 11.7 lakh crore, which is in line with market expectation. The gap of about Rs 5.5 lakh crore between gross and net borrowing reflects repayment of earlier debt, either on maturity or through switching of existing securities into more liquid bonds.

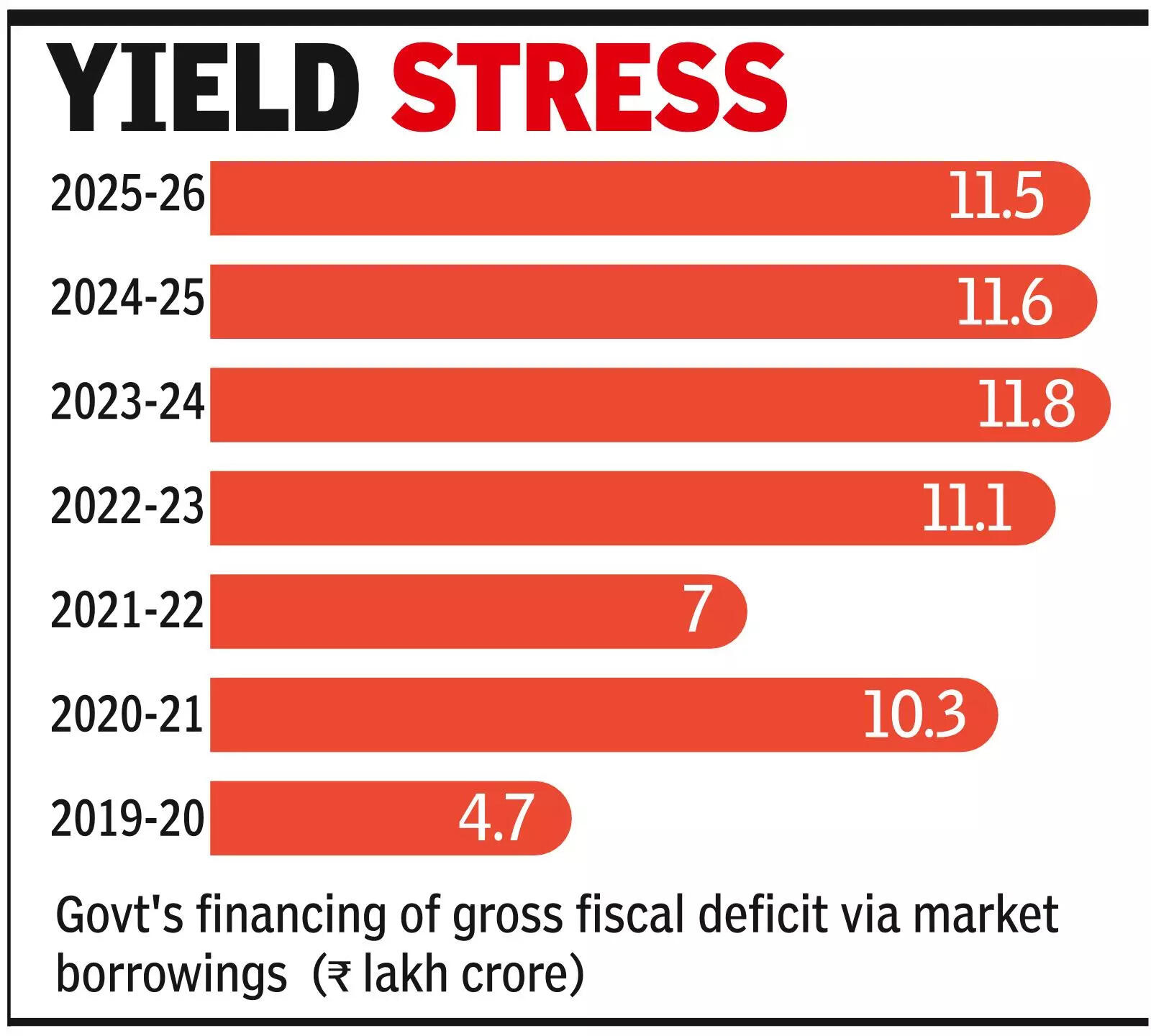

Yield stress

“The higher-than-expected gross borrowing of Rs 17.2 lakh crore could weigh on market sentiments as demand and supply imbalance has already been weighing on bond yields. We expect the 10-year bond yield to open higher tomorrow,” said Sakshi Gupta, principal economist, HDFC Bank.Govt bond yields have edged higher over the past few months as supply of paper has outpaced demand, with large issuances by Centre and states weighing on the market. According to a bond dealer, amid global market uncertainties, interest in bonds is tilted more towards short tenure papers; very long tenure papers still have buyers like insurance companies and pension funds. However, long-tenure papers with maturities of 5-15 years may witness bearish bias. “Overall benchmark 10-year yield is likely to move in the 6.65% to 6.8% range given RBI’s commitment to contain any meaningful spike in the yield through open market operations,” the bond dealer said.Economists say besides borrowing size, quality of expenditure matters. If the money goes into capital investment it’s positive. “Budget proposes capex of Rs 12.1 lakh crore which is more than net market borrowing of Rs 11.7 lakh crore. I pray that one day capital expenditure will be more than total borrowing including small savings,” said Nilesh Shah, MD, Kotak Mahindra AMC.City halls find an incentive gateway to high financeBudget aims to energise the bond market, targeting liquidity, hedging depth and large municipal bond issuances through incentives.The Budget proposes corporate-bond market making, easier funding access and bond-index derivatives to deepen a shallow market providing an alternative to equities and bank finance. It also introduces total return swaps, letting investors capture bond returns without holding paper which will help manage risk and and widen participation.To scale urban infra finance, the Budget offers a Rs 100 crore incentive for a single municipal bond issue above Rs 1,000 crore. The push targets cities with large civic budgets—Mumbai (Rs 74,427 crore budget), Bengaluru (Rs 19,930 crore), Delhi (Rs 17,044 crore), Ahmedabad (Rs 15,502 crore) and Pune (Rs 12,618 crore). The incentive should cut borrowing cost and scale issuance, building on prior muni-bond gains.The package also tackles liquidity constraints. Market making should narrow bid-ask spreads and sustain trading; index derivatives/swaps could draw insurers/pension funds constrained by lower-rated exposure.