Quantum Computing Stocks – 2026 Investment Guide

Key Takeaways

Quantum computing presents a high-risk, high-reward investment opportunity with the market projected to reach $170 billion by 2040, but investors must navigate significant technical and financial challenges.

• Pure-play stocks like IonQ and D-Wave offer focused quantum exposure but carry extreme volatility with P/S ratios exceeding 150x current revenues.

• Tech giants (Alphabet, IBM, Microsoft) provide safer quantum investment through diversified business models while advancing breakthrough technologies like Willow chips.

• Error correction remains the critical bottleneck – current systems need 1,457 physical qubits for one stable logical qubit, limiting commercial viability.

• Evaluate partnerships and real-world applications over hype – companies with commercial deployments across finance, healthcare, and manufacturing show stronger prospects.

• Allocate only small portfolio percentages to quantum stocks due to speculative nature, ongoing cash burn, and uncertain profitability timelines despite promising growth projections.

The quantum revolution is real, but commercial success remains years away. Smart investors should focus on companies demonstrating practical applications and strong partnerships while maintaining realistic expectations about timeline and risk.

The quantum computing market could reach $170 billion by 2040. This makes the best quantum computing stocks a potentially lucrative opportunity for investors who think ahead. The technology is moving faster from theory to real-life applications. We can see this through major breakthroughs like IBM’s 1,121-qubit Condor processor and Alphabet’s error-reducing Willow chip.

The market offers both pure-play options and tech giants that have entered the space. Companies like IonQ stand out with their impressive 99.99% gate fidelity. Market analysts expect IonQ’s value to rise by 42.44% by December 2025. On top of that, big tech companies like Alphabet have caught major investors’ attention. Warren Buffett’s investment shows this clearly – he bought 17.8 million shares worth about $4.3 billion.

The path to investing in quantum computing stocks needs a special approach. These companies face unique challenges that set them apart from typical tech investments. They must achieve stable, error-free operations while building products that work in the real world. This piece helps you review these specialized stocks, grasp the technology that powers them, and spot the most promising opportunities in this emerging sector.

What is quantum computing and why it matters

Quantum computers work on principles of physics that set them apart from the computers we use every day. While regular computers process information as bits (0s and 1s), quantum computers use quantum bits or qubits that can exist in multiple states at once. This core difference gives quantum computing the power to solve complex problems in minutes that classical computers would take years to complete.

How quantum computing differs from classical computing

Your smartphone, laptop, and supercomputers use binary logic where calculations involve bits that are either on (1) or off (0). Quantum computing breaks these boundaries by making use of quantum mechanics—the laws that control the universe at its smallest scales and coldest temperatures.

The power difference becomes clear in processing capabilities. A classical computer’s potential states double with each added bit in a linear progression. Quantum computers grow exponentially—each new qubit can double the system’s power. This allows quantum systems to handle huge amounts of data all at once instead of one after another.

Real results back up this difference. Google’s Sycamore quantum computer solved a specific problem in 200 seconds that would take the world’s fastest supercomputer about 10,000 years to finish. IBM’s recent paper showed quantum computers performing better than classical machines in specific tasks, marking early progress in what IBM calls “quantum utility”.

The role of qubits, superposition, and entanglement

Three key concepts drive quantum computing’s power:

Qubits work as the simple unit of quantum information—much like bits in classical computing. Their behavior sets them apart through two quantum properties.

Superposition lets qubits exist in multiple states at once—they can be 0, 1, or both simultaneously. Two qubits can show four values at once (00, 01, 10, 11), three qubits show eight values, and this pattern continues. Quantum computers can test many solutions at the same time because of this feature.

Entanglement creates unique bonds between qubits. One qubit’s state affects another instantly, no matter the distance. This lets quantum computers handle complex calculations that classical systems can’t touch. Einstein called this phenomenon “spooky action at a distance.”

Why quantum computing is attracting investors

Investment in quantum technology grew by 50% from $1.30 billion in 2023 to $2.00 billion in 2024. U.S. quantum computing companies are expected to bring in more than $1 billion in revenue by 2025.

Investors see huge potential in quantum computing’s ability to solve complex problems across industries:

Drug discovery and healthcare: Quantum computers could map molecular interactions instantly and cut R&D time in half to create breakthrough treatments

Financial services: Banks and hedge funds are learning to use quantum computing for better portfolios, risk analysis, and trading strategies

Material science: Quantum simulations could speed up discoveries in energy solutions and ultra-efficient electronics, from new batteries to superconductors

Quantum computing brings both risks and benefits to cybersecurity. Advanced quantum computers could break current RSA encryption using Shor’s algorithm. This has led to new investments in quantum-resistant cryptography and quantum key distribution technologies.

