TSX Opportunities: GoGo AI Network Among 3 Promising Penny Stocks

The Canadian market has experienced a dynamic start to 2026, with geopolitical developments and economic data shaping investor sentiment. Amid these shifts, penny stocks continue to capture attention as a unique investment avenue. Despite their somewhat outdated label, these smaller or newer companies can offer compelling growth opportunities when backed by strong financials. In this article, we explore three promising penny stocks on the TSX that could stand out as potential gems for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.14 | CA$54.6M | ✅ 3 ⚠️ 4 View Analysis > |

| Cannara Biotech (TSXV:LOVE) | CA$1.88 | CA$173.34M | ✅ 3 ⚠️ 0 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.22 | CA$124.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$52.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.41 | CA$924.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.78M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.58 | CA$183.59M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.02 | CA$30.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.99 | CA$188.02M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 378 stocks from our TSX Penny Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GoGo AI Network Inc. focuses on investing in healthcare technology companies and has a market cap of CA$17.98 million.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to CA$2.16 million.

Market Cap: CA$17.98M

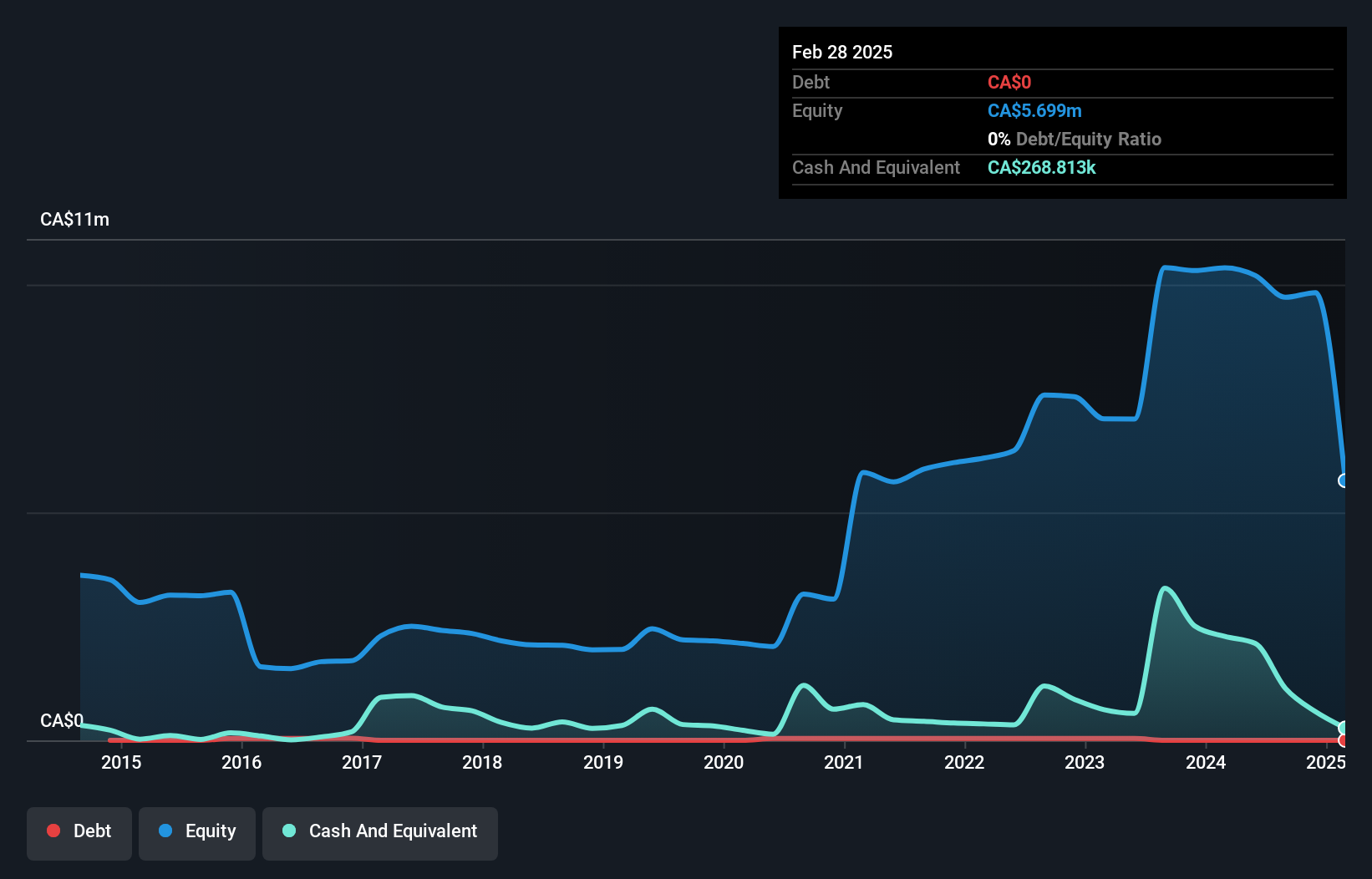

GoGo AI Network Inc., recently rebranded from MedBright AI Investments, is a Canadian penny stock with a market cap of CA$17.98 million and revenue from its Pharmaceuticals segment amounting to CA$2.16 million. The company has transitioned to profitability over the past year, showcasing an outstanding Return on Equity at 44.8%. Despite having no debt and not diluting shareholders recently, GoGo’s high share price volatility and insufficient short-term asset coverage pose risks. The appointment of Brandon Kou as President could enhance strategic execution given his extensive experience in corporate strategy and growth-stage technology businesses.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring and exploring mineral properties in Peru, with a market cap of CA$29.32 million.

