The government bond market, which has been predicted to be the all-time supply offensive this year, ..

The government bond market, which has been predicted to be the all-time supply offensive this year, has met a reef called the “hawkish (favoring monetary tightening) Monetary Policy Committee.” Public corporations, which had been speeding up procurement since the beginning of the year, faced a volatility market on the prospect of a record increase in the size of government-guaranteed bonds and treasury bonds.

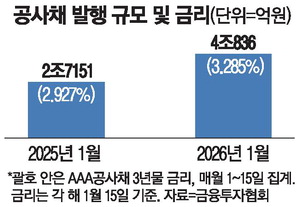

According to the Financial Investment Association on the 18th, the amount of public bonds issued from the 1st to the 15th of this month amounted to KRW 4.836 trillion. This is a 50% increase compared to the same period last year. This is the result of public corporations actively issuing bonds to preempt liquidity at the beginning of the year, fearing a rise in interest rates and the possibility of bidding due to oversupply.

However, as the Bank of Korea’s Monetary Policy Committee showed a more hawkish attitude than market expectations on the 15th, bond rates soared, reversing the mood. The interest rate on the three-year treasury bond soared to 3.090% from 2.996% the previous day.

On the 16th, the day after the Monetary Policy Committee, the Korea Housing Finance Corporation began to recruit investors to issue bonds worth 100 billion won, but the issuance was canceled because it failed to secure demand. Despite flexibility, such as raising interest rates and adjusting maturities, it was not enough to turn around investor sentiment.

The Korea Asset Management Corporation (KAMCO) made a bid and succeeded in raising the money, but had to offer a slightly higher interest rate than the public sentiment. Until early this month, the bullish trend, which continued to issue at lower interest rates than the public sentiment, has been dampened. The biggest burden on the market this year is by far the overwhelming supply. The amount of government bonds issued by the government to foster high-tech industries and stabilize supply chains totaled 25 trillion won. 15 trillion won in advanced strategic industry fund bonds issued by the Korea Development Bank and 10 trillion won in supply chain stabilization fund bonds from the Export-Import Bank are pending. Mercury has already started procurement by issuing 400 billion won this month. On top of that, as the issuance limit of treasury bonds is set at 225.7 trillion won, concerns over the effect of building high-quality government guarantees to suck up demand for private corporate bonds are becoming a reality.

[Reporter Myung Ji Ye]#