The technology still needs time to mature, and fully fault-tolerant quantum computers are years away. This creates both risks and opportunities for investors as the quantum computing market could reach between $45 billion and $131 billion by 2040, based on different market scenarios.

Top 5 pure-play quantum computing stocks to watch

Investors can get targeted exposure to emerging quantum technology through pure-play quantum computing stocks instead of diversified tech giants. These specialized companies lead the quantum innovation race and might offer better returns.

IonQ: Trapped-ion technology and ecosystem strategy

IonQ distinguishes itself among quantum stocks by using individual atoms as qubits – a unique approach to quantum computing. The company achieves some of the industry’s highest commercially available gate fidelities at 99.4%. Their systems connect all qubits to each other, which lets algorithms run more efficiently with fewer operations.

The company became the first publicly traded pure-play quantum company and has grown beyond computing to quantum networking, sensing, and security applications. Their ambitious roadmap shows plans for systems exceeding 2,000,000 physical qubits, which could mean 40,000-80,000 logical qubits. Analysts remain optimistic about IonQ’s future, setting an average price target of $70.83 with a projected 42.44% upside by December 2025.

Rigetti: Speed-focused superconducting systems

Rigetti Computing’s competitive edge comes from speed. Their quantum gates operate at 50-70ns—about 1,000 times faster than ion trap technologies. This Berkeley-based company designs and makes quantum chips, combines them with controlling architecture, and creates software through its Forest cloud computing platform.

The company plans to make its 108-qubit Cepheus-1-108Q system available by Q1 2026’s end. Their 2024 financial report showed $10.80 million in revenue with a $201 million net loss. Analysts see Rigetti’s stock (NASDAQ: RGTI) reaching $28.67, suggesting a 19.64% potential upside.

D-Wave: Annealing and gate-based hybrid approach

D-Wave chose a unique path in quantum computing by starting with quantum annealing technology, which made commercialization possible sooner. This technology performs exceptionally well at solving optimization problems, making it valuable for specific business uses.

The company acquired Quantum Circuits for $550 million to boost its gate-model quantum goals. This two-platform strategy helps D-Wave tackle more quantum computing applications. Their acquisition aims to deliver error-corrected, scaled gate-model quantum computers, with plans to release an initial dual-rail system in 2026.