Operations: Condor Resources Inc. has not reported any revenue segments.

Market Cap: CA$29.32M

Condor Resources Inc., with a market cap of CA$29.32 million, is pre-revenue and focuses on mineral exploration in Peru. The company remains unprofitable, with earnings declining by 60.2% annually over the past five years. Despite this, Condor’s management team and board are seasoned, boasting average tenures of 14.8 and 9.9 years respectively. The company is debt-free and has not diluted shareholders in the past year; however, it faces financial constraints with less than a year of cash runway based on current free cash flow levels. Recent results show a reduced net loss compared to the previous year’s figures.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cannara Biotech Inc., along with its subsidiaries, focuses on the indoor cultivation, processing, and sale of cannabis and cannabis-derivative products in Canada, with a market cap of CA$173.34 million.

Operations: The company generates revenue primarily from its cannabis operations, amounting to CA$103.02 million, with additional income from real estate operations totaling CA$3.84 million.

Market Cap: CA$173.34M

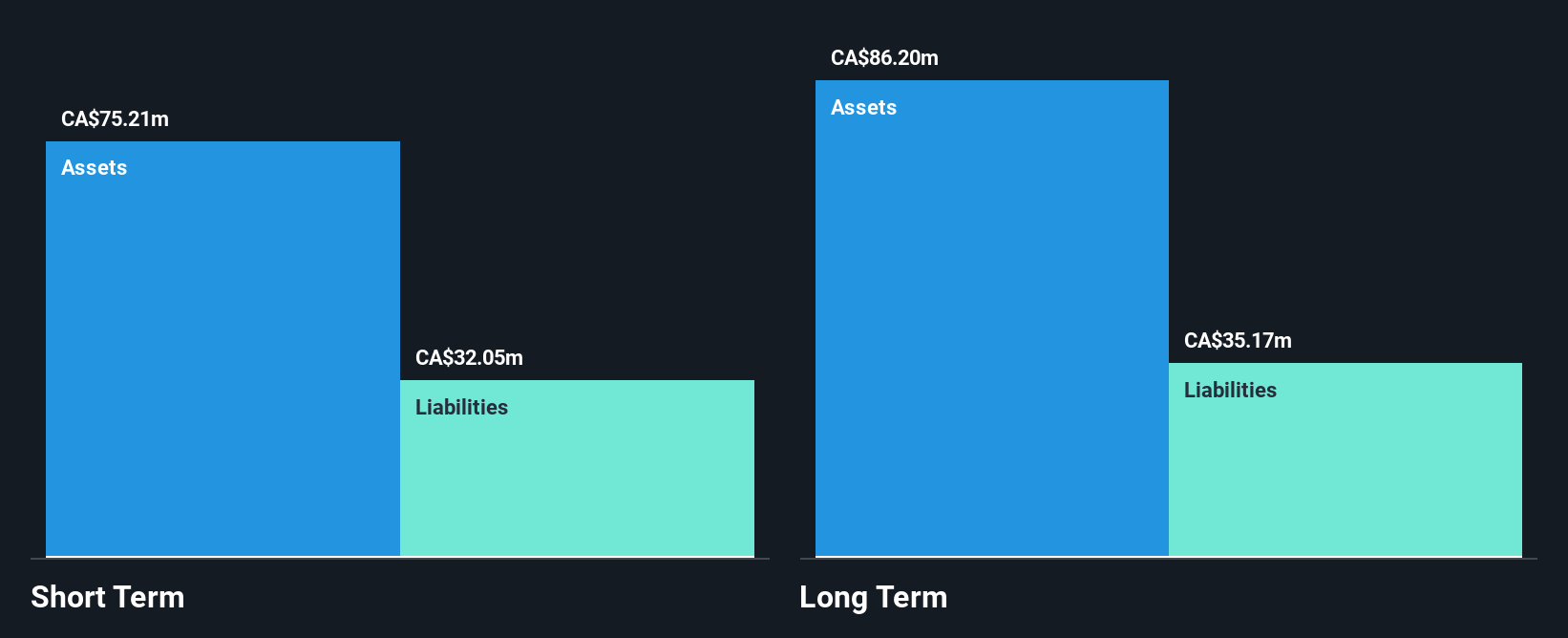

Cannara Biotech Inc., with a market cap of CA$173.34 million, has shown significant revenue growth, reaching CA$107.32 million this year from its cannabis operations. The company reported a net income of CA$13.08 million and improved earnings per share to CA$0.14, reflecting high-quality earnings and strong financial health with satisfactory debt levels and well-covered interest payments. Despite increased debt over the past five years, Cannara’s short-term assets comfortably cover both short- and long-term liabilities. Recent inclusion in the S&P/TSX Venture Composite Index highlights its growing prominence in the market amidst stable weekly volatility and experienced management oversight.

Where To Now?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com