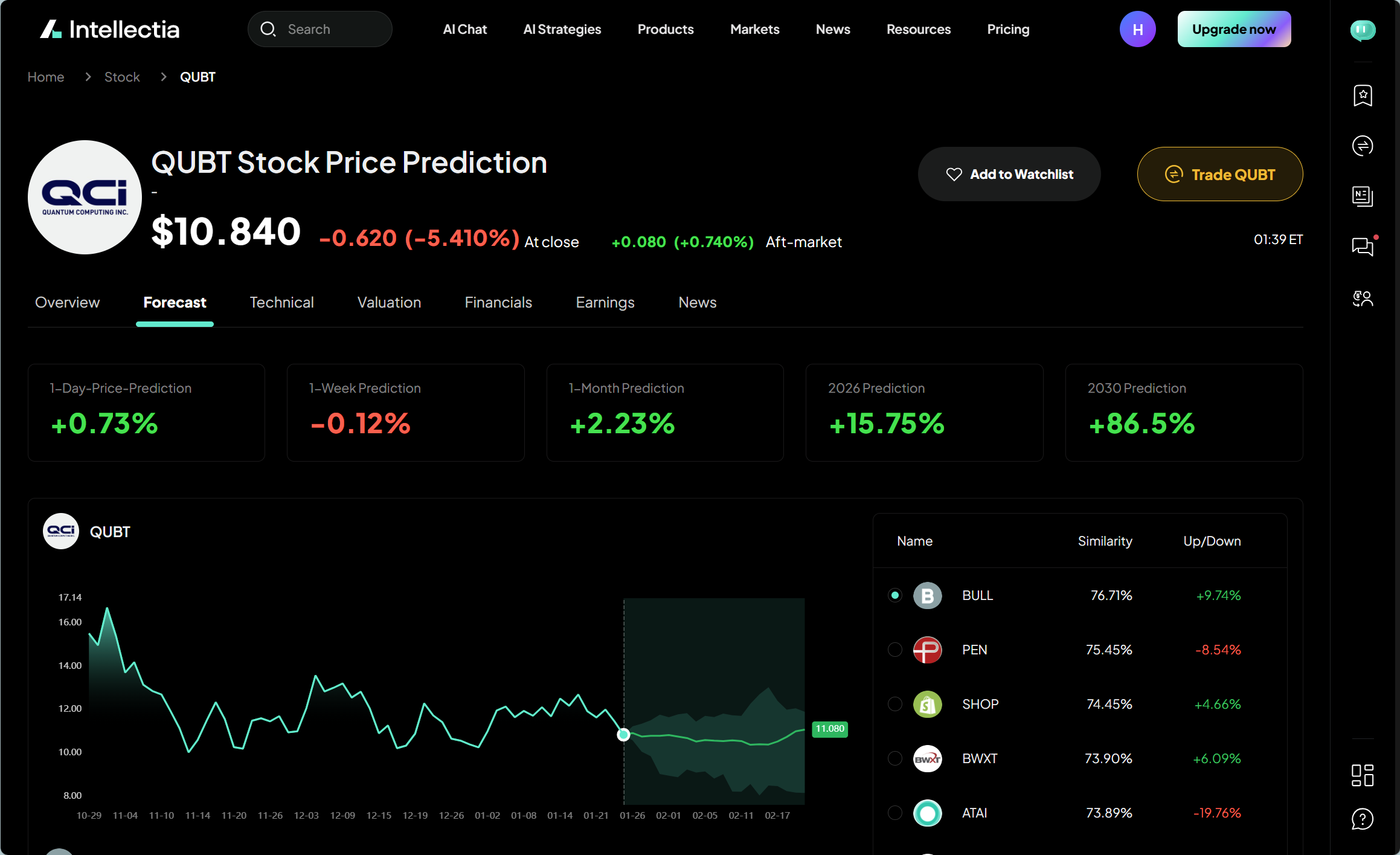

Quantum Computing Inc. (QUBT): Software-driven innovation

QUBT stands out by using room-temperature photonics-based quantum machines that don’t need expensive cooling infrastructure. The company creates software tools and applications, and their main product Qatalyst helps developers create quantum-ready applications on regular computers.

The company’s stock grew 66% in the last year. Analysts believe $1000 invested now could reach $2981.71 by March 2026.

D-Wave Quantum (QBTS): Commercialization and partnerships

D-Wave Quantum (NYSE: QBTS) works with major organizations like Volkswagen, Mastercard, Deloitte, and Siemens Healthineers. They recently formed a mutually beneficial alliance with Interpublic Group to develop quantum applications for marketing optimization.

The company’s Q3 2025 revenue reached $3.70 million, doubling from the previous year. Their stock performance has been impressive, climbing over 400% in the last year to $29.28 per share. Analysts predict an average price target of $39.64, with some expecting it to reach $48 per share.

To find more promising quantum computing investments, specialized tools can help. The Intellectia.ai AI Screener lets you quickly filter the entire market to find companies that clearly benefit from the Gemini 3 trend—maybe by finding Google’s suppliers or competitors increasing their chip orders.

Big tech players investing in quantum computing

Tech giants now make strategic bets on quantum computing and allocate substantial resources to gain competitive advantages in this emerging field. Their stock performance mirrors progress in quantum technology development. These factors make them valuable additions to diversified quantum investment portfolios.

Alphabet: Willow chip and Cirq software

Alphabet’s quantum ambitions revolve around its groundbreaking Willow chip, which showed remarkable error correction capabilities. The chip reduced errors exponentially as it scaled up—a major breakthrough in quantum computing that scientists have pursued for almost 30 years. The 105-qubit processor completed calculations in under five minutes, while today’s fastest supercomputers would need approximately 10 septillion years.

Alphabet strengthens its quantum initiatives with Cirq, a Python software library that writes, manipulates, and optimizes quantum circuits. This developer-friendly approach builds an ecosystem around Alphabet’s quantum initiatives and potentially boosts its position among top quantum computing stocks.

IBM: Nighthawk and Loon chips for fault tolerance

IBM pushes forward its quantum roadmap with Nighthawk, which features 120 qubits connected through 218 tunable couplers in a square topology. This design allows 30% more complex circuits on average due to improved connectivity. The company plans to deliver Quantum Starling by 2029—a large-scale, fault-tolerant system that runs quantum circuits with 100 million gates on 200 logical qubits.

The Loon processor, scheduled for 2025, will implement qLDPC codes essential for fault-tolerant computing. These developments make IBM one of the best quantum computing stocks for long-term investors who want exposure to commercial quantum applications.

Microsoft: Azure Quantum and custom chips

Microsoft takes a unique approach with its Majorana-1 quantum chip by focusing on topological qubits that are inherently more stable and less error-prone than traditional architectures. The company’s Azure Quantum platform acts as an umbrella for quantum innovation and combines cloud access to simulators and early quantum processors.

Microsoft’s quantum efforts benefit from strategic collaborations with leading academic institutions, including Delft University of Technology and the University of Copenhagen.

Nvidia: CUDA-Q and hybrid quantum-classical systems

Nvidia joins the quantum space with CUDA-Q, a platform for hybrid quantum-classical computing. This qubit-agnostic system naturally merges with all quantum processing units and provides GPU-accelerated simulations when adequate quantum hardware isn’t available.

CUDA-Q quantum algorithm simulations achieve speedups up to 180x over leading CPUs. Investors who want to buy quantum computing stocks will find Nvidia offers exposure to quantum technology while maintaining its core business in classical computing and AI.

Key challenges and risks in quantum computing stocks

Investors who want to buy best quantum computing stocks must know the most important technical and financial hurdles these companies face. You can make informed decisions about potential risks versus rewards in this emerging sector by examining these challenges.

Error correction and system stability

Error correction stands out as the defining engineering challenge for quantum computing companies. Quantum bits (qubits) break down easily from environmental factors like vibrations or electromagnetic fields. Google’s Willow chip showed major progress in error reduction, but current systems still face catastrophic error bursts about once per hour. Current technology suggests that commercially viable error rates would need massive resources—a distance-27 logical qubit requires 1,457 physical qubits.

Lack of current commercial viability

The road to widespread quantum computing adoption faces big obstacles. High error rates and noise make integration with classical computing systems complicated. Extreme cooling requirements and high costs make building and maintaining quantum systems difficult. Quantum computers need completely different programming approaches than classical systems, which creates more barriers to practical use.

High volatility and speculative nature

Pure-play quantum stocks often swing wildly in price, with shares moving 20-30% when companies announce technical milestones or funding rounds. These dramatic shifts highlight how speculative these investments are. Right now, these stocks trade at extremely high valuations—Quantum Computing Inc. has a price-to-sales ratio of 3,167, Rigetti Computing at 975, D-Wave at 376, and IonQ at 158. These numbers put quantum stocks deep in historical bubble territory, even when looking at sales growth several years ahead.

Revenue and profitability concerns

Major quantum computing stocks burn through cash and expect operating losses well into the future. Quantum research needs lots of capital, which leads to share-based dilution—IonQ raised $2 billion through stock and warrant offerings in 2025. The quantum computing sector brought in $650-750 million during 2024 and should pass $1 billion in 2025, but individual companies still struggle to find profitable business models.

How to evaluate quantum computing stocks in 2026

Quantum investing needs specific frameworks that differ from traditional tech stock analysis. The quantum market shows promise with projected growth from $0.80 billion in 2025 to $1.08 billion in 2026. A full picture helps identify the best opportunities.

Check for real-world use cases and partnerships

The first step is to get into commercial partnerships in a variety of industries. Companies that build mutually beneficial alliances in finance, healthcare, and manufacturing show practical uses beyond research. To cite an instance, see HSBC and Quantinuum’s ground applications in cybersecurity, fraud detection, and natural language processing. Quantinuum’s work with Amgen, BMW Group, and JPMorganChase proves market needs.

Assess R&D progress and technical milestones

Technical achievements point toward quantum advantage. Microsoft and Quantinuum reached a milestone of 12 logical qubits. IBM’s Nighthawk processor now features 120 qubits with 218 couplers. Companies with clear roadmaps inspire confidence – Quantinuum aims for fault-tolerant quantum computing by 2030.

Look at analyst ratings and institutional interest

Institutional investors often validate investment quality. Quantum Computing Inc.’s stock has 4.26% institutional ownership. The AI Stock Picker offers applicable information based on daily market data.

Compare quantum computing stock prices and growth

Financial metrics paired with growth projections tell the complete story. D-Wave Quantum holds a Strong Buy consensus with 55.49% upside potential. QUBT shows better earnings estimates (-$0.16 compared to previous -$0.23). However, it receives mixed analyst recommendations, with price targets averaging $17.00.

Conclusion

Quantum computing stands at the cutting edge of technology and offers huge investment potential for smart investors. These stocks look attractive with a projected market growth to $170 billion by 2040, but major technical hurdles exist. Even industry leaders struggle with error correction and qubit stability. Most companies burn through cash and carry speculative valuations.

You can invest directly in quantum innovation through pure-play companies like IonQ and Rigetti, but expect higher volatility. Tech giants such as Alphabet, IBM, and Microsoft give you quantum exposure while their established businesses provide stability. This mix helps protect your investment as quantum technology advances.

Smart investors should review potential stocks based on commercial partnerships, technical achievements, and backing from institutions. Companies that show ground applications across industries have better long-term prospects than those stuck in theoretical research.

The quantum computing sector could revolutionize technology, despite its speculative nature. Your risk tolerance and investment timeline should guide your approach. Quantum stocks trade at premium valuations compared to current revenues. The first companies that achieve practical quantum advantage will likely reward investors well. A small portion of your portfolio could tap into this emerging technology, but keep realistic expectations about when these companies will turn profitable.